Magyar Telekom fourth quarter 2015 results

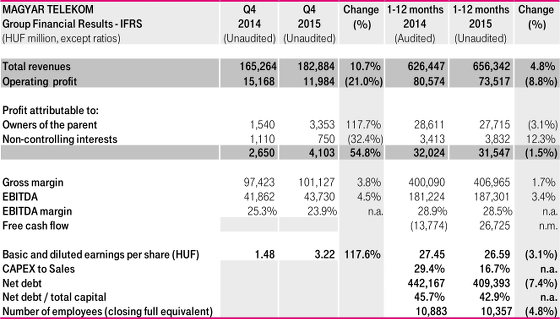

- Revenues in Q4 2015 rose by 10.7% quarter on quarter from HUF 165.3 billion to HUF 182.9 billion, driven by outstanding SI/IT performance, as well as the solid growth in the fixed line business.Mobile revenues decreased by 4.1%compared to the same period of last year, mainly due to the fall in wholesale revenues following the sharp decrease in Mobile Termination Rates (MTRs) in Hungary, as well as a decline in SMS and equipment sales. At the same time, mobile data revenues increased significantly over this period due to growth in the subscriber base.Fixed line revenuesimproved by 8.1% as a result of higher broadband retail, equipment and wholesale revenues, boosted also by the GTS Hungary acquisition.System Integration (SI) and IT revenuesalmost doubled compared to the fourth quarter of 2014 mostly driven by major Hungarian IT projects at the end of the year. Despite the exit from the residential gas business as of 31 July, 2015energy revenuesincreased by 5.5% quarter on quarter underpinned by strong performance in the business sub-segment both in gas and electricity services. With regardsthe 2015 full year results, total revenues grew by 4.8%compared to 2014 which is higher than previously guided. The marginal decline in mobile revenues was offset by higher fixed line and energy service revenues, as well as very strong SI/IT sales underpinned by EU funded projects. Revenues increased at both T-Hungary and T-Systems by 3.4% and 13.1% respectively; while in Macedonia and Montenegro, revenues declined by 3.9% and 5.6% respectively year on year due to ongoing competitive and regulatory pressures.

- Total direct costs increased by 20.5% to HUF 81.8 billion in Q4 2015, driven by significantly higher SI/IT service related costs in line with the robust increase in revenues. Interconnection costs fell by 27.7% following the cut in MTRs in Hungary, while bad debt expenses also slightly improved. Looking at thedirect costs for full year 2015, we experienced a 10.2% increasecompared to 2014 due to higher SI/IT and energy related costs associated with extended sales in both business lines, partly offset by a fall in interconnection costs and an improvement in bad debts relating to mobileequipmentsales in Hungary. On a quarterly comparative basis,the gross margin increased by 3.8%,and by 1.7% for the full year.

- EBITDA in Q4 2015 increased by 4.5% quarter on quarter to HUF 43.7 billion, despite the higher employee-related expenses deriving from the rise in severance costs booked in relation to the two-year headcount reduction program in 2014/2015, as well as effect of the GTS acquisition on the headcount.Year on year EBITDA improved by 3.4%, far exceeding our original guidance of roughly stable EBITDA compared to 2014; this was driven principally by higher gross profit contributions, not only from the energy and SI/IT businesses, but also from core fixed line and mobile.

(HUF billion)

2014

2015

- Hungarian sector specific special taxesdecreased by 8.3% from HUF 6.7 billion to HUF 6.1 billion quarter on quarter and went down by 1.8% on annual basis.

- Depreciation and amortization (D&A) expenses went up by 18.9% to HUF 31.7 billion in Q4 2015, driven by higher amortization of telecom licenses linked to the new frequency rights acquired in October, 2014. Software activation related to the new billing and new SAP system also caused additional expenses. D&A for the full year increased by 13.0% in 2015 compared to 2014.

- Net financial results improved by 29.5% to HUF 5.6 billion in Q4 2015, primarily due to the higher gains generated through foreign exchange translations and hedges caused by a weakening Hungarian forint, as well as lower interest rates quarter on quarter. Year on year, net financial results remained roughly stable.

- Income tax expense decreased significantly, by 50.2% to HUF 2.3 billion quarter on quarter. The difference is mainly due to the one-time release of a deferred tax asset of HUF 2.5 billion in Q4 2014 relating to our Macedonian subsidiaries, driven by the impairment in Stonebridge’s investment (Stonebridge is our holding company in Macedonia) in Makedonski Telekom, following the poor share price performance of Makedonski Telekom in 2014, and a capital reduction in Stonebridge. Looking at2015 as a whole, income tax expenses decreased by 31.5%, for much the same factors that caused the decline for the fourth quarter; meanwhile, the underlying effective tax rate for 2015 remained in-line with previous years, at the average rate of ca. 30%.

- Profit attributable to the owners of the parent company (net income) more than doubled from HUF 1.5 billion to HUF 3.4 billion in the fourth quarter of 2015, primarily driven by this significant drop in income tax expenses and to a lesser degree, lower profits attributable to non-controlling interests on account of a fall in profits at both Makedonski Telekom and Crnogorski Telekom. However,over the full year, despite lower income taxes, profit attributable to the owners of the parent company decreased by 3.1% reflecting the 8.8% fall in operating profitand a higher share of profits attributable to non-controlling interests.

