Magyar Telekom results for the first quarter of 2021

Highlights:

Total revenues increased by 1.9% year-on-year to HUF 162.3 billion in Q1 2021as increases in telecommunication service revenues in both countries of operation compensated for moderately lower System Integration and IT (‘SI/IT’) sales and the fall-out in Hungarian retail broadband revenues.

- Mobile revenues increased by 2.5% year-on-year to HUF 90.4 billion in Q1 2021, driven by further growth in mobile data revenues which offset lower retail voice revenues.

- Fixed line revenues increased by 1.9% year-on-year, to HUF 53.8 billion in Q1 2021as the continued decline in voice revenues was fully offset by further improvements in TV revenues in both markets.

- System Integration (SI) and IT (‘SI/IT’) revenues were moderately down at HUF 18.1 billion in Q1 2021, reflecting the combined impact of lower revenues from Hungarian public sector projects which was mostly offset by higher corporate revenues, while revenues from customized solution projects declined year-on-year from an elevated base in North Macedonia.

Direct costs increased by 3.1% year-on-year to HUF 69.2 billion in Q1 2021,mostly driven by higher interconnect and TV content expenses, coupled with some increases in equipment costs.

- Interconnect costsincreased by 11.1% year-on-year to HUF 5.9 billion in Q1 2021, reflecting the continued increase in off-network mobile voice and SMS traffic, which resulted in higher payments to domestic mobile operators.

- SI/IT service-related costsdecreased by 3.5% year-on-year to HUF 12.4 billion in Q1 2021, owing to lower volumes of related projects at both operation.

- Bad debt expensesdecreased by HUF 0.6 billion year-on-year to HUF 2.0 billion in Q1 2021, as the combined impact of favorable aging of mobile receivables in Hungary and the absence of one-off expenses in relation to the COVID-19 pandemic and the release of customers from loyalty periods that impacted Q1 2020 results.

- Telecom taxrose by 4.7% year-on-year to HUF 6.8 billion in Q1 2021, driven by increases in mobile voice traffic in the business and residential segments, as well as higher residential landline usage in Hungary.

- Other direct costswere up 5.7% year-on-year to HUF 42.0 billion in Q1 2021, driven by higher equipment costs coupled with an increase in the Hungarian TV content outpayments, and some one-off additional costs that emerged in relation to the lockdowns in relation to the third wave of in Hungary.

Gross profit improved by 1.0% year-on-year to HUF 93.1 billion in Q1 2021,thanks to a higher contribution from telecommunication services, which was partly offset by one-off costs in relation to the third wave of the pandemic in Hungary.

Indirect costs improved by 6.3% year-on-year, to HUF 42.9 billion in Q1 2021,primarily reflecting the lower level of severance expenses, Group-wide.

- Employee-related expenseswere down by HUF 2.9 billion year-on-year, amounting to HUF 19.2 billion in Q1 2021, attributable to the lower level of severance expenses and the reduction in the average headcount, which was partly counterbalanced by the general wage increase introduced in Hungary in July 2020.

- Utility taxwas marginally higher year-on-year, amounting to HUF 7.3 billion in Q1 2021, reflecting the combined impact of an increase in the length of the taxable network (mostly due to expiring tax credits from network investments in 2015), offset by the positive effect of the tax credit relating to Magyar Telekom’s new network investments and upgrades that enable internet access of at least 100 Mbps.

- Other operating expenses(without utility tax) increased by 2.9% year-on-year to HUF 17.3 billion for the quarter, as the positive contribution of cost optimization measures was somewhat offset by the FX impact on North Macedonian expenses due to the weakening of the forint against the denar as well as increase in network operation related expenses and provisions related to legal cases at the Hungarian operation.

- Other operating incomewas up at HUF 0.8 billion in Q1 2021, primarily driven by income related to real estate sales in Hungary.

EBITDA rose by 8.2% year-on-year to HUF 50.2 billion,withEBITDA AL improving by 8.1% year-on-year to HUF 44.2 billion in Q1 2021, driven by the improvement in gross profit and lower employee related expenses.

