Magyar Telekom results for the third quarter of 2022

Total revenue increased by 9.0% year-on-year to HUF 190.9 billion in Q3 2022and by 9.4% year-on-year to HUF 547.5 billion in the first nine months of 2022. This improvement was primarily driven by the strong growth in mobile data and higher equipment sales whilst the weakening of the Hungarian forint against the North Macedonian denar amplified the North Macedonian subsidiary’s contribution.

- Mobile revenue rose by 12.3% year-on-year to HUF 110.7 billion in Q3 2022, driven by growth in mobile data revenue and higher equipment sales which offset lower voice revenue at both countries of operation.

- Fixed line revenue increased by 7.3% year-on-year, to HUF 60.3 billion in Q3 2022,thanks primarily to increases in fixed broadband and TV revenues driven by the customer base expansion at both countries of operation.

- System Integration (SI) and IT (‘SI/IT’) revenues were down by 2.2%, at HUF 20.0 billion in Q3 2022, from HUF 20.4 billion in Q3 2021 as a result of the absence of revenues formerly generated by the Hungarian healthcare business unit including Pan-Inform LLC and lower project volumes in North Macedonia. In underlying terms, SI/IT revenues at the Hungarian operation showed positive development thanks to higher project volumes.

Direct costs increased in line with revenues, by 9.8% year-on-year to HUF 80.6 billion in Q3 2022,mainly driven by the increase in equipment costs and partly offset by lower bad debt expense.

- Interconnect costsdecreased by 7.3% year-on-year to HUF 6.0 billion in Q3 2022, reflecting lower payments at the Hungarian operation to domestic mobile operators.

- SI/IT service-related costsdecreased moderately year-on-year to HUF 13.8 billion in Q3 2022, in line with lower revenues.

- Bad debt expenses were lower by HUF 0.5 billion year-on-year, amounting to HUF 1.4 billion in Q3 2022 thanks to favorable aging and positive contribution from factoring results at the Hungarian operation.

- Telecom taxincreased moderately year-on-year to HUF 6.6 billion in Q3 2022, reflecting higher mobile voice traffic, partly offset by lower fixed voice volumes.

- Other direct costswere up 18.3% year-on-year to HUF 52.8 billion in Q3 2022, driven by higher equipment costs in line with the increase in sales volumes and an increase in roaming outpayments reflective of the easing of travelling restrictions compared to a year earlier.

Gross profit improved by 8.5% year-on-year to HUF 110.3 billion in Q3 2022,thanks to a higher contribution from telecommunication services, particularly data, at both countries of operation.

Indirect costs rose by HUF 9.8 billion year-on-year, to HUF 45.1 billion in Q3 2022,due mainly to the newly introduced supplementary telecommunication tax coupled with higher other expenses.

- Employee-related expensesincreased by 3.6% year-on-year, amounting to HUF 20.8 billion in Q3 2022, driven by 2022 wage increase and one-off compensation to employees which are partly offset by lower severance expenses and the reduction in headcount.

- Supplementary telecommunication tax, imposed by the Government of Hungary with its decree issued on June 4, is levied on the actual business year’s annual net sales of electronic telecommunication services as defined by the law on local taxes and is payable for the full years 2022 and 2023. As a consequence, a HUF 6.5 billion expense was booked in Q3 2022, in relation to the third quarter 2022 supplementary tax charge.

- Other operating expenses(excluding the supplementary telecommunication tax) rose by 16.6% year-on-year to HUF 18.9 billion in Q3 2022, reflecting the negative impact of cost pressure stemming from high general inflation, particularly present in the North Macedonian operation. The cost increase was mainly attributable to higher energy costs, with respect to both fuel and electricity, with the latter putting particularly strong pressure on results of the North Macedonia operation.

- Other operating incomewas broadly stable year-on-year, amounting to HUF 1.1 billion in Q3 2022.

EBITDA declined by 1.8% year-on-year to HUF 65.2 billionin Q3 2022as the improvement in gross profit was offset by higher indirect costs, including the supplementary telecommunication tax.EBITDA AL was down by 2.8% year-on-year to HUF 58.6 billion in Q3 2022, due to aforementioned drivers coupled with higher IFRS 16 lease liability related depreciation and interest expenses, in line with the increasing volume of the related lease liabilities.

Depreciation and amortization (‘D&A’) expenses declined by 8.1% year-on-year to HUF 33.9 billion in Q3 2022, driven by lower depreciation expenses at the Hungarian operation attributable to full copper network retirement in some areas of Hungary, lower software related depreciation expenses thanks to the optimization of the IT infrastructure and the proportionally lower amortization of the spectrum licenses that expired in April 2022 and were since reacquired. These declines were partly offset by an increase accounted for in North Macedonia reflecting the weakening of the forint, whereas D&A in local currency declined.

