Magyar Telekom first quarter 2021 results

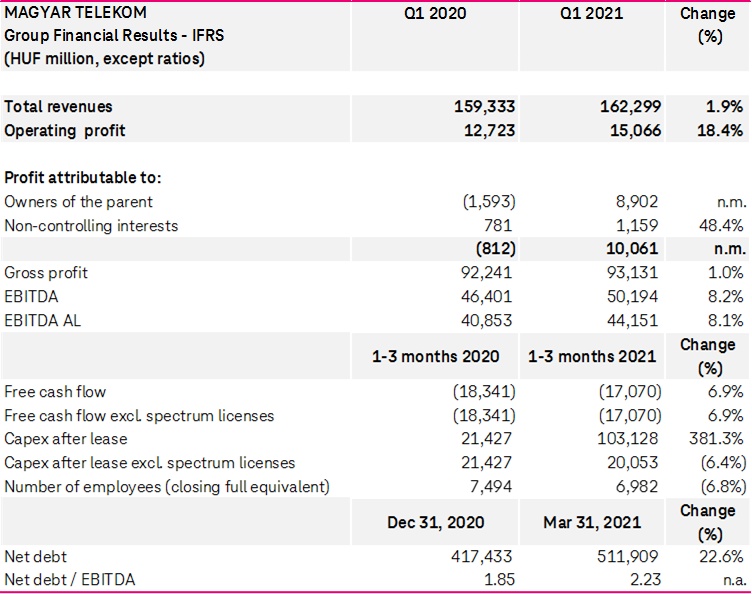

- Revenues grew by HUF 3.0 billion, or 1.9% year-on-year to HUF 162.3 billion in Q1 2021, driven by strong contributions from fixed and mobile services, whilst the growth rate of fixed broadband internet contribution decelerated.

- Gross profit improved by HUF 0.9 billion year-on-year to HUF 93.1 billion in Q1 2021. The contribution from fixed and mobile operations was partly offset by the negative impact of interconnect costs and telecom tax, as well as an increase in other direct costs, including higher TV content fees

- Indirect costs improved materially, by HUF 2.9 billion year-on-year in Q1 2021, since the cost base of the base period was burdened by one-off severance payments. As a result of gross profit improvement and lower indirect costs, EBITDA AL increased to HUF 44.2 billion, representing a 8.1% uplift year-on-year

- Capex AL excluding spectrum licenses decreased slightly year-on-year to HUF 20.1 billion in Q1 2021. A further HUF 83.1 billion was recognized as spectrum Capex following the completion of the auction of the 900 MHz and 1800 MHz frequency bands. Magyar Telekom expects to pay HUF 44.3 billion for frequency blocks in the first quarter of 2022 and the payment of capitalized periodic frequency fees will also be due from this date.

- Free cash outflow amounted to HUF 17.1 billion in Q1 2021, driven by a total payout of HUF 35.7 billion for PPE and intangibles on the back of relatively high Q4 2020 Capex and the usual seasonal working capital build

- Net debt grew to HUF 511.9 billion in Q1 2021, driven by the recognition of the above-mentioned spectrum related liabilities and negative cash flows during the period, resulting in net debt/EBITDA of 2.23x by the end of the period

- Based on the authorization granted by Government Decree, the Board of Directors approved the payment of total dividend of HUF 15 311 396 940 to the shareholders after 2020 results and is complemented with a share buy-back amounting to HUF 10.2 billion

Operational highlights

- Magyar Telekom acquired frequency usage rights of 8 MHz and 20 MHz duplexes on the 900 MHz and the 1800 MHz frequencies respectively, which will be used following the expiry of current entitlements of 10 MHz and 15 MHz in April 2022

- Magyar Telekom’s customer base continued to expand in a year-on-year comparison in Hungary: fixed broadband subscriptions rose by 7.1%, while the number of TV customers increased by 6.5% supported by continued interest towards IPTV services

- Magyar Telekom introduced its new cloud-based TV platform, becoming the first domestic provider of such enhanced home entertainment services, including 4K broadcasting

- Magyar Telekom’s supplier program to address climate change ranked amongst the top 7.0 % globally, according to the Carbon Disclosure Project (CDP) supplier engagement rating. Furthermore, the company has been included in FTSE4Good Index, an index designed to measure the performance of companies demonstrating strong Environmental, Social and Governance (ESG) practices, following the December 2020 ESG review

Tibor Rékasi, Magyar Telekom CEO commented:

“The operating environment

during the first quarter of 2021 has been challenging as the emergence of a

third wave of COVID-19 proved to be more severe than previous rounds. However,

thanks to our agile approach, Magyar Telekom was able to adapt swiftly to

evolving conditions and build on lessons learned throughout the pandemic to

improve our financial and operational performance. EBITDA amounted to HUF 50.2

billion in the first quarter, a considerable achievement, and one which will

serve as a solid base from which we should be able to deliver in line with our

guidance.

Magyar Telekom also secured 900

MHz and 1800 MHz frequency band rights during the quarter, a significant

milestone which will allow our customers to continue to use our mobile services

and innovative solutions at the usual high standards. I am confident that this

investment, together with continuous development of the gigabit capable network,

will enable us to not only enhance the lives of our customers, but also to the

economic success of Hungary.”

This investor news contains forward-looking statements. Statements that are not historical facts, including statements about our beliefs and expectations, are forward-looking statements. These statements are based on current plans, estimates and projections, and therefore should not have undue reliance placed upon them. Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update publicly any of them in light of new information or future events.

Forward-looking statements involve inherent risks and uncertainties. We caution you that a number of important factors could cause actual results to differ materially from those contained in any forward-looking statement. Such factors are described in, among other things, our annual financial statements for the year ended December 31, 2020, available on our website athttp://www.telekom.hu

.