Depreciation and amortization (‘D&A’) expensesrose by 4.3% year-on-year to HUF 35.1 billion in Q1 2021,attributable to the frequency licenses acquired in March 2020 in Hungary, while in North Macedonia the increase reflected higher amortization expenses in relation to content rights, software and licenses.

Profit for the period rose by HUF 10.9 billion year-on-year to HUF 10.1 billion in Q1 2021, reflecting higher EBITDA, coupled with better financial results. .

- Net financial resultimproved considerably year-on-year, from a loss of HUF 11.0 billion to a loss of HUF 1.6 billion in the quarter. This year-on-year change was mainly attributable to the absence of negative FX impacts due to the significant weakening of the forint against the euro during the base period in 2020, coupled with the positive effect of movements in the yield curve that led to unrealized gains on the recognition of derivatives at fair value in Q1 2021. These impacts fully offset the moderate increase in interest costs that mostly reflects the higher interest expenses in relation to lease and frequency usage rights liabilities.

- Income tax expensesincreased from HUF 2.5 billion in Q1 2020 to HUF 3.4 billion in Q1 2021, reflecting the year-on-year higher profit before tax.

Profit attributable to non-controlling interests rose by HUF 0.4 billion year-on-year to HUF 1.2 billion in Q1 2021, thanks to the improvement in both revenue and profitability trends in North Macedonia.

Free cash outflow amounted to HUF 17.1 billion in Q1 2021, driven by a total payout of HUF 35.7 billion for PPE and intangibles on the back of relatively high Q4 2020 Capex and the usual seasonal working capital build.

Tibor Rékasi,Magyar Telekom CEO commented:

“The operating environment

during the first quarter of 2021 has been challenging as the emergence of a

third wave of COVID-19 proved to be more severe than previous rounds. However,

thanks to our agile approach, Magyar Telekom was able to adapt swiftly to

evolving conditions and build on lessons learned throughout the pandemic to

improve our financial and operational performance. EBITDA amounted to HUF 50.2

billion in the first quarter, a considerable achievement, and one which will

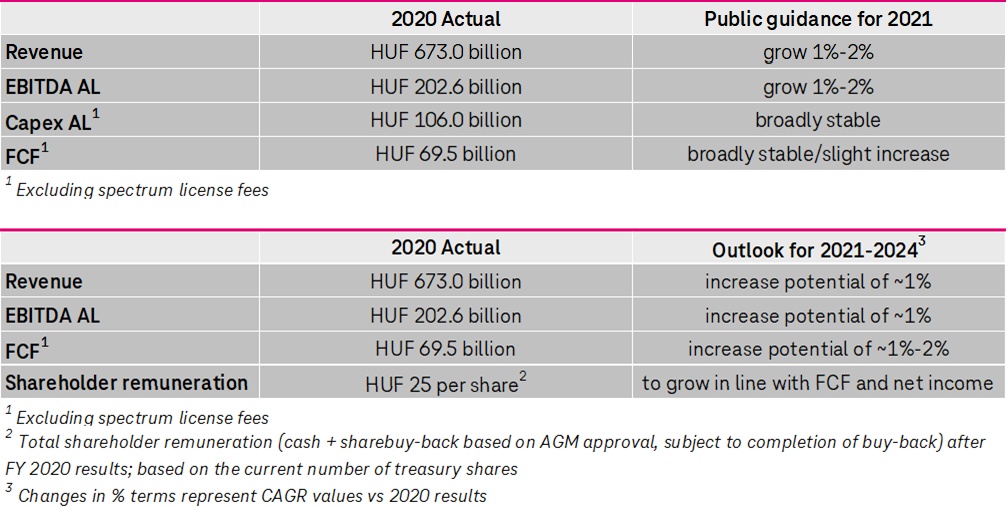

serve as a solid base from which we should be able to deliver in line with our

guidance.

Magyar Telekom also secured 900 MHz and 1800 MHz frequency band rights during the quarter, a significant milestone which will allow our customers to continue to use our mobile services and innovative solutions at the usual high standards. I am confident that this investment, together with continuous development of the gigabit capable network, will enable us to not only enhance the lives of our customers, but also to the economic success of Hungary.”