Magyar Telekom fourth quarter 2017 results

Strategic highlights:

- Group

revenues continued to increase driven by sustained growth in SI/IT, equipment

and mobile data revenues

- Improvement in Hungary thanks to enlarged customer base in key areas with favorable ARPU trends

- Decline in reported number of mobile customers driven by prepaid registration requirement in Hungary

- Macedonian performance negatively affected by intensifying competition resulting in price erosion and slowdown in customer base expansion

- Gross profit improvement achieved despite changing revenue mix in favour of lower-margin services

- Q4 2017 EBITDA year-on-year increase driven by savings in other operating expense

- Despite improvement in gross profit and positive impact of cost optimization measures, FY 2017 EBITDA down due to the absence of one-off gains realized in 2016 (Origo and Infopark building G sales)

- Increase in Free Cash Flow from continuing operations to HUF 58.4 billion reflects lower interest payments and Capex spending

- Net debt ratio decreased to 34.8% by end-2017

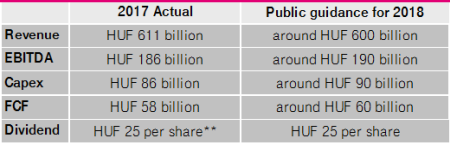

Christopher Mattheisen, CEO commented:

“Magyar Telekom continued to deliver strong

performance in 2017. The revenue growth recorded by the Group in the first nine

months of 2017 continued into Q4 2017, resulting in a 6% revenue rise for the

full year. At the same time, despite the absence of the considerable one-off

profits recorded in 2016, we managed to maintain EBITDA at 2016 levels, leaving

us well positioned for the year ahead. This also means that we have

outperformed our previously announced guidance both on revenues and EBITDA,

which reached HUF 611 billion and HUF 186 billion respectively, against our

guidance of HUF 580 billion and HUF 182 billion. We managed to surpass our FCF

goals by HUF 3 billion, finishing the year with HUF 58 billion, while CAPEX

stood at HUF 87 billion. Furthermore, thanks to our continued commitment to

meeting customer needs and constantly refreshing our product offering, we have

strengthened our position in the Hungarian market in several key areas

including post-paid mobile, TV and fixed broadband.

The Hungarian operation continued on the

positive trajectory set earlier this year as revenue increased across all three

major services lines.In the mobile segment, data services

continued to play a significant role in revenue creation with both domestic and

visitor data usage increasing. The growth in mobile revenues was supported by

the introduction of unlimited packages and a new mobile service portfolio

structure. These proved successful both financially and in terms of increasing

customer satisfaction, as over 700,000 customers signed up to these packages

throughout the year. These innovations, coupled with our ongoing efforts aimed

at migrating prepaid customers to post-paid packages, led to a higher ARPU for

the year. In the prepaid segment, we took decisive action to address the

challenges brought about by the new obligatory customer registration and we

used this as an opportunity to accelerate subscriber migration to post-paid.

In the fixed line segment, our focus was on

network development and the restructuring of our broadband offering to enhance

our competitiveness. Significantly, 2017 marked the introduction of the first

2Gbps package in the Hungarian market. Through such initiatives, we managed to

grow our customer base by over 5%, both in broadband and the TV segment, and

are confident that we are well positioned to capitalize on this growth going

forward. Our efforts were also supported by Flip, our new brand, which offers

one very attractively priced 3Play package that was well received by the

market.

In October, we faced a significant

regulatory change which meant we are only able to offer 2-year loyalty

contracts with equipment sales attached. In line with our objective of pursuing

differentiation through our device offering, and to mitigate any negative

effects of the new regulation, we strengthened our equipment offering across

both mobile and fixed segments.

FMC (fixed-mobile convergence) remains one

of our core focuses as we strongly believe that the key to long term success

lies in the ability to offer truly integrated solutions to our customers. In

line with this, we have extended our Magenta1 offer according to our customers’

requirements, including the possibility to swap fixed voice for mobile data in

the package. This helped us to further expand our FMC subscriber base. In the SI/IT segment we significantly

increased our income. This was primarily attributable to the acceleration of

the inflow of EU funds into Hungary, and though many projects were low margin

deals, the focus remains on pursuing higher margin projects.

In Macedonia, total revenues registered an

annual decline in 2017 as competition in the fixed segment remained strong, and

these same competitive pressures emerged in the fourth quarter in the mobile

segment. SI/IT revenues fell as a number of major projects were postponed in

2017. Despite these competitive pressures, we achieved year-on-year EBITDA

growth through the successful implementation of ongoing cost saving measures.

Looking ahead to 2018, we will place even

greater focus on the FMC segment where we are currently in a unique position to

meet the full range of communication requirements of Hungarian households. In

Macedonia, we are confident that, in spite of challenging market conditions, the

EBITDA turnaround is sustainable. Consequently, we expect a slight year-on-year

decline in our revenues to approximately HUF 600 billion for 2018, on account

of the exit of our energy business and lower equipment sales revenues. However,

these are not expected to affect 2018 EBITDA, which we anticipate will increase

to approximately HUF 190 billion for the year thanks to planned group-wide

efficiency improvements. We expect a slight increase in our CAPEX to around HUF

90 billion as we continue to invest in our fixed networks in Hungary. Our Free

Cash Flow will receive a slight boost in 2018 from upcoming real-estate sales

ahead of our move into new headquarters, and should total around HUF 60

billion. Based on the current operating and regulatory environment and outlook,

we expect the Company to pay HUF 25 dividend per share in relation to 2018

earnings. This is subject to the Board of Directors’ future proposal to the

General Meeting which will be submitted in due course, once all necessary

information is available and all prerequisites to making such a proposal are

met.”

Public guidance*:

*excluding Crnogorski Telekom financials and the transaction price of the disposal of the majority ownership

This investor news contains

forward-looking statements. Statements that are not historical facts, including

statements about our beliefs and expectations, are forward-looking statements.

These statements are based on current plans, estimates and projections, and

therefore should not have undue reliance placed upon them. Forward-looking

statements speak only as of the date they are made, and we undertake no

obligation to update publicly any of them in light of new information or future

events.

Forward-looking statements involve inherent risks and uncertainties. We caution you that a number of important factors could cause actual results to differ materially from those contained in any forward-looking statement. Such factors are described in, among other things, our annual financial statements for the year ended December 31, 2016, available on our website athttps://www.telekom.hu

In addition to figures prepared in accordance with IFRS, Magyar Telekom also presents non-GAAP financial performance measures, including, among others, EBITDA, EBITDA margin and net debt. These non-GAAP measures should be considered in addition to, but not as a substitute for, the information prepared in accordance with IFRS. Non-GAAP financial performance measures are not subject to IFRS or any other generally accepted accounting principles. Other companies may define these terms in different ways. For further information relevant to the interpretation of these terms, please refer to the chapter “Reconciliation of pro forma figures”, which is posted on Magyar Telekom’s Investor Relations webpage at www.telekom.hu/investor_relations.

.