Magyar Telekom results for the fourth quarter of 2022

Highlights:

Total revenue increased by 3.6% year-on-year to HUF 199.2 billion in Q4 2022and by 7.8% year-on-year to HUF 746.7 billion for the full year. This improvement was primarily driven by the strong growth in mobile data and increase in fixed broadband revenues whilst the weakening of the Hungarian forint against the Macedonian denar amplified the North Macedonian subsidiary’s contribution.

- Mobile revenue rose by 7.3% year-on-year to HUF 114.7 billion in Q4 2022, driven by the continued strong growth in mobile data revenue which offset lower voice and third party equipment export sales revenues.

- Fixed line revenue increased by 6.6% year-on-year, to HUF 62.3 billion in Q4 2022,thanks primarily to increases in fixed broadband and TV revenues driven by the customer base expansion at both countries of operation.

- System Integration (SI) and IT (‘SI/IT’) revenues were down by 17.5%, at HUF 22.2 billionin Q42022, as fiscal tightening in both countries of operation resulted in fewer public sector project deliveries whilst the absence of revenues formerly generated by the Hungarian healthcare business unit including Pan-Inform LLC also contributed to the decline.

Direct costs were lower by 1.8% year-on-year at HUF 93.4 billion in Q4 2022,as revenue driven increases were offset by lower bad debt impairment.

- Interconnect costsdecreased by 2.7% year-on-year to HUF 6.2 billion in Q4 2022, reflecting lower payments at the Hungarian operation to domestic mobile operators.

- SI/IT service-related costsdecreased by 17.3% year-on-year to HUF 15.9 billion in Q4 2022, in line with lower revenues.

- Impairment losses and gains on financial assets and contract assets (bad debt expenses)were lower by HUF 1.3 billion year-on-year, amounting to HUF 3.9 billion in Q4 2022 driven by lower amount of additional forward-looking impairment recognized at the Hungarian operation, reflecting a possible deterioration of the solvency of customers, driven by unfavorable macroeconomic tendencies partly counterbalanced by higher contract asset impairments. This was partly offset by higher bad debt expenses at the North Macedonian operation that was driven by annual write-offs and the effect from the annual unfavorable change in the impairment rates.

- Telecom taxdecreased by 4.1% year-on-year to HUF 6.5 billion in Q4 2022, reflecting lower mobile voice usage among business customers.

- Other direct costswere up by 5.8% year-on-year to HUF 61.0 billion in Q4 2022, driven by higher equipment costs and increase in roaming outpayments.

Gross profit improved by 8.9% year-on-year to HUF 105.8 billion in Q4 2022,thanks primarily to a higher contribution from telecommunication services.

Indirect costs rose by HUF 10.9 billion year-on-year, to HUF 43.1 billion in Q4 2022,due mainly to the recently introduced supplementary telecommunication tax coupled with higher other expenses.

- Employee-related expensesincreased by HUF 3.2 billion year-on-year, amounting to HUF 19.2 billion in Q4 2022, driven by 2022 wage increase coupled with higher bonus expenses, reflecting different timing of related bookings within the year.

- Supplementary telecommunication tax, imposed by the Government of Hungary with its decree issued on June 4, is levied on the actual business year’s annual net sales of electronic telecommunication services as defined by the law on local taxes and is payable for the full years 2022 and 2023. As a consequence, a HUF 5.7 billion expense was booked in Q4 2022, in relation to the fourth quarter 2022 supplementary tax charge.

- Other operating expenses(excluding the supplementary telecommunication tax) rose by 17.0% year-on-year to HUF 20.5 billion in Q4 2022, reflecting the negative impact of cost pressure stemming from high general inflation, the weakening of the Hungarian forint as well as from higher energy costs, with respect to fuel, gas and electricity as well.

- Other operating incomerose by HUF 1.0 billion year-on-year, amounting to HUF 2.4 billion in Q4 2022, mainly reflecting reversal of accruals over 5-years.

