Investor News

Magyar Telekom third quarter 2017 results

Budapest, November 8, 2017 18:00

Magyar

Telekom (Reuters: MTEL.BU and Bloomberg: MTELEKOM HB), the leading Hungarian

telecommunications service provider, today reported its consolidated financial

results for

the third quarter and first nine months of 2017, in accordance with International Financial Reporting

Standards (IFRS).

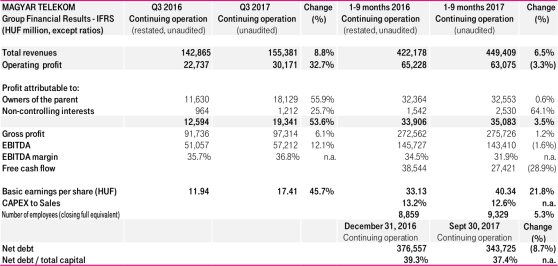

Financial highlights:

Strategic highlights:

- Increase in Group revenue 1 driven by strong demand for equipment across all segments and continued growth of mobile data usage

-

- Growth in mobile revenues driven by sustained increase in mobile service revenues resulting from strong mobile data demand, coupled with increasing visitor data usage and equipment sales, latter also supported by the provision reversal relating to the ceased loyalty program

- Fixed line revenue increase attributable to a major data project, as well as improved ARPU levels for both TV and broadband in Hungary and higher TV set sale volumes

- System Integration and IT (SI/IT) revenue increase reflects high demand for equipment deliveries particularly in the Hungarian public segment

- EBITDA grew by 12.1% year-on-year resulting from increased revenue, one-off income from real estate sales and cost optimisation measures

- Reduction in 9M 2017 Free Cash Flow from continuing operations reflects a deterioration in receivable balances as well as one-off gains (from the sale of Origo and Infopark Building G) of HUF 11.3 billion which supported 9M 2016 results

- Net debt ratio stood at 37.4% at the end of September 2017

Christopher Mattheisen, CEO commented:

“The strong revenue growth demonstrated by the Group in the first half of the year continued in Q3, up by 8.8% compared to the same period last year. We also saw a significant turnaround in EBITDA, which increased 12.1% year-on-year thanks to the launch of various initiatives. This improvement ultimately resulted from a more balanced revenue composition and cost structure optimisation measures.

Our Hungarian operations witnessed an increase in revenue in all three major service lines. In the mobile segment, demand for data services remained strong; visitor data usage also increased, reflecting the EU Roam Like Home legislation that came into force in mid-June this year. This growth in mobile will continue to be supported by unlimited data packages launched at the end of the summer. Favourable trends in customer mix and ARPU witnessed in the first half of the year continued to positively impact performance in the third quarter.

In the fixed line segment, we restructured our broadband offerings during the quarter, better exploiting our network capabilities by increasing the download speed offered in order to enhance our competitiveness. Initial results are promising; over 80 thousand customers have subscribed to the new packages, with almost half opting for a package of over 100 Mbps.

At the beginning of September, we expanded our flagship quadruple play Magenta 1 offering in line with evolving customer requirements. Besides the included fixed TV , broadband and mobile voice services, customers can now decide between fixed voice or mobile data as the additional element. This initiative demonstrates our continued focus on expansion of our active FMC (fixed-mobile convergence) customer base, which now stands at 11% of our total households. As the only integrated operator in Hungary, we are in a unique position to fulfil the communication requirements of Hungarian households and thus maximize the telecommunication share of the household spending wallet.

In Macedonia, EBITDA rose by 4% year-on-year, despite an increase in competitor related pricing pressure on the mobile market in the third quarter. This was thanks to continued expansion of mobile broadband and TV service subscriber bases coupled with significant savings in operating expenses.

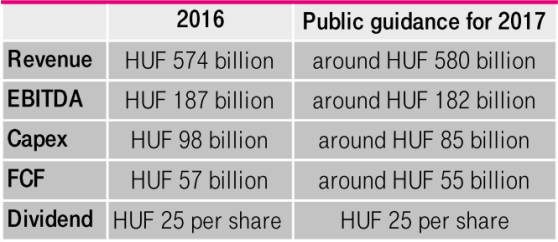

Looking ahead to the rest of the year, whilst we expect the various initiatives we have introduced in both the mobile and fixed line segments to continue to support our performance, we also anticipate an increase in competitive pressures both in Hungary and Macedonia. As such, our public targets for the full year 2017 remain unchanged.”

Public guidance*:

*excluding Crnogorski Telekom financials and the transaction price of the disposal of the majority ownership

This investor news contains

forward-looking statements. Statements that are not historical facts, including

statements about our beliefs and expectations, are forward-looking statements.

These statements are based on current plans, estimates and projections, and

therefore should not have undue reliance placed upon them. Forward-looking

statements speak only as of the date they are made, and we undertake no

obligation to update publicly any of them in light of new information or future

events.

Forward-looking statements involve inherent risks and uncertainties. We caution you that a number of important factors could cause actual results to differ materially from those contained in any forward-looking statement. Such factors are described in, among other things, our annual financial statements for the year ended December 31, 2016, available on our website at https://www.telekom.huwhich have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) and adopted by the European Union.

In addition to figures prepared in accordance with IFRS, Magyar Telekom also presents non-GAAP financial performance measures, including, among others, EBITDA, EBITDA margin and net debt. These non-GAAP measures should be considered in addition to, but not as a substitute for, the information prepared in accordance with IFRS. Non-GAAP financial performance measures are not subject to IFRS or any other generally accepted accounting principles. Other companies may define these terms in different ways. For further information relevant to the interpretation of these terms, please refer to the chapter “Reconciliation of pro forma figures”, which is posted on Magyar Telekom’s Investor Relations webpage at www.telekom.hu/investor_relations.

.