Magyar Telekom third quarter 2022 results

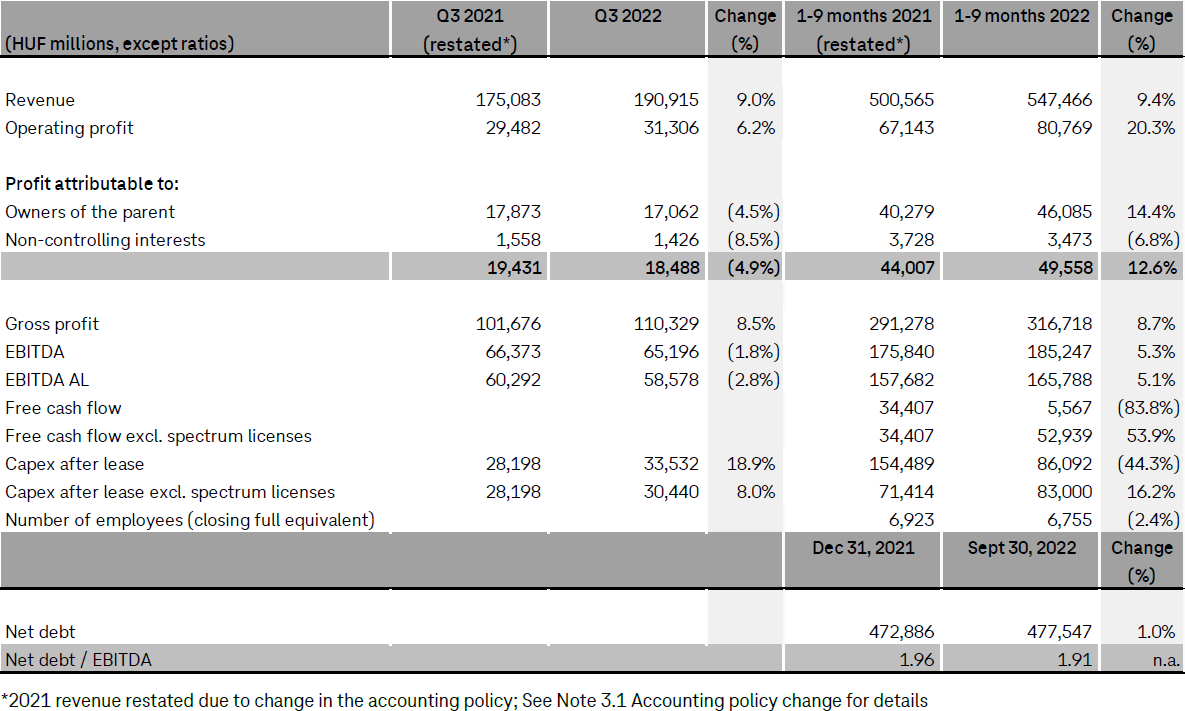

- Group revenue grew by 9.0% year-on-year in Q3 2022, reflecting continued strong demand for mobile data, high bandwidth broadband packages and mobile equipment in both countries of operation

- Gross profit improved in line with the revenue trend, growing by 8.5% year-on-year in Q3 2022

- EBITDA AL declined by 2.8% year-on-year to HUF 58.6 billion in Q3 2022, as the supplementary telecommunication tax and higher energy costs (particularly in North Macedonia) offset the improvement in gross profit

- Net income was lower by 4.5% year-on-year, at HUF 17.1 billion in Q3 2022, primarily driven by the lower EBITDA

- Capex after lease excluding spectrum licenses rose to HUF 83.0 billion in the first nine months of 2022, driven mainly by the strong progress in fixed and mobile network development in both countries of operation

- Free cash flow, excluding spectrum license fees, amounted to HUF 52.9 billion in the first nine months of 2022, improving by HUF 18.5 billion year-on-year as higher capex payments, income tax payment settlements and losses incurred due to the weakening of the forint were fully offset by the positive underlying results and the fact that payment of the new supplementary telecommunication tax will only be due in Q4 2022

