Magyar Telekom fourth quarter 2019 results

Strategic highlights:

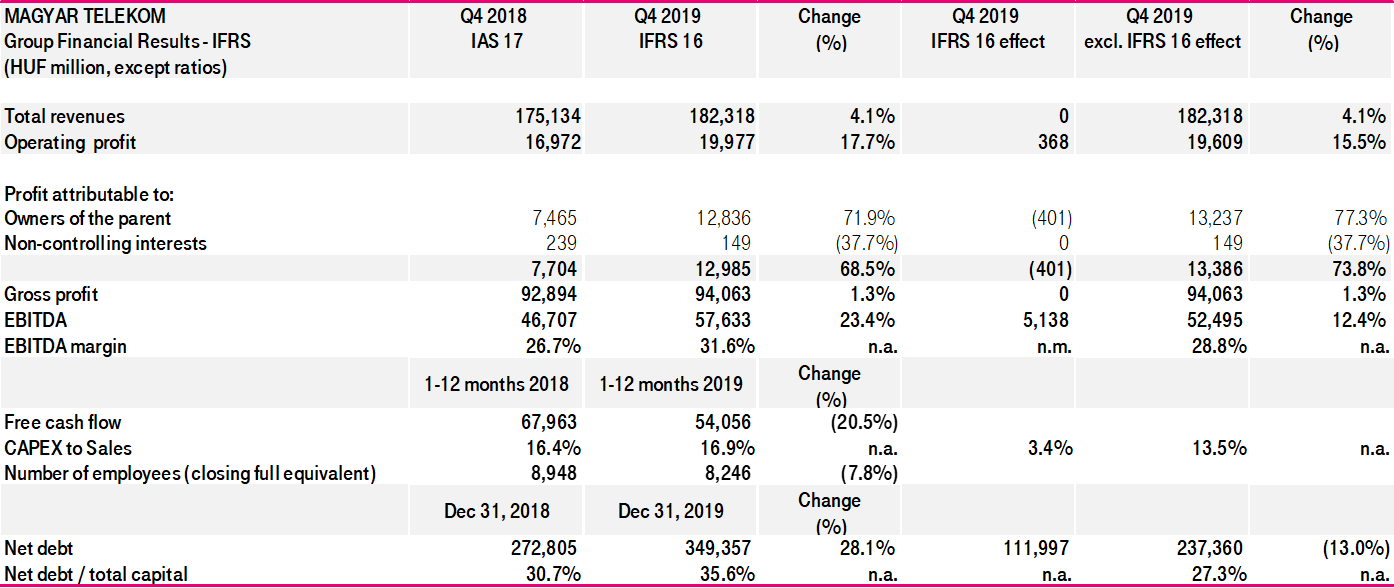

- Increase in Group revenues driven by continued expansion of telecommunication service revenues and higher SI/IT sales

- Improvement in gross profit reflects an increase in service revenues

- EBITDA growth delivered through higher gross profit and savings in indirect costs

- Free cash flow decline reflects the payment of the 2100 MHz frequency license extension fee, unfavourable changes in working capital, and lower proceeds from real estate sales

- After 2019 results HUF 20 dividend per share proposed for approval at the Annual General Meeting

Tibor Rékasi, CEO commented:

“We are pleased to announce that the Group has sustained its momentum in 2019, delivering revenue and EBITDA growth. On revenue we outperformed our guidance of 1.5% growth, achieving total revenues of HUF 666.7 billion in 2019. We also recorded a 4.4% increase in EBITDA in 2019, against our guidance of 1-2% growth, achieving a figure of HUF 201.0 billion for the full year (excluding the impact of IFRS16 adoption). CAPEX for the Group stood at HUF 89.6 billion (excluding the impact of IFRS16 adoption), in line with our broadly stable expectation for the year. Unfortunately for the first time in recent years we marginally missed our free cash flow target, where instead of the projected circa 5% growth we reported a 4.2% decline to HUF 65.1 billion (excluding spectrum license payments). This decline was attributable to timing issues in our real estate project, as proceeds from the sale of a major asset was not realized in 2019.

