Magyar Telekom results for the first quarter of 2023

Highlights:

Total revenue increased by 12.5% year-on-year to HUF 195.9 billion in Q1 2023. This improvement was primarily driven by strong growth in mobile data, higher system integration and IT revenue and further increase in fixed broadband revenue whilst the introduction of inflation-based fee adjustment to the Hungarian subscription fees also contributed to the increase.

- Mobile revenue rose by 10.6% year-on-year to HUF 112.3 billion in Q1 2023, driven by the continued growth in mobile data revenue and the moderate increase in voice-retail revenue.

- Fixed line revenue increased by 10.9% year-on-year, to HUF 63.1 billion in Q1 2023,thanks primarily to increases in fixed broadband and TV revenues driven by the customer base expansion which was further supported by the favorable impact of the introduction of inflation based-fee adjustment to the Hungarian subscription fees.

- System Integration and IT (‘SI/IT’) revenues increased by HUF 4.9 billion to HUF 20.5 billion in Q1 2023,reflecting a more favorable in-year project distribution at the Hungarian operation.

Direct costs were up by 11.8% year-on-year at HUF 81.8 billion in Q1 2023,reflecting revenue driven increases at SI/IT service related and other direct costs.

- Interconnect costsdecreased by 8.5% year-on-year to HUF 5.5 billion in Q1 2023, reflecting lower payments at the Hungarian operation to domestic mobile operators in line with the lower outgoing traffic volumes.§ SI/IT service-related costsincreased by HUF 3.7 billion year-on-year to HUF 14.8 billion in Q1 2023, in line with the higher revenues.

- Impairment losses and gains on financial assets and contract assets (bad debt expenses)was higher by 6.4% year-on-year, amounting to HUF 2.1 billion in Q1 2023 as a combined result of broadly unchanged expenses at the Hungarian operation coupled with higher expenses at the North Macedonian operation driven by one-off impairment costs.

- Telecom taxdecreased by 4.3% year-on-year to HUF 6.4 billion in Q1 2023, reflecting lower mobile and fixed voice usage of the customer base.

- Other direct costswere up by 11.9% year-on-year to HUF 53.0 billion in Q1 2023, driven by higher equipment costs, TV content fees and increase in roaming outpayments.

Gross profit improved by 13.1% year-on-year to HUF 114.1 billion in Q1 2023,thanks primarily to a higher contribution from telecommunication services.

Indirect costs rose by HUF 17.3 billion year-on-year, to HUF 56.1 billion in Q1 2023,as a combined result of the recently introduced supplementary telecommunication tax, higher other expenses and the absence of one-off gain recognized on the sale of an IT subsidiary in Q1 2022.

- Employee-related expensesincreased by 6.9% year-on-year, amounting to HUF 19.6 billion in Q1 2023, reflecting the wage increase in effect from January 1, 2023 at the Hungarian operation.

- Utility taxrose by 6.8% to HUF 7.8 billion, as the increase in the length of the taxable network due to expiring tax credits from network investments in 2017, offset the positive effect of the tax credit relating to new network investments and upgrades that enable internet access of at least 100 Mbps.

- Supplementary telecommunication tax,imposed by the Government of Hungary with its decree issued on June 4, 2022, and levied on the actual business year’s annual net sales of electronic telecommunication services was booked in the amount of HUF 7.2 billion in Q1 2023, in line with the increase in the tax base. Supplementary telecommunication tax in relation to Q1 2022 results was booked in Q2 2022, as its introduction was made only following the closing of the period.

- Other operating expenses(excluding the utility tax and the supplementary telecommunication tax) rose by HUF 5.0 billion year-on-year to HUF 22.1 billion in Q1 2023, reflecting higher energy costs at the Hungarian operation, particularly electricity, coupled with further cost pressure stemming from the high general inflation.

- Other operating incomewas lower by HUF 3.4 billion year-on-year, amounting to HUF 0.7 billion in Q1 2023, driven by the absence of a one-off HUF 3.3 billion gain realized on the sale of an IT subsidiary in Q1 2022.