- Investments in tangible and intangible assets (CAPEX) decreased by 40.4% to HUF 109.8 billion for the full year, although it should be recalled that HUF 97.6 billion was spent in Q4 2014 for the Hungarian frequency licenses. Excluding this investment in frequency licenses in 2014 and the additional Capex spent on fixed line network development in Hungary amounting to approx. HUF 20.5 billion in 2015, Capex increased only by approx. HUF 2.5 billion compared to the previous year. In 2015, Telekom Hungary accounted for HUF 88.4 billion of the total CAPEX, while HUF 5.4 billion was allocated to T-Systems Hungary. The Macedonian and Montenegrin operations accounted for HUF 10.6 billion and HUF 5.2 billion of the CAPEX respectively.

- Free cash flow(FCF defined as operating cash flow and investing cash flow adjusted for proceeds from / payments for other financial assets and repayment of other financial liabilities)increased from an outflow of HUF 13.8 billion in full year 2014 to an inflow of HUF 26.7 billion in 2015. Operating cash flow improved by HUF 10.8 billion mostly due to higher EBITDA and lower tax payments in 2015 deriving from the tax law amendments in Macedonia in 2014, but also reflecting a higher severance provision in 2015 versus 2014. Total investing cash flow (excluding Proceeds from other financial assets – net) in 2015 amounted to HUF 110.7 billion, down by HUF 30.1billion compared to 2014, due to the positive effect of the HUF 58.5 billion frequency acquisition in 2014 that more than compensated for the GTS acquisition (paid for in cash), and the capital intensive HSI roll-out project.

- Net debt decreased by 7.4% from HUF 442.2 billionat the end of the fourth quarter of 2014 toHUF 409.4 billion by the end of December 2015, while thenet debt ratio(net debt to total capital)improved from 45.7% to 42.9%driven by a reduction in both short- and long-term borrowings. Magyar Telekom’s dividend policy seeks to maintain its net debt within the 30%-40% range and the net debt ratio is on a downward trajectory. Thus, we expect that the net debt ratio will approach the targeted range between 30-40% in the upcoming years.

Christopher Mattheisen, CEO commented:

“It

fills me with great pride to report the highest Group revenue since 2008 at 656 billion forint for full year 2015 and a significantly improved EBITDA at 187 billion forint. Following the turn-around in our revenue, margins and most

latterly EBITDA, we have also managed to return to positive Free Cash Flow

generation in 2015. This will serve as the cornerstone for the resumption of

dividend payments relating to last year’s earnings, with a dividend payment of

15 forint per share proposed to our Annual General Meeting in April 2016.

By providing integrated fixed and mobile services, we continued next generation IP network development across all segments which will strengthen our technology leadership positions further. We launched our MagentaOne Quad-Play offer in both Hungary and Macedonia to maximize the telecommunication share of the household spending wallet, with Montenegro following in January of this year. Meanwhile, our focus on costs has allowed us to become a leaner and more efficient company. Following the conclusion of our headcount reduction program in Hungary, our focus will be on product and process simplification and digitalization, including moving more of our customer servicing online.

In Hungary, we have reached over 97% 4G population coverage with almost a million customers on our 4G network. Moreover, we have rolled out High Speed Internet access to almost half a million households. Consequently, it was the growth in mobile and fixed line broadband, as well as in TV that drove the outstanding revenues in Hungary, along with a significant increase in System integration/IT and energy sales. I am also delighted to announce that after five years of decline, T-Systems has also managed to turn around its EBITDA and return to growth.

Looking to 2016, we remain focused on the continued execution of our turnaround strategy which involves growing our profitability in line with our targets. The ongoing shift in our revenue mix, achieved by migrating customers to bundled packages across Magyar Telekom’s operations, is expected to mitigate the decline in voice revenue. Following our exit from the residential gas business and a move away from full consolidation of the B2B energy business, we expect revenues of 580 to 590 billion forint in 2016, and have upgraded our 2017 revenue guidance to a range of between 585 and 595 billion forint.

Overall, our reported EBITDA is expected to range between 187 and 191 billion forint in 2016, whilst our updated EBITDA guidance for 2017 is between 189 and 193 billion forint. The growing contribution from System integration and IT activities across our geographies will play a key role in achieving our target of growing Group EBITDA from one year to the next. In terms of Capex, despite continued network development, we expect an annual decline of approximately 10% in both 2016 and 2017.”

This investor

news contains forward-looking statements. Statements that are not historical

facts, including statements about our beliefs and expectations, are

forward-looking statements. These statements are based on current plans, estimates

and projections, and therefore should not have undue reliance placed upon them.

Forward-looking statements speak only as of the date they are made, and we

undertake no obligation to update publicly any of them in light of new

information or future events.

Forward-looking statements involve inherent risks and uncertainties. We caution you that a number of important factors could cause actual results to differ materially from those contained in any forward-looking statement. Such factors are described in, among other things, our annual financial statements for the year ended December 31, 2014, available on our website athttps://www.telekom.hu

In addition to figures prepared in accordance with IFRS, Magyar Telekom also presents non-GAAP financial performance measures, including, among others, EBITDA, EBITDA margin and net debt. These non-GAAP measures should be considered in addition to, but not as a substitute for, the information prepared in accordance with IFRS. Non-GAAP financial performance measures are not subject to IFRS or any other generally accepted accounting principles. Other companies may define these terms in different ways. For further information relevant to the interpretation of these terms, please refer to the chapter “Reconciliation of pro forma figures”, which is posted on Magyar Telekom’s Investor Relations webpage atwww.telekom.hu/investor_relations