In Hungary,

we refined our mobile and fixed portfolios, in alignment with our

‘more-for-more’ strategy, to ensure we remain well positioned to meet customer

needs and market expectations. This is

reflected in the year-on-year revenue increases reported by our fixed and

mobile segments of 2.9% and 3.0%, respectively. Both segments continue to grow,

primarily due to our data products, which are the fastest growing revenue lines

in both the fixed and mobile segment. This was further supported by robust equipment

sales, both in the domestic market and abroad. In the mobile segment, we

continue our efforts to migrate customers from pre- to postpaid packages, thus

increasing our blended mobile ARPU.

In the

fixed market we maintained our strong focus on growing our network, bringing us

closer to our goal of providing gigabit internet connectivity nationwide. We

continued to see positive results from this strategy in the growth of fixed

line revenue.

While

we experienced some setbacks in the SI/IT sector during the year in relation to

postponed public sector spending, by the end of the year we were back on track

with revenues growing again in Q4 2019. Unfortunately, this was not enough to

fully offset the decline recorded earlier in the year resulting in an annual

decline of 6.9%.

Consistent

with our strategy, we remain determined to expand our FMC customer base. To

maintain our competitive advantage, we have enhanced our Magenta1 offering

which delivers highly attractive services and related equipment. In addition to

enabling customers with a prepaid mobile tariff to take advantage of the

Magenta 1 offer, we have also reviewed the offer to ensure its advantages are

more clearly presented to customers.

In North Macedonia we are continuing to deliver a turnaround in revenue and EBITDA, with figures growing annually by 5.7% and 7.5% respectively. Despite intensifying competition in the market, we have successfully grown our core business, supported by increased customer demand for data and equipment. In the SI/IT segment we have seen exceptional growth as revenues more than doubled in the final quarter versus the prior year, resulting in 46.7% growth for the full year in the segment.

Looking ahead we expect revenues to stay at the current level throughout 2020, whilst EBITDA After Lease is expected to increase by 1%-2% thanks reduction in indirect costs. Capital expenditures are expected to remain stable (excluding the increase driven by IFRS 16 implementation and any possible spectrum costs) as spending on the fixed network will continue to reflect the accelerated fiber-rollout program. We expect free cash flow (excluding spectrum license fees) to increase by around 5% thanks to further real estate sales. However, as opposed to earlier forecasts, now we expect free cash flow to stay broadly stable in 2021 as we plan to complete the real estate sales projects in 2020.”

Public guidance

1) excluding spectrum license fees and CAPEX of right-of-use assets (i.e. the impact of IFRS 16 implementation)

This investor news contains

forward-looking statements. Statements that are not historical facts, including

statements about our beliefs and expectations, are forward-looking statements.

These statements are based on current plans, estimates and projections, and

therefore should not have undue reliance placed upon them. Forward-looking

statements speak only as of the date they are made, and we undertake no

obligation to update publicly any of them in light of new information or future

events.

Forward-looking statements involve inherent risks and uncertainties. We caution you that a number of important factors could cause actual results to differ materially from those contained in any forward-looking statement. Such factors are described in, among other things, our annual financial statements for the year ended December 31, 2018, available on our website athttps://www.telekom.hu

In addition to figures prepared in accordance with IFRS, Magyar Telekom also presents non-GAAP financial performance measures, including, among others, EBITDA, EBITDA margin and net debt. These non-GAAP measures should be considered in addition to, but not as a substitute for, the information prepared in accordance with IFRS. Non-GAAP financial performance measures are not subject to IFRS or any other generally accepted accounting principles. Other companies may define these terms in different ways. For further information relevant to the interpretation of these terms, please refer to the chapter “Reconciliation of pro forma figures”, which is posted on Magyar Telekom’s Investor Relations webpage at www.telekom.hu/investor_relations.

.