Magyar Telekom results for the third quarter of 2018

Highlights:

Total revenues (excluding the impact of IFRS 15 adoption) increased by 5.4% year-on-year to HUF 163.8 billion in Q3 2018and by 7.1% to HUF 481.1 billion in the first nine months of 2018, compared to the corresponding periods in 2017.Revenue growth continued to be primarily driven by a strong increase in SI/IT revenues, along with higher equipment sales and mobile data usage.

- Mobile revenues (excluding IFRS 15 impacts) increased by 5.5% year-on-year to HUF 90.2 billion in Q3 2018and by 5.1% year-on-year to HUF 251.6 billion in the first nine months of 2018. This was driven by the continued strong growth of both mobile data and equipment sales revenues.

- Fixed line revenues (excluding IFRS 15 impacts) rose by 2.5% year-on-year to HUF 50.1 billion in Q3 2018and by 5.1% to HUF 152.1 billion in the first nine months of 2018. This growth was attributable to rising equipment sales as well as higher TV and broadband retail service revenues.

- System Integration (SI) and IT revenues grew by 19.8% year-on-year to HUF 23.5 billionin Q3 2018, resulting in year-on-year revenue growth of 26.7% for the first nine months of 2018. Growth continued to be driven by public sector projects in Hungary, whereas in Macedonia, the increase in SI/IT revenues was driven by the higher volume of customized solutions projects.

- Energy Serviceswere discontinued following the exit from the residential segment of the electricity market, as of November 1, 2017.

Direct costs (excluding IFRS 9 and 15 impacts) increased by 19.9% year-on-year, to HUF 69.6 billion in Q3 2018(by 17.1% year-on-year to HUF 203.3 billion in the first nine months of 2018), driven by higher SI/IT and equipment costs, in line with the growth delivered in related revenue lines.

- Interconnect costsincreased by 12.2% year-on-year to HUF 5.4 billion in Q3 2018, reflecting increased mobile traffic in Hungary which led to higher payments to domestic mobile operators.

- SI/IT service related costsincreased by 24.4% year-on-year to HUF 16.3 billion in Q3 2018, driven by a higher volume of related projects.

- Bad debt expensesdeteriorated by HUF 0.5 billion year-on-year to HUF 2.0 billion in Q3 2018. This was driven primarily by individual impairments in Hungary which could not be offset by some improvement recorded in Macedonia which was driven by lower impairment costs related to mobile services.

- Telecom taxgrew slightly by 0.7% year-on-year to HUF 6.4 billion in Q3 2018, reflecting higher mobile traffic in Hungary, both in the retail and business segments.

- Other direct costsincreased by 27.4% year-on-year, to HUF 39.6 billion in Q3 2018, primarily due to an increase in the cost of equipment sales in line with higher sales, and an increase in TV outpayments.

Gross profit (excluding IFRS 9 and 15 impacts) decreased by 3.3% year-on-year to HUF 94.2 billion in Q3 2018.This was driven by the increasing weight of lower margin services in the sales mix, as well as the absence of the one-off effect of a provision reversal related to the ceased loyalty program in Hungary that impacted Q3 2017. In the first nine months of 2018, gross profit moderately increased to HUF 277.8 billion, as the strong increase in revenues outweighed the above effects.

Indirect costs (excluding IFRS 9 and 15 impacts) increased by 1.1% year-on-yearto HUF 40.6 billionin Q3 2018as savings in other operating expenses failed to fully offset higher employee related expenses and the decline in other operating income. In the first nine months of 2018, indirect costs improved to HUF 131.3 billion, thanks to savings in other operating expenses.

- Employee-related expensesrose by 8.1% year-on-year at HUF 20.1 billion in Q3 2018. The growing impact of changes to the trainee employment-form at the Hungarian operation and a 5% average wage increase at the Company was coupled with higher severance expense related to changes in the organization structure.

- Other operating expensesimproved by 9.7% year-on-year to HUF 21.3 billion in Q3 2018 as savings in maintenance and energy expenses coupled with a one-time correction related to bank charges fully offset higher rental fees in relation to the new headquarters.

- Other operating incomedecreased by HUF 1.3 billion year-on-year to HUF 0.9 billion in Q3 2018, reflecting lower income received from the brand fee for the E2 energy joint venture, as well as the absence of the one-off gain related to a real estate sale which positively impacted the Q3 2017 results.

EBITDA (excluding IFRS 9 and 15 impacts) declined by 6.3% year-on-year to HUF 53.6 billion in Q3 2018reflecting the combined impact of lower gross profit and some increases in indirect costs. In the first nine months of 2018, EBITDA improved by 2.2% year-on-year to HUF 146.5 billion as both gross profit and indirect costs improved compared to the corresponding period in 2017.

Depreciation and amortization expensesincreased by 10.7% year-on-year to HUF 29.9 billion in Q3 2018 and by 6.8% to HUF 85.8 billion in the first nine months of 2018, driven by shortened useful lives of customer connections related network elements.

