Magyar Telekom results for the first quarter of 2017

Highlights:

- Total revenues, without the contribution of Crnogorski Telekom, increased 1.6% year-on-year to HUF 140.5 billion in Q1 2017 (Q1 2016: HUF 138.3 billion). This increase was largely driven by mobile data, equipment sales and SI/IT revenue growth.Mobile revenues increased by 2.7% to HUF 74.3 billion in Q1 2017, as the continued growth in mobile data and equipment sales offset the decline in voice revenues.Fixed line revenues declined by 1.7% to HUF 47.5 billion in Q1 2017, due to lower voice, broadband, wholesale and other revenues. At the same time, the first quarter saw increased TV revenues and equipment sales.System Integration (SI) and IT revenues improved by 11.4% year-on-year to HUF 17.1 billion in Q1 2017, thanks to two major public procurement projects won: an infrastructure implementation project for the FINA World Championships, and an equipment delivery and system implementation project for the National University of Public Services. Furthermore, IT service sales in the Hungarian SMB segment also increased.Energy Services revenues decreased to HUF 1.6 billion in Q1 2017, due to a contracting electricity customer base and expiry of the last remaining gas universal contracts.

- Direct costs increased by 6.5%to HUF 52.9 billion in Q1 2017 compared to Q1 2016. Telecom tax was reclassified from Other operating expenses to Direct costs since Management believes that presenting the new direct cost breakdown the financial data of the Group become more transparent. The increase in direct costs is a result of higher SI/IT and other costs, partly offset by lower energy service related costs and bad debt expense.Interconnect costsdecreased to HUF 4.4 billion, driven by lower fixed traffic in both Hungary and Macedonia.SI/IT service related costsincreased by HUF 1.4 billion to HUF 10.7 billion, reflecting higher revenues.Bad debt expensesimproved by 25.6% to HUF 1.7 billion, thanks to an enhanced collection and credit check process.Telecom taxdecreased by 5.4% to HUF 5.9 billion, reflecting the changing customer behavior.Other direct costsincreased by 15.5% to HUF 28.8 billion, due to an increase in the cost of equipment sales in line with a higher volume of Hungarian smartphone sales, as well as to higher TV content related costs, mainly attributable to the new content fee introduced in July 2016 in Hungary.

- Gross profit decreased by 1.2% year-on-year to HUF 87.6 billion in Q1 2017as improved SI/IT margin and lower bad debt expense were more than offset by the increase in mobile equipment subsidies and TV service margin deterioration due to the new content fee.

- Indirect costs increased by 1.5% to HUF 50.0 billion in Q1 2017 and other operating income significantly declineddue to one-offs (sale of a real estate and Origo) positively impacting Q1 2016 results.Employee-related expensesimproved by 2.1% to HUF 19.4 billion as a proportionately higher level of employee costs were related to projects capitalized in Q1 2017 than in the Q1 2016, whilst outsourcing to Ericsson resulted in savings in Macedonia.Hungarian utility taxin Q1 2017 was HUF 7.4 billion, HUF 0.2 billion higher than in Q1 2016, reflecting network acquisitions, as well as an increased length of taxable network due to refinement of the cable network records . These offset the positive effects of Magyar Telekom’s tax credit relating to those new network investments and upgrades which enable internet access of least 100 Mbps.Other operating expensesincreased by 4.5% to HUF 23.2 billion, driven by higher rental fees related to the sale and subsequent leaseback of Infopark (Building G) and the rental of local state-of-the-art cable networks, while maintenance, repairs, and remedial work expenses also increased in Hungary. In addition, maintenance costs increased in Macedonia due to the outsourcing to Ericsson.Other operating incomedeclined sharply year-on-year to HUF 0.8 billion, reflecting the absence of above-mentioned one-off items, as well as provision reversals relating to the amendment of the collection flat rate in Q1 2016.

- EBITDA declined by 16.5%year-on-year to HUF 38.3 billion in Q1 2017, due to lower gross margin and higher indirect costs, as well as an unusually high Q1 2016 comparison figure, supported by one-off items.

- Depreciation and amortization expenses increased by 1.6%to HUF 25.7 billion, reflecting the software activation related to new billing and CRM systems in Hungary.

- Profit for the period from continuing operations fell by 54.6% to HUF 4.8 billion in Q1 2017. Operating profitdeclined by 38.8% to HUF 12.6 billion, impacted by both lower EBITDA and higher D&A compared to Q1 2016.Net financial lossnarrowed to HUF 6.1 billion in Q1 2017, driven by the decline in interest expense thanks to lower average interest rates and lower total amount of loans outstanding. The lower interest expense was partly offset by higher losses on the fair valuation of derivatives, as in Q1 2017 the HUF strengthened by 0.75% against the EUR compared to a 0.33% weakening in Q1 2016. Income tax expense declined by 39.0% to HUF 2.1 billion in Q1 2017. The lowerincome taxexpense reflects the significant decline in profit before income tax; although offset to a degree by the local tax.