Operational highlights

- Network development continued at pace, with fixed gigabit coverage reaching over 3.3 million access points across Hungary and considerable progress in mobile RAN modernization at both countries of operation

- Successful monetization of investments was evident in dynamic customer base expansion and increasing ARPUs in Hungary: fixed broadband subscriptions rose by 7.2%, TV customers increased by 5.6%; and the mobile postpaid base expanded by 5.8%, with corresponding ARPU increases of 7.2%, 2.5% and 3.0% respectively year-on-year in Q3 2022

- Scope Ratings GmbH, reaffirmed Magyar Telekom at BBB+ with a stable outlook that reflects Scope Ratings GmbH’s view of Magyar Telekom’s strong and stable positions in the domestic mobile and broadband markets and its moderate leverage

- Magyar Telekom received further recognition for delivery against its sustainability strategy from sustainability rating agencies: its 'AA' ESG rating was reaffirmed by MSCI while ISS Corporate Solutions ranked the Company among the best performers of the telecom sector globally with respect to its sustainability credentials

Tibor Rékasi, Magyar Telekom CEO commented:

“Despite the

turbulent operating environment, we are pleased to have maintained positive

commercial momentum during the third quarter. This achievement has been

underpinned by continued efforts to provide seamless connectivity and

outstanding customer experience through targeted investments in our networks

and evolving service offering. A prime example of the latter is the successful

launch of a new mobile portfolio aimed at addressing growing demand for mobile

data in the Hungarian residential market by offering three unlimited data

packages. Such initiatives have contributed to continued growth of our customer

base and ARPU levels in key service areas, which in turn led to a revenue

uplift of 9.0% year-on-year for the third quarter.

Nonetheless, the

ongoing macroeconomic headwinds combined with the introduction of a

supplementary telecommunication tax led to downward pressure on our

profitability, causing an EBITDA AL decline of 2.8% year-on-year for the

quarter.

Looking ahead to the

rest of the year, we see continued pressure on our profitability arising from

the increasingly challenging economic environment. Given the strong commercial

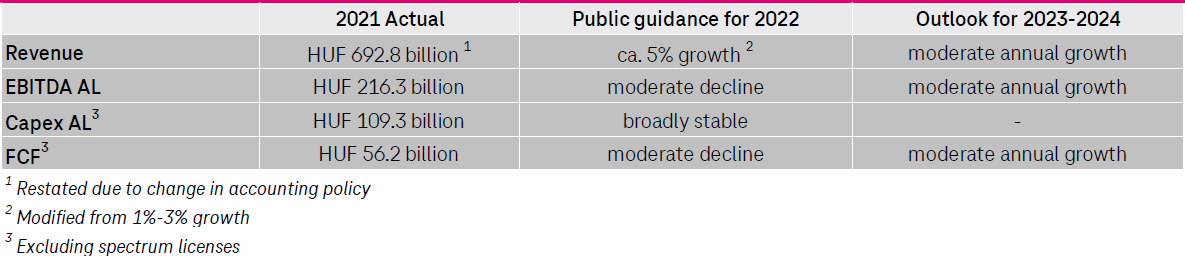

performance year to date, however, we have upgraded our revenue target for the

year, from a growth rate of 1-3% to around 5%. We expect this higher rate of

revenue growth to support our efforts to partially mitigate the negative

effects of cost inflation and the introduction of the supplementary

telecommunication tax on EBITDA.”

This investor news contains forward-looking statements. Statements that are not historical facts, including statements about our beliefs and expectations, are forward-looking statements. These statements are based on current plans, estimates and projections, and therefore should not have undue reliance placed upon them. Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update publicly any of them in light of new information or future events.

Forward-looking statements involve inherent risks and uncertainties. We caution you that a number of important factors could cause actual results to differ materially from those contained in any forward-looking statement. Such factors are described in, among other things, our annual financial statements for the year ended December 31, 2021, available on our website athttp://www.telekom.hu

.