Investor News

Magyar Telekom first quarter 2017 results

Budapest, May 10, 2017 18:00

Magyar Telekom (Reuters: MTEL.BU and Bloomberg: MTELEKOM HB), the leading Hungarian telecommunications service provider, today

reported its consolidated financial results for the first quarter of 2017, in accordance with International Financial Reporting

Standards (IFRS).

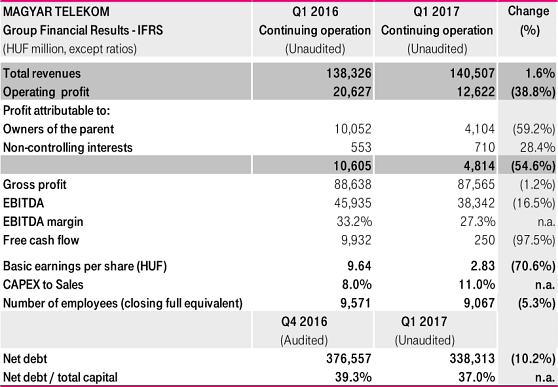

Financial highlights:

Strategic highlights:

- Increase in Group revenue

1 driven by the strategically important areas of mobile data and SI/IT

- Increase in mobile equipment revenues and accelerating postpaid customer growth in Hungary reflect strong customer acquisition and retention efforts in Q1 2017

- Stable telephony revenues in Hungary supported by increased customer base in fixed broadband and pay TV, coupled with improving customer mix and increasing ARPU in the mobile segment

- Return to growth in Hungarian SI/IT revenues, principally due to public procurement tenders

- Decline in wholesale revenues in Macedonia partly compensated by growth in mobile data and pay TV revenues (both driven by higher subscriber bases)

- EBITDA decline driven by absence of one-off gains which boosted Q1 2016 results, and higher mobile equipment subsidies

- Reduction in Free Cash Flow from continuing operations reflects the high Q1 2016 comparison figure, which was boosted by one-off gains (from the sale of Origo and Infopark Building G) of HUF 11.3 billion

- Net transaction price of HUF 36.4 billion received on the disposal of Crnogorski Telekom

- Net debt ratio improved to 37.0% as a result of the sale of Crnogorski Telekom

Christopher Mattheisen, CEO commented:

“I am pleased to report a strong performance in the first quarter of 2017, with revenues for the Group increased by 1.6%. This excludes the results of Crnogorski Telekom, which, since the beginning of the year, are deconsolidated from Group results. The 16.5% decline in EBITDA that we witnessed in Q1 2017 largely reflects one-off profits realized on the sales of Infopark (Building G) and Origo in Q1 2016.

Our Hungarian operations performed well, with increased revenues due to growth in mobile data and SI/IT revenues. In the first quarter of this year, to capitalize on the positive momentum in the mobile market, we focused on customer acquisition and retention through increased marketing activities and investments in the form of higher levels of equipment subsidies. These efforts resulted in accelerated mobile postpaid customer growth, decreased churn and increased sales of smartphones and data packages. In the short term, the costs associated with these efforts have had a slight negative impact on our direct margin. However, many customers have subscribed to a 2-year loyalty contract, which has boosted rates of customer retention. At the end of March, we launched a new and flexible postpaid mobile tariff portfolio, with a choice of data and voice packages, which aims to increase our FMC customer base through discounts and the encouragement of upgrades to larger data packages. Notwithstanding the positive impacts this focus of customer acquisition and retention is having on our mobile indicators, it has also benefited the fixed line segment resulting in strong net adds in both fixed broadband and TV customer figures. Our efforts to grow our fixed customer base despite the highly competitive environment will be further supported by continued investment to expand our high speed internet network, albeit on a lower scale than in previous years. We plan to cover more than 250 thousand new households with high speed internet in 2017.

In Macedonia, despite political and competitive headwinds, as well as a 33% cut in mobile termination rates, MakTel’s performance was relatively stable, resulting in a slight revenue and EBITDA decline. Mobile revenues showed steady growth for the quarter, thanks to our continued 4G and smartphone push, reflected in growing mobile broadband revenues and increased equipment sales.

Looking ahead to the rest of the year, although Digi seems to have postponed its entry to the mobile market, competitive pressures remain, both in mobile B2B and prepaid segments as well as for 3Play pricing. Further cuts to EU roaming rates, as well as the looming regulatory deadline for prepaid SIM registration are also set to pose challenges.

As previously communicated, we anticipate growth in the Hungarian SI/IT market this year, underpinned by higher EU fund inflows. We intend to increase our share of this growing market and the first quarter bears testimony that this is already happening; our SI/IT revenues have increased by 11.8% thanks to revenue streams resulting primarily from public procurement tender wins.

We believe that going forward, our new mobile postpaid portfolio will contribute to further expansion of our FMC customer base and as currently the only integrated operator, we will be able to maximize the telecommunication share of the household spending wallet.”

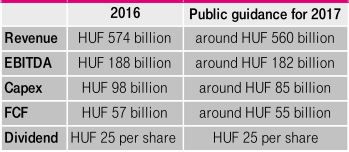

Public guidance*:

*excluding Crnogorski Telekom financials and the transaction price of the disposal of the majority ownership

This investor news contains forward-looking statements. Statements that are not historical facts, including statements

about our beliefs and expectations, are forward-looking statements. These statements are based on current plans, estimates

and projections, and therefore should not have undue reliance placed upon them. Forward-looking statements speak only as of

the date they are made, and we undertake no obligation to update publicly any of them in light of new information or future

events.

Forward-looking statements involve inherent risks and uncertainties. We caution you that a number of important factors could cause actual results to differ materially from those contained in any forward-looking statement. Such factors are described in, among other things, our annual financial statements for the year ended December 31, 2016, available on our website at https://www.telekom.hu which have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) and adopted by the European Union.

In addition to figures prepared in accordance with IFRS, Magyar Telekom also presents non-GAAP financial performance measures, including, among others, EBITDA, EBITDA margin and net debt. These non-GAAP measures should be considered in addition to, but not as a substitute for, the information prepared in accordance with IFRS. Non-GAAP financial performance measures are not subject to IFRS or any other generally accepted accounting principles. Other companies may define these terms in different ways. For further information relevant to the interpretation of these terms, please refer to the chapter “Reconciliation of pro forma figures”, which is posted on Magyar Telekom’s Investor Relations webpage at www.telekom.hu/investor_relations.