Magyar Telekom fourth quarter 2022 results

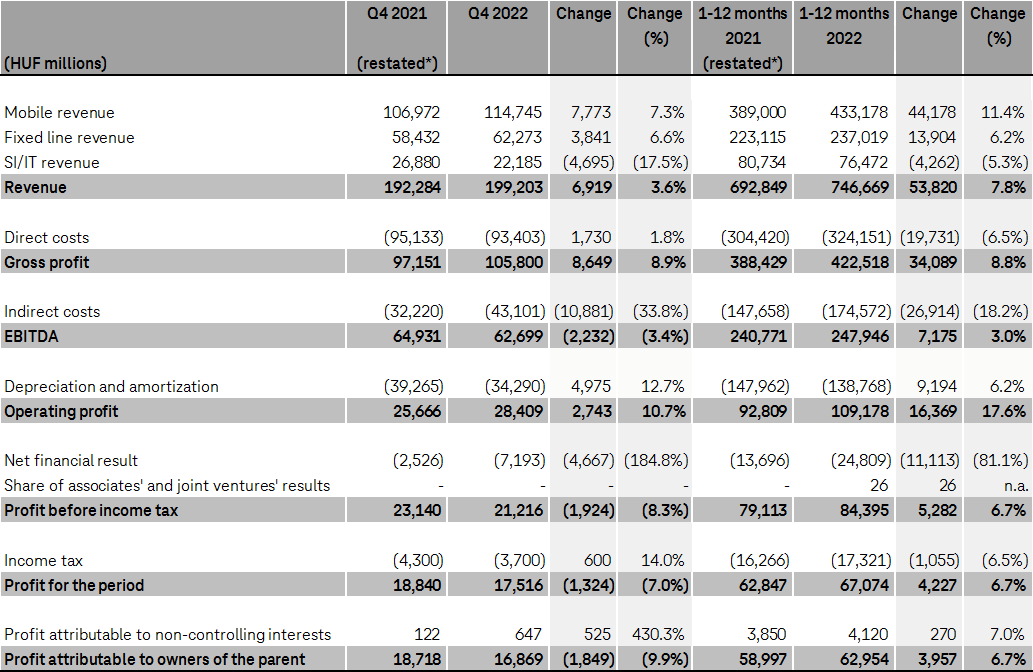

- Group revenue grew by 3.6% year-on-year in Q4 2022, thanks to continued strong demand for mobile data coupled with further increases in broadband revenues

- Gross profit strongly improved in line with the revenue trend, growing by 8.9% year-on-year in Q4 2022

- EBITDA AL declined by 4.9% year-on-year to HUF 55.7 billion in Q4 2022, as the supplementary telecommunication tax coupled with inflationary pressure on other costs offset the improvement in gross profit§ Net income was 9.9% lower year-on-year, at HUF 16.9 billion in Q4 2022, primarily driven by lower EBITDA coupled with deteriorating net financial results

- Capex after leases excluding spectrum licenses rose to HUF 126.7 billion in 2022, driven by the strong progress in mobile network development in both countries of operation, higher spending related to fiber provisioning and installation in Hungary and temporarily higher TV content capitalization expenses in North Macedonia

- Free cash flow, excluding spectrum license fees, was lower year-on-year at HUF 50.9 billion in 2022, as higher capex payments and the payment of the supplementary telecommunication tax in Q4 2022 offset the positive underlying results

- The Board of Directors proposes a total dividend payment of HUF 29.46 billion for the 2022 financial year for approval to the Company’s Annual General Meeting and envisages the value of the buyback to be up to HUF 14.6 billion resulting in a total annual shareholder remuneration of up to HUF 44.06 billion after the 2022 results

Operational highlights

- Network development continued at pace; thanks to the 370 thousand new access points covered during 2022 fixed gigabit coverage reached over 3.4 million across Hungary by the year end

- Considerable progress was made in the mobile RAN modernization program in both countries; in Hungary 60% of base stations were modernized by the end of 2022 providing excess capacities that are in high demand with 25% year-on-year growth in average mobile data usage; at the same time, the program was fully completed in North Macedonia.

- Successful penetration of the fiber network and monetization of investments was evident in dynamic customer base expansion in Hungary: fixed broadband subscriptions rose by 6.9%, TV customers increased by 4.8%, and the mobile postpaid base expanded by 5.1%

- Magyar Telekom’s ESG rating was upgraded to the highest category of “AAA” by MSCI

Tibor Rékasi, Magyar Telekom CEO commented:

“Despite the increasingly turbulent external environment, we have maintained our strong commercial momentum with increased demand for both mobile data and gigabit broadband in 2022. By the end of the year, more than 1.2 million customers were connected through gigabit capable technology to our fixed network. Our continued focus on providing seamless connectivity and outstanding user experience to our customers has reinforced our position in the market, helping us grow our revenues by 7.8% in 2022.

Our EBITDA AL grew by 2.4% year-on-year in 2022. This growth was achieved despite the inflationary pressure on our costs and the recently introduced supplementary telecommunication tax and demonstrates the strong commercial performance achieved by the Group.

Looking ahead to 2023, we expect continued pressure on our profitability from the challenging economic environment, particularly from energy cost pressures and increasing vendor costs. Based on the strong commercial performance and the previously communicated fee adjustment across our contracts, we are targeting 5%-10% revenue and EBITDA AL growth in 2023. We expect moderate year-over-year growth in adjusted net income and free cashflow generation of circa HUF 60 billion.

Looking beyond 2023, we are committed to delivering dynamic growth in our operational performance and profitability, leveraging our experience and strong market position to navigate any further volatility in our market conditions.”

This investor news contains forward-looking statements. Statements that are not historical facts, including statements about our beliefs and expectations, are forward-looking statements. These statements are based on current plans, estimates and projections, and therefore should not have undue reliance placed upon them. Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update publicly any of them in light of new information or future events.

Forward-looking statements involve inherent risks and uncertainties. We caution you that a number of important factors could cause actual results to differ materially from those contained in any forward-looking statement. Such factors are described in, among other things, our annual financial statements for the year ended December 31, 2021, available on our website athttp://www.telekom.hu

.