- Profit attributable to non-controlling interestsincreased to HUF 0.7 billion in Q1 2017, due to higher profit in Macedonia, where lower depreciation and amortization expenses more than offset the EBITDA decline.

- Profit from discontinued operation: In January 2017, the Company signed a share purchase agreement with Hrvatski Telekom d.d. for the sale of the Company’s entire 76.53% shareholding in Crnogorski Telekom A.D., for a total consideration of EUR 123.5 million (HUF 38.5 billion). The transaction closed in January 2017. Consequently, in accordance with IFRS5, the results and cash flows of the Montenegrin operations are presented as discontinued operations for both the comparative and the current period. (For further details please see section 2.2.3)

- Net debt decreased by 10.2%from HUF 376.6 billion at the end of the fourth quarter of 2016 to HUF 338.3 billion by the end of March 2017, and the net debt ratio (net debt to total capital) improved from 39.3% to 37.0%, reflecting the payment received from the sale of Crnogorski Telekom.

- TheFree Cash Flowfrom continuing operations decreased to HUF 0.3 billion reflecting the high Q1 2016 comparison figure, which was boosted by one-off gains (from the sale of Origo and Infopark Building G) of HUF 11.3 billion.

Christopher Mattheisen, CEO commented:

“I am pleased to report a strong performance in the first quarter of 2017, with revenues for the Group increased by 1.6%. This excludes the results of Crnogorski Telekom, which, since the beginning of the year, are deconsolidated from Group results. The 16.5% decline in EBITDA that we witnessed in Q1 2017 largely reflects one-off profits realized on the sales of Infopark (Building G) and Origo in Q1 2016.

Our Hungarian operations performed well, with increased revenues due to growth in mobile data and SI/IT revenues. In the first quarter of this year, to capitalize on the positive momentum in the mobile market, we focused on customer acquisition and retention through increased marketing activities and investments in the form of higher levels of equipment subsidies. These efforts resulted in accelerated mobile postpaid customer growth, decreased churn and increased sales of smartphones and data packages. In the short term, the costs associated with these efforts have had a slight negative impact on our direct margin. However, many customers have subscribed to a 2-year loyalty contract, which has boosted rates of customer retention. At the end of March, we launched a new and flexible postpaid mobile tariff portfolio, with a choice of data and voice packages, which aims to increase our FMC customer base through discounts and the encouragement of upgrades to larger data packages. Notwithstanding the positive impacts this focus of customer acquisition and retention is having on our mobile indicators, it has also benefited the fixed line segment resulting in strong net adds in both fixed broadband and TV customer figures. Our efforts to grow our fixed customer base despite the highly competitive environment will be further supported by continued investment to expand our high speed internet network, albeit on a lower scale than in previous years. We plan to cover more than 250 thousand new households with high speed internet in 2017.

In Macedonia, despite political and competitive headwinds, as well as a 33% cut in mobile termination rates, MakTel’s performance was relatively stable, resulting in a slight revenue and EBITDA decline. Mobile revenues showed steady growth for the quarter, thanks to our continued 4G and smartphone push, reflected in growing mobile broadband revenues and increased equipment sales.

Looking ahead to the rest of the year, although Digi seems to have postponed its entry to the mobile market, competitive pressures remain, both in mobile B2B and prepaid segments as well as for 3Play pricing. Further cuts to EU roaming rates, as well as the looming regulatory deadline for prepaid SIM registration are also set to pose challenges.

As previously communicated, we anticipate growth in the Hungarian SI/IT market this year, underpinned by higher EU fund inflows. We intend to increase our share of this growing market and the first quarter bears testimony that this is already happening; our SI/IT revenues have increased by 11.8% thanks to revenue streams resulting primarily from public procurement tender wins.

We

believe that going forward, our new mobile postpaid portfolio will contribute

to further expansion of our FMC customer base and as currently the only

integrated operator, we will be able to maximize the telecommunication share of

the household spending wallet.”

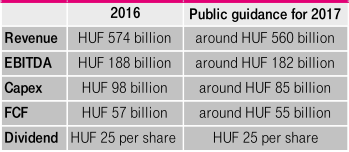

Public guidance*:

*excluding Crnogorski Telekom financials and the transaction price of the disposal of the majority ownership

For detailed information on Magyar Telekom's Q1 2017 results please visit our corporate website (www.telekom.hu/about_us/investor_relationswww.bse.hu