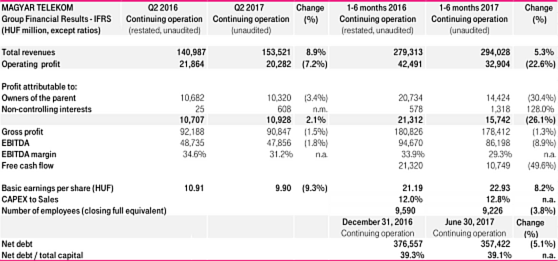

Magyar Telekom second quarter 2017 results

Strategic highlights:

- Increase in Group revenue1

- Mobile service revenues continued to increase as growth in mobile data revenues offset voice revenue erosion driven by competitive pressures

- Growth of mobile equipment revenues continued, driven by higher volumes of smartphone sales, mainly in Hungary

- Lower fixed broadband revenues resulted from competitive pressures, adding to the fixed line revenue decline

- Gross profit decline as increase in lower margin equipment heavy sales could just partially compensate for high margin voice revenue fallout

- EBITDA decline due to lower gross profit, partly mitigated through cost enhancing measures

- Reduction in Free Cash Flow from continuing operations reflects the one-off gains (from the sale of Origo and Infopark Building G) of HUF 11.3 billion supporting H1 2016 results

- Net transaction price of HUF 36.4 billion received on the disposal of Crnogorski Telekom in Q1 2017

- Net debt ratio stood at 39.1% at the end of June 2017; increasing during the quarter due to dividend payment

Christopher Mattheisen, CEO commented:

“Group revenues continued to grow strongly in the second quarter of 2017, up by 8.9% compared to the same period last year. However, EBITDA declined 1.8%, as successfully implemented cost saving measures did not fully offset gross profit pressures. Nevertheless, there were a number of notable achievements in the period that I would like to bring to your attention.

Within our Hungarian operations, our new postpaid mobile portfolio, launched at the end of March, has been well received by the market; in excess of 300,000 subscribers have migrated over to this new plan. Amongst these early movers, we have witnessed significantly higher data allowance subscriptions that have helped to drive average usage levels up by around 50% and led to an increase in overall ARPU levels. Thanks to the flexibility provided by this new scheme combined with increased retention activities in relation to prepaid registration, 50% more of our prepaid customers migrated to postpaid packages in the second quarter compared to previous quarters. Our performance in the prepaid registration process has exceeded our original expectations; we have secured over 95% of our prepaid revenues.

During the quarter, we continued the roll-out of the Company’s high speed internet network that now reaches over 2.9 million Hungarian households. As a direct consequence of the various initiatives introduced to increase fixed service subscriber numbers and capitalize on our upgraded network, we now have more than 600 thousand customers connected to our high speed internet network, whilst the number of TV customers exceeds 1 million. One example of such an initiative is the launch of a new brand, ‘Flip’, which is available in certain areas in Hungary where Magyar Telekom is typically not the preferred choice. Flip offers one very attractively priced 3Play package without any loyalty contract in exchange for simplified, online and self-care focused customer service.

In System Integration and IT, we have almost doubled our revenues year-on-year. This was primarily driven by the material uptick in the number of EU funded projects, which tend to be hardware and software heavy contracts, albeit at significantly lower profit margins. However, we expect that these projects will be the catalysts to capture a number of higher margin IT contracts going forward, as we build upon these newly established customer relationships and fixed asset investments.

In Macedonia, positive trends witnessed in the previous quarters continued. In the mobile segment, despite the cut in mobile termination rates, ARPU continued to improve, thanks to expansion of the postpaid subscriber base coupled with significant uptake in mobile broadband usage. Stripping out the impact of the severance expense booked in Q2 2016, EBITDA stabilised in the second quarter this year.

Based on the encouraging trends we have observed in the first half of the year, including strong performance of the Hungarian SI/IT segment and the high demand for fixed and mobile equipment, we envisage that revenue for the full year 2017 will be higher than originally guided, at around 580 billion forint. All other elements of the original guidance remain unchanged as the increase in revenue is largely due to additional revenue streams that are lower margin, serving to establish and consolidate customer relationships rather than result in an immediate return.”

Public guidance*:

*excluding Crnogorski Telekom financials and the transaction price of the disposal of the majority ownership

** changed from around HUF 560 billion

This investor news contains

forward-looking statements. Statements that are not historical facts, including

statements about our beliefs and expectations, are forward-looking statements.

These statements are based on current plans, estimates and projections, and

therefore should not have undue reliance placed upon them. Forward-looking

statements speak only as of the date they are made, and we undertake no

obligation to update publicly any of them in light of new information or future

events.

Forward-looking statements involve inherent risks and uncertainties. We caution you that a number of important factors could cause actual results to differ materially from those contained in any forward-looking statement. Such factors are described in, among other things, our annual financial statements for the year ended December 31, 2016, available on our website athttps://www.telekom.hu

In addition to figures prepared in accordance with IFRS, Magyar Telekom also presents non-GAAP financial performance measures, including, among others, EBITDA, EBITDA margin and net debt. These non-GAAP measures should be considered in addition to, but not as a substitute for, the information prepared in accordance with IFRS. Non-GAAP financial performance measures are not subject to IFRS or any other generally accepted accounting principles. Other companies may define these terms in different ways. For further information relevant to the interpretation of these terms, please refer to the chapter “Reconciliation of pro forma figures”, which is posted on Magyar Telekom’s Investor Relations webpage at www.telekom.hu/investor_relations.

.