Profit for the period decreased by 4.9% year-on-year to HUF 18.5 billion in Q3 2022, as lower EBITDA and increasing financial expenses offset the positive impact stemming from the lower D&A.

- Net financial resultdeteriorated from a loss of HUF 5.5 billion in Q3 2021 to a loss of HUF 8.1 billion in Q3 2022. Interest expense increased driven by higher interest related to lease liabilities and higher average interest costs whilst the unfavorable change in other finance expense reflects higher losses related to the significant weakening of the forint during the period. The latter offset the gains from the recognition of derivatives at fair value caused by the upward shift in the relevant yield curves.

- Income tax expensesincreased by 3.6% year-on-year to HUF 4.7 billion in Q3 2022, as the increase in local business tax in line with the higher related tax base offset the saving related to the year-on-year lower level of the profit before tax.

Profit attributable to non-controlling interests declined by 8.5% year-on-year to HUF 1.4 billion in Q3 2022, as the improvement in the underlying results in North Macedonia was offset by the higher energy expenses leading to overall lower profitability at the subsidiary.

Free cash flow, excluding spectrum license fees, amounted to HUF 52.9 billion in the first nine months of 2022, improving by HUF 18.5 billion year-on-yearas higher capex payments,income tax payment settlements and losses incurred due to the weakening of the forint were fully offset by the positive underlying results and the fact that payment of the new supplementary telecommunication tax will only be due in Q4 2022.

Operational highlights

- Network development continued at pace, with fixed gigabit coverage reaching over 3.3 million access points across Hungaryand considerable progress in mobile RAN modernization at both countries of operation

- Successful monetization of investments was evident in dynamic customer base expansion and increasing ARPUs in Hungary: fixed broadband subscriptions rose by 7.2%, TV customers increased by 5.6%; and the mobile postpaid base expanded by 5.8%, with corresponding ARPU increases of 7.2%, 2.5% and 3.0% respectively year-on-year in Q3 2022

- Scope Ratings GmbH, reaffirmed Magyar Telekom at BBB+ with a stable outlook that reflects Scope Ratings GmbH’s view of Magyar Telekom’s strong and stable positionsin the domestic mobile and broadband markets and its moderate leverage

- Magyar Telekom received further recognition for delivery against its sustainability strategy from sustainability rating agencies:its 'AA' ESG rating was reaffirmed by MSCI while ISS Corporate Solutions ranked the Company among the best performers of the telecom sectorglobally with respect to its sustainability credentials

Tibor Rékasi,Magyar Telekom CEO commented:

“Despite the turbulent operating environment, we are pleased to have maintained positive commercial momentum during the third quarter. This achievement has been underpinned by continued efforts to provide seamless connectivity and outstanding customer experience through targeted investments in our networks and evolving service offering. A prime example of the latter is the successful launch of a new mobile portfolio aimed at addressing growing demand for mobile data in the Hungarian residential market by offering three unlimited data packages. Such initiatives have contributed to continued growth of our customer base and ARPU levels in key service areas, which in turn led to a revenue uplift of 9.0% year-on-year for the third quarter. Nonetheless, the ongoing macroeconomic headwinds combined with the introduction of a supplementary telecommunication tax led to downward pressure on our profitability, causing an EBITDA AL decline of 2.8% year-on-year for the quarter.Looking ahead to the rest of the year, we see continued pressure on our profitability arising from the increasingly challenging economic environment. Given the strong commercial performance year to date, however, we have upgraded our revenue target for the year, from a growth rate of 1-3% to around 5%. We expect this higher rate of revenue growth to support our efforts to partially mitigate the negative effects of cost inflation and the introduction of the supplementary telecommunication tax on EBITDA.”

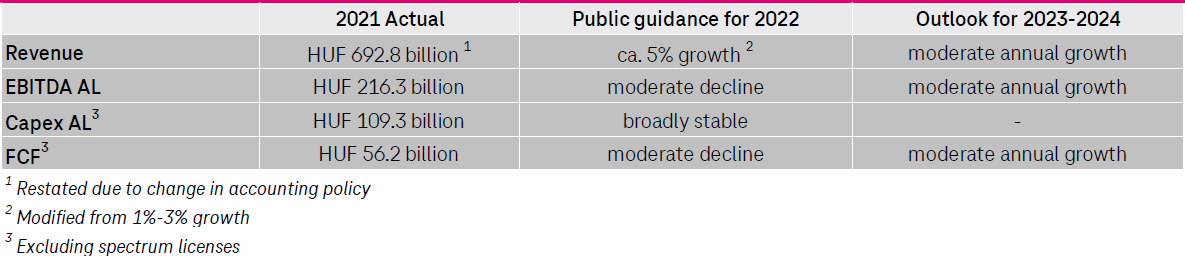

Public targets