Magyar Telekom fourth quarter 2020 results

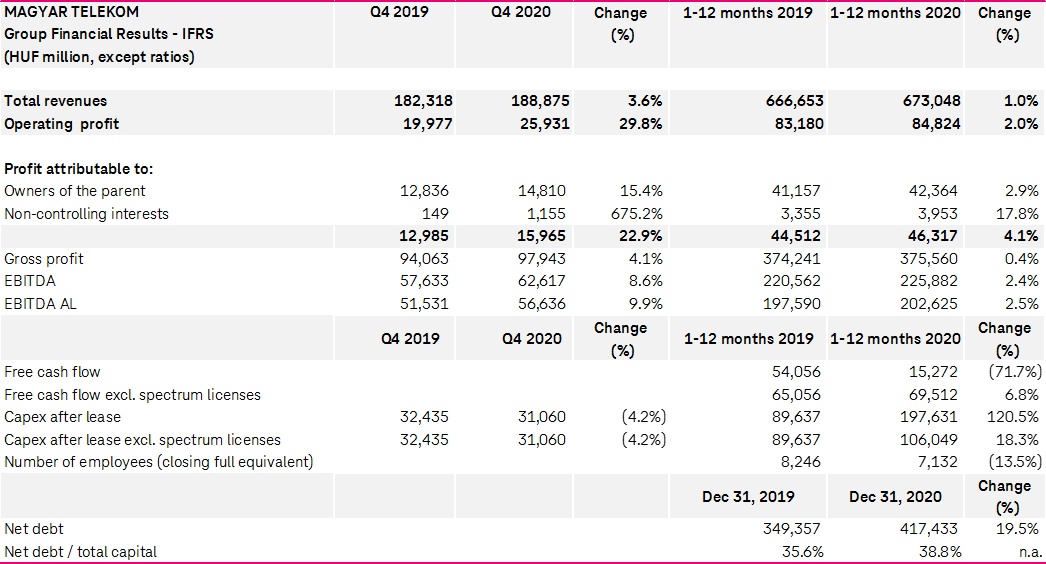

- Revenues grew by 3.6% year-on-year to HUF 188.9 billion in Q4 2020, driven by higher contributions from fixed and mobile services, and growing equipment sales. These positive trends enabled the Group to generate revenues of HUF 673.0 billion for the full year, a 1.0% increase versus 2019

- Gross profit improved by HUF 3.9 billion year-on-year to HUF 97.9 billion in Q4 2020 and by HUF 1.3 billion year-on-year to HUF 375.6 billion in 2020. A strong contribution from fixed and mobile operations was partly offset by unfavorable roaming and visitor margin evolution and higher payable telecommunication taxes, both a consequence of COVID-19 pandemic

- Indirect costs improved again by HUF 1.1 billion year-on-year in Q4 2020. As a result of gross profit improvement and lower indirect costs, EBITDA AL increased by HUF 5.1 billion, or 9.9% year-on-year, to HUF 56.6 billion in Q4 2020. The full year EBITDA AL grew at a similar rate in absolute terms to HUF 202.6 billion

- CAPEX AL excluding spectrum licenses decreased slightly year-on-year to HUF 31.1 billion in Q4 2020 but grew by more than HUF 16.4 billion year-on-year to HUF 106.0 billion in 2020. The significant increase versus 2019 was attributable to the accelerated fiber network roll-out and comprehensive radio network modernization

- Free cash flow excluding spectrum licenses reached HUF 69.5 billion in 2020, representing a HUF 4.5 billion improvement versus the previous year. Despite increased investment into the business, favorable working capital developments, rising profitability and lower financial charges payable led to enhanced annual free cash flow

- Free cash flow after spectrum licenses reached HUF 15.3 billion for the full year, including the payment of 5G spectrum license fees in Q2 2020§ Net debt reached HUF 417.4 billion at December 31, 2020, corresponding to a net debt to total capital ratio of 38.8%

