Magyar Telekom results for the second quarter and first half of 2023

Highlights:

Total revenue increased by 14.0% year-on-year to HUF 208.1 billion in Q2 2023. This improvement was primarily driven by strong growth in mobile data and fixed broadband revenue reflecting the underlying business growth as well as the positive impact of the inflation-based fee adjustment implemented to the Hungarian subscription fees from March 1, 2023. Total revenue in the first half of 2023 increased by 13.3% year-on-year, driven by the same factors and year-on-year higher System Integration and IT revenue during the first months of 2023.

- Mobile revenue rose by 15.2% year-on-year to HUF 121.3 billion in Q2 2023, driven by the continued growth in mobile data revenue coupled with increasing voice-retail revenue.

- Fixed line revenue increased by 14.8% year-on-year, to HUF 67.1 billion in Q2 2023,thanks primarily to increases in fixed broadband and TV revenue driven by the customer base expansions as well as the favorable impact of the introduction of inflation-based fee adjustment to the Hungarian subscription fees.

- System Integration and IT (‘SI/IT’) revenue increased by 5.1% to HUF 19.7 billion in Q2 2023,as higher revenue at the Hungarian operation thanks to increased revenue from high value projects offset the absence of major customized solution project revenue at the North Macedonian operation.

Direct costs were up by 7.6% year-on-year at HUF 82.9 billion in Q2 2023,driven by higher SI/IT service related and other direct costs.

- Interconnect costsdeclined by 1.7% year-on-year to HUF 5.7 billion in Q2 2023, reflecting lower payments at the Hungarian operation to domestic mobile operators in line with the lower outgoing traffic volumes.

- SI/IT service-related costsrose by 10.5% year-on-year to HUF 14.8 billion in Q2 2023, as a result of the increase in revenue and the higher weight of lower margin projects in the quarter.

- Impairment losses and gains on financial assets and contract assets (bad debt expenses)was higher by 20.5% year-on-year, amounting to HUF 2.4 billion in Q2 2023 in line with higher revenue base and also reflecting less favorable aging structure of the customer receivables at the Hungarian operation.

- Telecom taxwas lower by 2.2% year-on-year, amounting to HUF 6.4 billion in Q2 2023, primarily reflecting lower mobile voice usage of the business customer base.

- Other direct costswere up by 8.7% year-on-year to HUF 53.6 billion in Q2 2023, driven by higher equipment costs, TV content fees and increase in roaming outpayments.

Gross profit improved by 18.7% year-on-year to HUF 125.2 billion in Q2 2023,thanks to a higher contribution from telecommunication services.

Indirect costs rose by 3.6% year-on-year, to HUF 49.3 billion in Q2 2023,as a combined result of the different timing of the booking of the supplementary telecommunication tax and higher other expenses.

- Employee-related expensesincreased by 7.9% year-on-year, amounting to HUF 20.3 billion in Q2 2023, reflecting primarily the wage increase in effect from January 1, 2023 at the Hungarian operation.

- Utility taxincome of HUF 0.2 billion was recorded in Q2 2023, attributable to a correction item resulting from the analysis of the differences in earlier records.

- Supplementary telecommunication taxwas booked in the amount of HUF 7.5 billion in Q2 2023, reflecting the expected revenue increase. As the tax was imposed by the Government of Hungary with its decree issued on June 4,2022 a HUF 12.4 billion expense was booked in Q2 2022, in relation to the first six months of 2022 supplementary tax charge.

- Other operating expenses(excluding the utility tax and the supplementary telecommunication tax) rose by 33.1% year-on-year to HUF 22.5 billion in Q2 2023, reflecting higher energy costs at the Hungarian operation, particularly electricity, coupled with inflation-driven further cost pressures.

- Other operating incomewas HUF 0.9 billion in Q2 2023, in line with earlier trends.

EBITDA increased by 31.1% year-on-year to HUF 75.9 billionin Q2 2023driven by the improvement in gross profit that offset the higher indirect costs, whereas the supplementary telecommunication tax for the first half of 2022 was all booked in Q2 2022.EBITDA in the first half of 2023 increased by 11.6% year-on-year to HUF 134.0 billion.