EBITDA declined by 3.4% year-on-year to HUF 62.7 billionin Q4 2022as the improvement in gross profit was offset by higher indirect costs, including the supplementary telecommunication tax.EBITDA AL was down by 4.9% year-on-year to HUF 55.7 billion in Q4 2022, due to aforementioned drivers coupled with higher IFRS 16 lease liability related depreciation and interest expenses, in line with the increasing volume of the related lease liabilities. For the full year, EBITDA rose by 3.0%, and EBITDA AL by 2.4% year-on-year. These improvements were primarily driven by the increase in service revenue coupled with the one-off gain on the sale of an IT subsidiary in Q1 2022.

Depreciation and amortization (‘D&A’) expenses declined by 12.7% year-on-year to HUF 34.3 billion in Q4 2022. In Hungary the declined was driven by lower depreciation expenses attributable to full copper network retirement in some areas of Hungary, lower software related depreciation expenses thanks to the optimization of the IT infrastructure and the proportionally lower amortization of the spectrum licenses that expired in April 2022 and were since reacquired. In North Macedonia, the lower D&A was reflecting the absence of one-off increases related to shortened useful life and accelerated depreciation in relation to RAN modernization in Q4 2021.

Profit for the period decreased by 7.0% year-on-year to HUF 17.5 billion in Q4 2022, as lower EBITDA and increasing financial expenses offset the positive impact stemming from the lower D&A. For the full year 2022, profit increased by 6.7% to HUF 67.1 billion as improvements in EBITDA and lower D&A could counterbalance higher financial expenses.

- Net financial resultdeteriorated from a loss of HUF 5.5 billion in Q3 2021 to a loss of HUF 8.1 billion in Q3 2022. Interest expense increased driven by higher interest related to lease liabilities and higher average interest costs whilst the unfavorable change in other finance expense reflects higher losses related to the significant weakening of the forint during the period. The latter offset the gains from the recognition of derivatives at fair value caused by the upward shift in the relevant yield curves.

- Income tax expenseswere lower by 14.0% year-on-year at HUF 3.7 billion in Q4 2022, reflecting the year-on-year lower level of the profit before tax.

Profit attributable to non-controlling interests increased by HUF 0.5 billion year-on-year to HUF 0.6 billion in Q4 2022, as higher EBITDA was coupled with a sharp decline in D&A at the North Macedonian subsidiary.

Free cash flow, excluding spectrum license fees,was lower year-on-year at HUF 50.9 billion in 2022, as higher capex payments and the payment of the supplementary telecommunication tax in Q4 2022 offset the positive underlying results.

Tibor Rékasi,Magyar Telekom CEO commented:

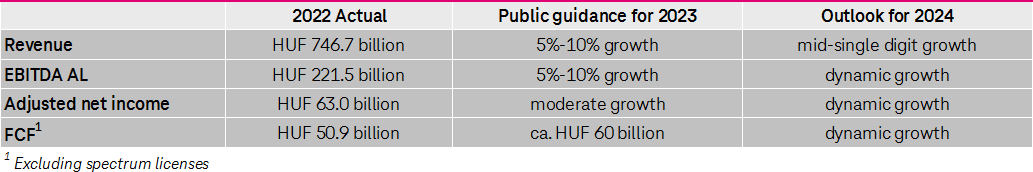

“Despite the increasingly turbulent external environment, we have maintained our strong commercial momentum with increased demand for both mobile data and gigabit broadband in 2022. By the end of the year, more than 1.2 million customers were connected through gigabit capable technology to our fixed network. Our continued focus on providing seamless connectivity and outstanding user experience to our customers has reinforced our position in the market, helping us grow our revenues by 7.8% in 2022. Our EBITDA AL grew by 2.4% year-on-year in 2022. This growth was achieved despite the inflationary pressure on our costs and the recently introduced supplementary telecommunication tax and demonstrates the strong commercial performance achieved by the Group. Looking ahead to 2023, we expect continued pressure on our profitability from the challenging economic environment, particularly from energy cost pressures and increasing vendor costs. Based on the strong commercial performance and the previously communicated fee adjustment across our contracts, we are targeting 5%-10% revenue and EBITDA AL growth in 2023. We expect moderate year-over-year growth in adjusted net income and free cashflow generation of circa HUF 60 billion. Looking beyond 2023, we are committed to delivering dynamic growth in our operational performance and profitability, leveraging our experience and strong market position to navigate any further volatility in our market conditions.”

Public targets