Operational highlights

- Continued expansion of the gigabit capable network resulted in close to 2.5 million access points in Hungary with 377 thousand access points covered by end-2020

- Subscriber numbers in Hungary continued to grow in fixed broadband, pay TV and mobile by 7.5%, 6.9% and 1.1%, respectively, in 2020

- Average mobile data usage grew to an all-time high of 6.4 GB/month in Q4 2020, up 47% year-on-year in 2020

- Magyar Telekom received an AA ESG rating from MSCI and completed the year with net carbon neutral operations for scope 1 and 2 emissions for the sixth year in a row

Tibor Rékasi, Magyar Telekom CEO commented:

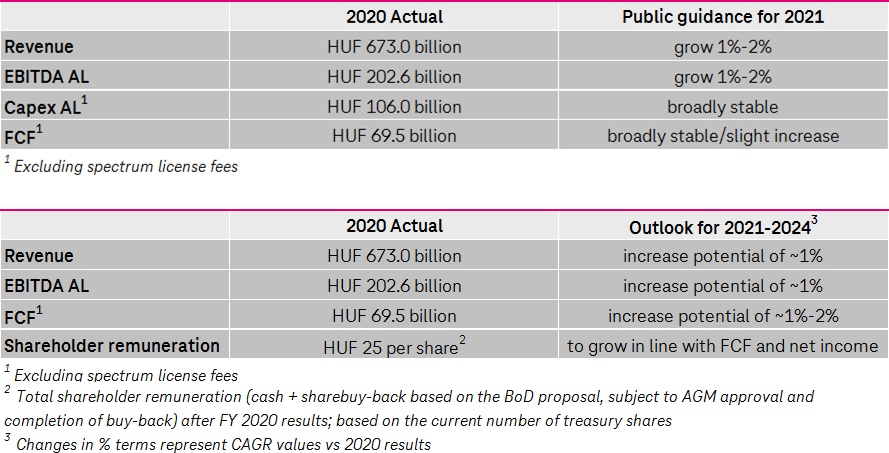

“I am particularly proud thatin the face of the COVID-19 pandemic, all our employees rose to the challenge to deliver a performance ahead of our 2020 expectations. In the fourth quarter, the business achieved robust results with a significant HUF 5 billion improvement in total EBITDA AL to HUF 56.6 billion. This strong final-quarter performance contributed to the successful delivery of our most important annual financial KPIs, including revenue, EBITDA AL and free cash flow.

2020 will also go down in history as a year of significant investments into our fixed and mobile networks. The fiber network roll-out gathered pace last year with overall development exceeding previous years’ levels. Looking ahead to 2021, I am confident that we will continue on our growth path despite ongoing volatility in our operating environment.”

This investor news contains

forward-looking statements. Statements that are not historical facts, including

statements about our beliefs and expectations, are forward-looking statements.

These statements are based on current plans, estimates and projections, and

therefore should not have undue reliance placed upon them. Forward-looking

statements speak only as of the date they are made, and we undertake no

obligation to update publicly any of them in light of new information or future

events.

Forward-looking statements involve inherent risks and uncertainties. We caution you that a number of important factors could cause actual results to differ materially from those contained in any forward-looking statement. Such factors are described in, among other things, our annual financial statements for the year ended December 31, 2019, available on our website athttps://www.telekom.hu

In addition to figures prepared in accordance with IFRS, Magyar Telekom also presents non-GAAP financial performance measures, including, among others, EBITDA, EBITDA margin and net debt. These non-GAAP measures should be considered in addition to, but not as a substitute for, the information prepared in accordance with IFRS. Non-GAAP financial performance measures are not subject to IFRS or any other generally accepted accounting principles. Other companies may define these terms in different ways. For further information relevant to the interpretation of these terms, please refer to the chapter “Reconciliation of pro forma figures”, which is posted on Magyar Telekom’s Investor Relations webpage at www.telekom.hu/investor_relations.

.