Magyar Telekom first quarter 2016 results

Strategic highlights:

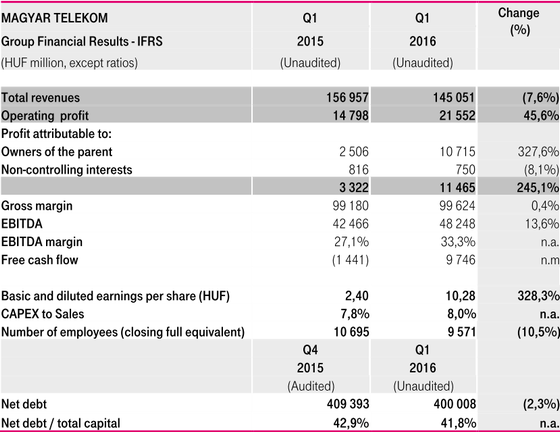

- Group revenue declined primarily as a result of the exit from the retail gas business and transfer of the B2B energy business into the joint venture

- Excluding contributions from energy, core like-for-like revenues grew by 1.8%

- EBITDA growth accelerated to 13.6% year-on-year due to this the underlying growth, boosted by one-off gains

- One-off profits of HUF 5.1 billion realized on the real estate deal and the Origo sale

- Increased Free Cash Flow reflecting higher EBITDA, improved working capital and one-off profits despite the incremental severance payout, loan repayment and a higher settlement of capex creditor balances

- Net debt ratio improved to 41.8%

- Sustained strategic focus on reducing costs through headcount reduction, product and process simplification and digitalization, including more online customer servicing

- Strong underlying performance in Hungary driven by increased customer base in fixed line and mobile broadband, pay TV and post-paid mobile telephony

- Continued growth in System Integration/IT

- Group-wide rollout of quad-play Magenta1 proposition based on integrated Telekom brand

- Revenue turnaround achieved in Macedonia following 5 years of decline

- Sustained competitive and regulatory pressures in Montenegro

Christopher Mattheisen, CEO commented:

“I am pleased to report that the positive trends in our operations achieved during 2015 have continued into the first quarter of this year, boosted further by one-offs gains. Although our headline revenue witnessed a decline compared the first quarter of 2015, this was primarily due to our decision to exit from the residential gas market and the deconsolidation of our B2B energy business. Excluding contributions from energy, on a like-for-like basis, our revenues continued to grow (+1.8%) with the Hungarian segment maintaining its positive momentum, and growth in mobile and SI/IT revenues driving a revenue turnaround in Macedonia following 5 years of decline.

Growth in Group EBITDA for the quarter accelerated to 13.6% year-on-year due a combination of this underlying revenue growth, a sustained strategic focus on cost rationalization (headcount reduction, product and process simplification and digitalization, including more online customer servicing), and one-off gains. We successfully sold one of our main office buildings and our media company, Origo, which resulted in one-off gains of 5.1 billion Hungarian forints for the quarter. Mirroring this growth in Group EBITDA and assisted further by an improvement in working capital levels, Group Free Cash Flow also increased by 11.2 billion forints, despite the incremental severance payout, loan repayment and higher level of CAPEX creditors. The net debt to total capital ratio improved further to 41.8%, approaching our target range of 30-40%.

Thanks to the efforts made last year to invest in 4G networks across our footprints, our Group mobile broadband and equipment revenues increased significantly albeit they were partly offset by reduced voice wholesale revenues resulting from the sharp decrease in mobile termination rates in Hungary. Following the fixed access network upgrades, we were also able to grow further our fixed broadband and TV customer bases at higher ARPUs in Hungary, which contributed to overall growth of 2.3% in fixed line Group revenues. Group-wide rollout of our quad-play Magenta1 proposition based on the integrated Telekom brand has helped too in promoting our brand and services. We were also able to continue to grow our System Integration and IT revenues, an area of the market which we consider to offer significant development potential and intend to target.

Current performance is in-line with expectations and we are happy to maintain our guidance targets; for the avoidance of doubt, the one-off gains in this quarter were as expected and already incorporated into our outlook.”

1) includes HUF 49.3 billion relating to the energy business

This investor news contains forward-looking statements. Statements that are not historical facts, including statements about our beliefs and expectations, are forward-looking

statements. These statements are based on current plans, estimates and projections, and therefore should not have undue reliance placed upon them. Forward-looking statements

speak only as of the date they are made, and we undertake no obligation to update publicly any of them in light of new information or future events.

Forward-looking statements involve inherent risks and uncertainties. We caution you that a number of important factors could cause actual results to differ materially from those contained in any forward-looking statement. Such factors are described in, among other things, our annual financial statements for the year ended December 31, 2015, available on our website at https://www.telekom.hu which have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) and adopted by the European Union.

In addition to figures prepared in accordance with IFRS, Magyar Telekom also presents non-GAAP financial performance measures, including, among others, EBITDA, EBITDA margin and net debt. These non-GAAP measures should be considered in addition to, but not as a substitute for, the information prepared in accordance with IFRS. Non-GAAP financial performance measures are not subject to IFRS or any other generally accepted accounting principles. Other companies may define these terms in different ways. For further information relevant to the interpretation of these terms, please refer to the chapter “Reconciliation of pro forma figures”, which is posted on Magyar Telekom’s Investor Relations webpage at www.telekom.hu/investor_relations.