EBITDA AL was up by 33.5% year-on-year to HUF 68.6 billion in Q2 2023 and increased by 11.4% year-on-year in the first half of 2023, as the aforementioned drivers were coupled with also higher IFRS 16 lease liability related depreciation and interest expenses, in line with the increasing volume of the related lease liabilities.

Depreciation and amortization (‘D&A’) expenseswere broadly stable year-on-year, amounting to HUF 34.9 billion in Q2 2023,as increases in IFRS 16 lease liability related depreciation expenses were offset by lower software related depreciation expenses in Hungary thanks to the optimization of the IT infrastructure and the absence of one-off increases related to shortened useful life and accelerated depreciation in relation to RAN modernization in Q2 2022 in North Macedonia.

Profit for the period rose by 101.9% or HUF 11.9 billion year-on-year to HUF 23.7 billion in Q2 2023and was up by 14.1% year-on-year at HUF 35.5 billion in the first half year of 2023.Improvement was driven by the higher EBITDA and lower D&A that offset increases in financial expenses.

- Net financial resultdeteriorated from a loss of HUF 6.5 billion in Q2 2022 to a loss of HUF 12.0 billion in Q2 2023. Interest expense increased driven by higher interest related to lease liabilities, installment sales and higher average interest costs. The unfavorable change in other finance expense primarily reflects less favorable results related to derivatives attributable to the different shifts in the relevant yield curves and different euro-forint currency movement resulting in a year-on-year deterioration.

- Income tax expenseswere up by 20.5% year-on-year at HUF 5.4 billion in Q2 2023, reflecting the year-on-year higher profit levels.

Profit attributable to non-controlling interests increased by 22.4% year-on-year to HUF 1.4 billion in Q2 2023, reflecting primarily the improvement in EBITDA at the North Macedonian subsidiary.

Free

cash flow, excluding spectrum license fees, amounted to HUF 7.3 billion in H1

2023, down by HUF 25.1 billion year-on-year.This decrease

is the result of a variance in timing of the supplementary telecommunication

tax payment. In 2022, this tax was payable in November, whereas in 2023 a

payment (including 2022 tax settlement and 2023 advance payment) of HUF 26.4

billion was due in May.

Tibor Rékasi, Magyar Telekom CEO commented:

“Throughout the second quarter of 2023, we continued to navigate an uncertain economic environment while remaining focused on our primary goal of being the ‘number one choice for customers’ by offering seamless connectivity and an outstanding user experience. Our dedication has paid off, and by the end of the second quarter, we successfully reached 1.3 million customers with gigabit connections. Additionally, we met more than 25% higher average mobile data usage compared to the base period. To maintain the highest standard of service and meet our customers’ growing data needs, we continued to progress our multi-year mobile network modernization program and as a next step, we expanded the reach of our 5G service and have already achieved 60% coverage.

The success of our efforts to improve customer service are evident as despite facing cost pressures stemming primarily from the current macro environment, our EBITDA AL grew by 11.4% year-on-year in the first half of 2023.

Looking to the second half of the year, we remain committed to maintaining our solid market positions and operational momentum, allowing us to meet our public targets for Revenue, EBITDA AL and FCF whilst with regards to adjusted net income, we now target to reach a double-digit growth.”

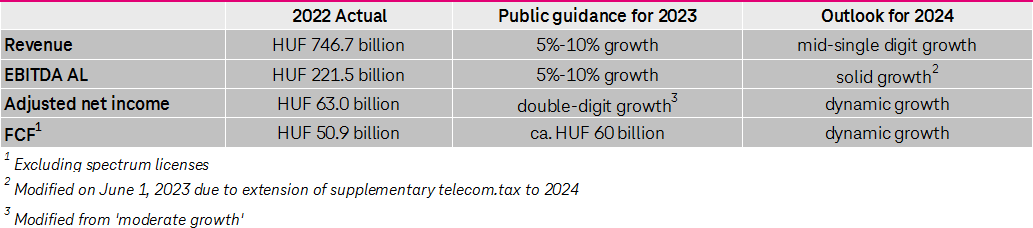

Public targets