Investor News

Magyar Telekom third quarter 2018 results

Budapest, November 7, 2018 18:00

Magyar Telekom (Reuters: MTEL.BU and

Bloomberg: MTELEKOM HB), the leading Hungarian telecommunications service

provider, today reported its consolidated financial results for the third quarter and

first nine months of 2018, in accordance with International Financial Reporting

Standards (IFRS).

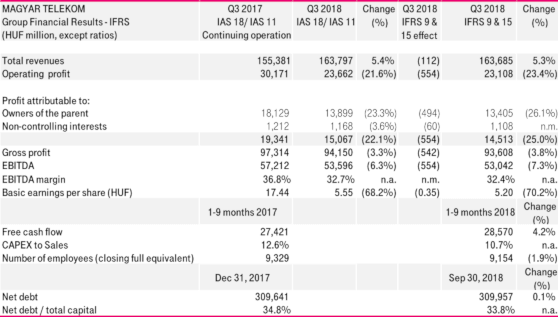

Financial highlights:

Strategic highlights:

- Further increase in Group revenue as growth in

equipment and SI/IT sales continued to be coupled with an improvement in

service revenues

- Integrated fixed-mobile packages give further support to postpaid, broadband and TV customer expansion in both countries

- Strong demand for equipment sales in Hungary further support favourable service revenue trends

- SI/IT revenue growth primarily driven by a high volume of public sector infrastructure projects in Hungary

- Decline in Gross profit reflecting revenue mix changes as well as the absence of one-off items supporting Q3 2017 performance

- Temporary decline in EBITDA as gross profit decreases and indirect costs slightly increase

- Increase in Free cash flow as higher first nine months EBITDA, lower capex payments and declining acquisition costs offset higher receivable balances related to instalment sales and a temporary increase in payments to handset suppliers

Tibor Rékasi, CEO commented:

“I am delighted

that we have maintained our strong performance from the first half of the year

in the third quarter of 2018. Once again, we delivered growth across all

business lines, with System Integration and IT and Equipment sales revenues

contributing strongly to the 5.4% revenue growth achieved in the quarter.

In Hungary, the

demand for mobile data continued to grow, in line with the increasing number of

smart devices in the market. The latter was reinforced by our strategy for

equipment sales, which included a new subsidy structure favoring smart handsets

in the product mix. Our new mobile packages drive pre- to postpaid migration

among our customers and further support our mobile data revenue growth. These

factors were also shown in our mobile ARPU, where we achieved 8% growth

year-on-year.

As per our

ongoing strategy, we maintained a strong focus on our fixed network. We are

working to achieve our goal of extending our fiber coverage to an additional

300,000 households in 2018. This effort is part of our overall long-term plan

to offer gigabit internet connectivity across the whole country. The benefits

of these efforts materialize in the ongoing growth of our broadband retail and

TV revenue lines. In addition, equipment revenues continued to grow

year-on-year, reflecting our successful efforts to meet customer needs, by

allowing customers to purchase mobile devices with their fixed contracts and

vice versa.

Next to offering

an outstanding fixed network to our customers, the other pillar of our growth

strategy is our FMC offering. Currently we are still the only truly integrated

player in the Hungarian market with an integrated fixed-mobile offering to our

customers. During the third quarter we updated our Magenta1 proposition to present

a clearer structure and more convincing offer to customers. While in the second

quarter we doubled the mobile data allowance, in the third quarter we unified

our offering, giving our Magenta1 customers the ability to achieve a 30%

discount on all related services. Thanks to the changes introduced in our

Magenta1 offering in 2018, over one-fifth of our households are now Magenta1

subscribers. In addition to our consumer focus, we relaunched Magenta1 Business

in the third quarter, offering business customers similar advantages, including

possible IT related services.

In the System

Integration and IT segment we had a strong quarter, reaching 19.8% revenue

growth year-on-year. The growth was again attributable to a high volume of

software and hardware projects with a lower profit margin. These projects, with

a lower than average margin, serve to establish relationships with several

different institutions – ones we can later convert to higher margin service

contracts.Group

performance during the quarter was further supported by the continued

turnaround in Macedonia. Both revenues and EBITDA improved thanks to solid

performance across all business lines, a positive trend in service revenues, as

well as favorable exchange rate movements. “

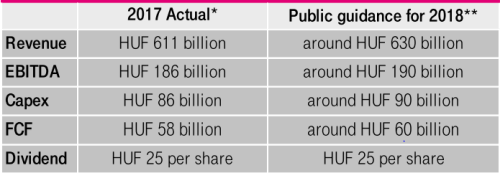

Public guidance

*excluding Crnogorski Telekom financials and the transaction price of the disposal of the majority ownership

**including IFRS 9 & 15 imapcts

This investor news contains

forward-looking statements. Statements that are not historical facts, including

statements about our beliefs and expectations, are forward-looking statements.

These statements are based on current plans, estimates and projections, and

therefore should not have undue reliance placed upon them. Forward-looking

statements speak only as of the date they are made, and we undertake no

obligation to update publicly any of them in light of new information or future

events.

Forward-looking statements involve inherent risks and uncertainties. We caution you that a number of important factors could cause actual results to differ materially from those contained in any forward-looking statement. Such factors are described in, among other things, our annual financial statements for the year ended December 31, 2017, available on our website at https://www.telekom.hu which have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) and adopted by the European Union.

In addition to figures prepared in accordance with IFRS, Magyar Telekom also presents non-GAAP financial performance measures, including, among others, EBITDA, EBITDA margin and net debt. These non-GAAP measures should be considered in addition to, but not as a substitute for, the information prepared in accordance with IFRS. Non-GAAP financial performance measures are not subject to IFRS or any other generally accepted accounting principles. Other companies may define these terms in different ways. For further information relevant to the interpretation of these terms, please refer to the chapter “Reconciliation of pro forma figures”, which is posted on Magyar Telekom’s Investor Relations webpage at www.telekom.hu/investor_relations.

.