Profit for the period from continuing operations (excluding IFRS 9 and 15 impacts) decreased by 22.1% year-on-year to HUF 15.1 billion in Q3 2018, as lower EBITDA coupled with an increase in D&A expenses more than offset the positive impact of lower income tax expense. In the first nine months of 2018, profit for the period from continuing operationsincreased by 12.5% to HUF 39.5 billion thanks to higher EBITDA, coupled with savings in financial and income tax expenses.

- Net financial expensesimproved moderately year-on-year to HUF 5.3 billion in Q3 2018, reflecting lower average debt levels.

- Income taxexpenses decreased by 37.5% year-on-year, to HUF 3.3 billion in Q3 2018. This was driven by the combined impact of lower profit before tax, temporary correction items that level out on an annual basis, as well as the distorting effect of a change in the tax calculation methodology relating to the transition from local GAAP to standalone IFRS, which increased income tax expenses in Q3 2017.

Profit attributable to non-controlling interests (excluding IFRS 9 and 15 impacts), decreased moderately to HUF 1.2 billion in Q3 2018, as higher D&A expenses in Q3 2018 at the Macedonian operations offset the improvement in EBITDA. In the first nine months of 2018, profit attributable to non-controlling interests increased to HUF 3.0 billion, thanks to the improved performance of our Macedonian operation.

Profit from discontinued operation:In January 2017, the Company signed a share purchase agreement with Hrvatski Telekom d.d. for the sale of the Company’s entire 76.53% shareholding in Crnogorski Telekom A.D., for a total consideration of EUR 123.5 million (HUF 38.5 billion). The transaction closed in January 2017. Consequently, in accordance with IFRS5, the results and cash flows of the Montenegrin operations are presented as discontinued operations for both the comparative and the current period.

Net debt at the end of September 2018 was stable compared to the end of 2017 at HUF 310.0 billion, with the net debt ratio (net debt to total capital) declining moderately to 33.8%.

Increase in Free Cash Flowas higher first nine months EBITDA, lower capex payments and declining acquisition costs offset higher receivable balances related to instalment sales and a temporary increase in payments to handset suppliers.

Tibor Rékasi, CEO commented:

“I am delighted that we have maintained our strong performance from the first half of the year in the third quarter of 2018. Once again, we delivered growth across all business lines, with System Integration and IT and Equipment sales revenues contributing strongly to the 5.4% revenue growth achieved in the quarter.

In Hungary, the demand for mobile data continued to grow, in line with the increasing number of smart devices in the market. The latter was reinforced by our strategy for equipment sales, which included a new subsidy structure favoring smart handsets in the product mix. Our new mobile packages drive pre- to postpaid migration among our customers and further support our mobile data revenue growth. These factors were also shown in our mobile ARPU, where we achieved 8% growth year-on-year.

As per our ongoing strategy, we maintained a strong focus on our fixed network. We are working to achieve our goal of extending our fiber coverage to an additional 300,000 households in 2018. This effort is part of our overall long-term plan to offer gigabit internet connectivity across the whole country. The benefits of these efforts materialize in the ongoing growth of our broadband retail and TV revenue lines. In addition, equipment revenues continued to grow year-on-year, reflecting our successful efforts to meet customer needs, by allowing customers to purchase mobile devices with their fixed contracts and vice versa.

Next to offering an outstanding fixed network to our customers, the other pillar of our growth strategy is our FMC offering. Currently we are still the only truly integrated player in the Hungarian market with an integrated fixed-mobile offering to our customers. During the third quarter we updated our Magenta1 proposition to present a clearer structure and more convincing offer to customers. While in the second quarter we doubled the mobile data allowance, in the third quarter we unified our offering, giving our Magenta1 customers the ability to achieve a 30% discount on all related services. Thanks to the changes introduced in our Magenta1 offering in 2018, over one-fifth of our households are now Magenta1 subscribers. In addition to our consumer focus, we relaunched Magenta1 Business in the third quarter, offering business customers similar advantages, including possible IT related services.

In the System Integration and IT segment we had a strong quarter, reaching 19.8% revenue growth year-on-year. The growth was again attributable to a high volume of software and hardware projects with a lower profit margin. These projects, with a lower than average margin, serve to establish relationships with several different institutions – ones we can later convert to higher margin service contracts.

Group performance during the quarter was further supported by the continued turnaround in Macedonia. Both revenues and EBITDA improved thanks to solid performance across all business lines, a positive trend in service revenues, as well as favorable exchange rate movements.“

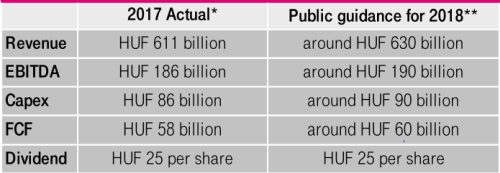

Public guidance:

*excluding Crnogorski Telekom financials and the transaction price of the disposal of the majority ownership

** including IFRS 9 & 15 impacts