Investor News

Magyar Telekom second quarter 2016 results

Budapest, August 4, 2016 18:00

Magyar Telekom (Reuters: MTEL.BU and Bloomberg: MTELEKOM HB), the

leading Hungarian telecommunications service provider, today reported its

consolidated financial results for the second quarter and first half of 2016, in accordance with

International Financial Reporting Standards (IFRS).

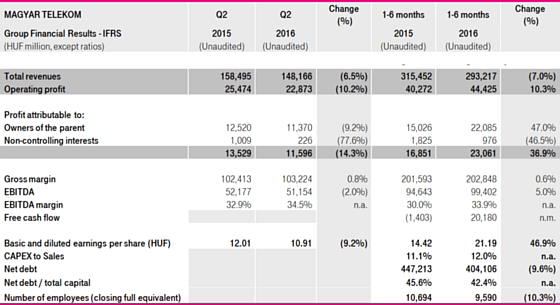

Financial highlights:

Strategic highlights:

- Group revenue decline driven by the exit from the retail gas business, transfer of B2B energy business into the joint venture and lower System Integration/Information Technology (SI/IT) revenues

- Core telco revenues (excluding energy and SI/IT) up by 2.2% year-on-year in Q2 2016

- Mobile revenues up by 3.8% vs. Q2 2015 as comparability of data no longer affected by the sharp Mobile Termination Rate (MTR) cut in Hungary introduced on 1 April 2015

- SI/IT revenues in Hungary declined due to a slowdown in EU fund inflows

- EBITDA down by 2.0% year-on-year in Q2 2016 as higher gross profit and lower employee related expenses were offset by higher other operating expenses

- H1 2016 EBITDA up by 5.0% year-on-year due to one-off gains of HUF 5.1 billion realized on the Infopark real estate deal and the Origo sale

- Free cash flow increase to HUF 20.2 billion reflects higher EBITDA, improved working capital, lower interest payments and one-off profits despite the incremental severance payout and a higher settlement of capex creditor balances

- Net debt ratio slightly up to 42.4% vs. Q1 2016 due to the dividend payment, but expected to decline during H2 2016

- Underlying performance in Hungary driven by increased customer base in fixed line and mobile broadband, pay TV and post-paid mobile telephony

- Group-wide success of 4Play Magenta 1 proposition based on integrated Telekom brand

- Sustained revenue turnaround in Macedonia driven by mobile and SI/IT revenues

- Continuous competitive and regulatory pressures in Montenegro

Christopher Mattheisen, CEO commented:

“I am pleased to report that the positive trends in our operations seen during the past few quarters have continued into the second quarter of this year. Although our headline revenue witnessed a 6.5% decline compared to the second quarter of 2015, this was primarily due to our decisions with respect to the energy business and lower Systems Integration and IT revenues resulting from a temporary slowdown in EU fund inflows. Excluding these, our core telco revenues continued to grow by 2.2% driven by growth in mobile data and equipment coupled with fixed broadband and TV revenue uplift. On the other hand, Group EBITDA for the quarter declined by 2.0% year-on-year as higher other operating expenses offset gross profit growth and lower employee related expenses.

Our Group revenues decreased by 7.0% compared to the first half of last year primarily driven by the decline in energy and SI/IT revenues which was partly mitigated by increasing telco revenues. Thanks to investments in 4G networks across our footprints, our Group mobile broadband and equipment revenues increased significantly whilst voice revenues declined. Following the fixed access network upgrades, we were also able to further grow our fixed broadband and TV customer bases at higher ARPUs in Hungary. Group-wide rollout of Magenta 1, our 4Play proposition based on the integrated Telekom brand, has helped too in promoting our brand and services.

Our EBITDA performance improved by 5.0% year-on-year in the first half of this year. It was achieved not only through gross margin growth, but also thanks to significant savings in employee related expenses and one-off gains in the first quarter. Group Capex for the first half of 2016 was practically unchanged compared to last year, resulting in a steadily increasing Free Cash Flow. Group FCF for the half year exceeded HUF 20 billion, despite the incremental severance payout, loan repayment and a higher settlement of capex creditors. The net debt to total capital ratio improved from 42.9% at the end of 2015 to 42.4% driven by a reduction in both short- and long-term borrowings. There is a slight increase in our leverage compared to the previous quarter due to the dividend payout in May 2016, but we expect our net debt ratio to further decline in the second half of this year.

Our performance so far this year has been in-line with our expectations and I am pleased to reiterate our guidance targets; for the avoidance of doubt, the one-off gains recorded in the first quarter were as expected and have been incorporated into our outlook.”

| Actual | Public guidance | ||

| 2015 | 2016 | 2017 | |

| Revenue | HUF 656.3 billion 1 | between HUF 580-590 bn | between HUF 585-595 bn |

| EBITDA | HUF 187.3 billion | between HUF 187-191 bn | between HUF 189-193 bn |

| Capex 2 | HUF 109.8 billion | ca. 10% yoy decline | ca. 10% yoy decline |

| FCF | HUF 26.7 billion | - | surpassing HUF 50bn 3 |

| Dividend | HUF 15 per share | target HUF 25 per share | - |

1) includes HUF 49.3 billion relating to the energy business

2) excluding spectrum acquisitions and annual frequency fee capitalization

3) after minority dividend payments

This investor news contains forward-looking statements. Statements that are not historical facts, including statements about

our beliefs and expectations, are forward-looking

statements. These statements are based on current plans, estimates and projections, and therefore should not have undue reliance

placed upon them. Forward-looking statements

speak only as of the date they are made, and we undertake no obligation to update publicly any of them in light of new information

or future events.

Forward-looking statements involve inherent risks and uncertainties. We caution you that a number of important factors could cause actual results to differ materially from those contained in any forward-looking statement. Such factors are described in, among other things, our annual financial statements for the year ended December 31, 2015, available on our website at https://www.telekom.hu which have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) and adopted by the European Union.

In addition to figures prepared in accordance with IFRS, Magyar Telekom also presents non-GAAP financial performance measures, including, among others, EBITDA, EBITDA margin and net debt. These non-GAAP measures should be considered in addition to, but not as a substitute for, the information prepared in accordance with IFRS. Non-GAAP financial performance measures are not subject to IFRS or any other generally accepted accounting principles. Other companies may define these terms in different ways. For further information relevant to the interpretation of these terms, please refer to the chapter “Reconciliation of pro forma figures”, which is posted on Magyar Telekom’s Investor Relations webpage at www.telekom.hu/investor_relations.