EBITDA declined by 6.6% year-on-year to HUF 58.0 billionin Q1 2023as the improvement in gross profit was offset by higher indirect costs, including the supplementary telecommunication tax.EBITDA AL was down by 8.9% year-on-year to HUF 50.8 billion in Q1 2023, due to aforementioned drivers coupled with higher IFRS 16 lease liability related depreciation and interest expenses, in line with the increasing volume of the related lease liabilities.

Depreciation and amortization(‘D&A’) expensesdeclined by 5.1% year-on-year to HUF 33.6 billion in Q1 2023.In Hungary the decline was driven by lower software related depreciation expenses thanks to the optimization of the IT infrastructure and the proportionally lower amortization of the spectrum licenses that expired in April 2022 and were since reacquired. In North Macedonia, the lower D&A was reflecting the absence of one-off increases related to shortened useful life and accelerated depreciation in relation to RAN modernization in Q1 2022.

Profit for the period decreased by HUF 7.6 billion year-on-year to HUF 11.8 billion in Q1 2023, as lower EBITDA and increasing financial expenses offset the positive impact stemming from the lower D&A.

- Net financial resultdeteriorated from a loss of HUF 3.0 billion in Q1 2022 to a loss of HUF 8.7 billion in Q1 2023. Interest expense increased driven by higher interest related to lease liabilities, installment sales and higher average interest costs. The unfavorable change in other finance expense reflects less favorable results on measurement of derivatives at fair value reflecting the different shifts in the relevant yield curves resulting in a year-on-year deterioration and which offset FX gains related to the strengthening of the forint during the period.

- Income tax expenseswere lower by 10.5% year-on-year at HUF 4.0 billion in Q1 2023, reflecting the year-on-year lower level of the profit before tax.

Profit attributable to non-controlling interests increased by HUF 0.4 billion year-on-year to HUF 1.3 billion in Q1 2023, reflecting improvement in EBITDA coupled with lower D&A at the North Macedonian subsidiary.

Free

cash flow, excluding spectrum license fees, was lower year-on-year at HUF 10.7

billion cash outflow in Q1 2023,reflecting

higher interest and lease outpayments and the absence of one-off cash inflow

from the subsidiary sale recorded in Q1 2022.

Tibor Rékasi, Magyar Telekom CEO commented:

“Despite facing a highly uncertain economic and business landscape, and an evolving competitive environment within the Hungarian telecommunication industry, we remain focused on delivering superior customer satisfaction by offering gigabit networks and meeting increasing demand for data. The success of these efforts is reflected in the continued expansion of our subscriber base which led to a year-on-year increase of 13.1% in our gross profit for the first quarter of 2023. However, our profitability has been impacted by the current macro environment, as evidenced by an 8.9% decrease in EBITDA AL due to significant cost pressures. In Hungary, our indirect costs, excluding the supplementary telecommunications tax, increased by 28%, primarily due to the sharp increase in our energy prices, in particular the four times higher electricity cost year-on-year. Given the increasing subcontractor costs, unfavorable yield environment and weaker forint, we continue to take proactive steps to address changes in our external environment and leverage our strong position in the market to drive positive momentum in our operating performance.”

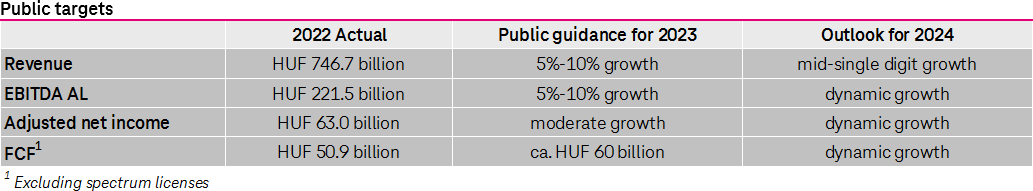

Public targets