Magyar Telekom second quarter 2019 results

Strategic highlights:

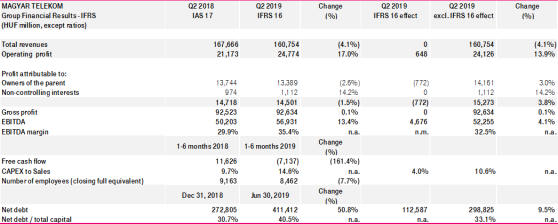

- Group revenues

declined despite favourable telecommunication service revenue trends across

both mobile and fixed segments, due to SI/IT revenue contraction

- Attractive integrated fixed-mobile offers continued to drive customer base and ARPU growth in both Hungary and North Macedonia

- The decline of voice revenue was offset by strong growth in data across both the fixed and mobile segments

- Lower Hungarian SI/IT revenues resulted from the absence of major one-off project completed in H1 2018 and temporarily lower volume of public sector contracts

- Gross profit remained stable owing to a combination of improving telecommunication service trends and lower SI/IT profit contribution

- EBITDA, excluding the impacts of IFRS 16 adoption, increased thanks to lower indirect costs

- Free cash flow decline reflects payment of the 2100 MHz frequency license extension fee together with a deterioration in working capital

- Net debt increased to HUF 411.4 billion at the end of Q2 2019 reflecting the recognition of lease liabilities in accordance with IFRS 16 and the payment of dividends in May 2019.

Tibor Rékasi, CEO commented:

“I am pleased to announce that, in H1 2019, positive trends across both the fixed and mobile segments in Hungary and all business segments in North-Macedonia facilitated consolidated moderate revenue and EBITDA growth, despite challenges in the Hungarian Systems Integration and IT (SI/IT) segment. With this performance, we are well on track to meet our guidance for 2019, which assumes a moderate decline in revenues and continued EBITDA growth.

Looking at Q2 2019, specifically, the revenue decline in the quarter is solely due to lower Hungarian SI/IT revenues attributable to a significant reduction in the volume of public sector contracts realized and the absence of a one-off project that was completed in the prior year. We recorded revenue growth across all other segments in Hungary and in North Macedonia during the quarter.

In the Hungarian mobile segment, strong demand for data helped offset the decline in voice revenues and lower equipment sales driven by a temporary slowdown in purchases of Huawei handsets. As long expected, DIGI launched its mobile service in Hungary during the quarter; however, their service offering, and availability remains very limited.

In the fixed segment, the ongoing rollout of our fiber network, which replaces crucial parts of our legacy network with fiber optic, played a key role in facilitating further development of our product offering. We are pleased to report that this has resulted in continued growth of our customer base and broadband ARPU. We were also successful in maintaining momentum in the TV segment, growing both revenues and our customer base. Despite the structural decline in voice revenues, we delivered 3.1% year-on-year fixed revenue growth in Q2 2019.

In line with our strategy, we continued to place strong emphasis on growing our FMC customer base. Even with the recent market changes we are the leading integrated player in the Hungarian market and we are taking full advantage of this position to reinforce our market presence and prepare for future developments in the market. Our Magenta1 offering, introduced in 2018 to deliver highly attractive services and related equipment, remains popular with our customers and supports the sustained growth in our FMC customer base.

Our efforts to further strengthen our online presence are reflected in improved sales and customer service, as we deliver increasingly simple and attractive solutions to our customers.”

Public guidance

1) excluding spectrum license fees

This investor news contains

forward-looking statements. Statements that are not historical facts, including

statements about our beliefs and expectations, are forward-looking statements.

These statements are based on current plans, estimates and projections, and

therefore should not have undue reliance placed upon them. Forward-looking

statements speak only as of the date they are made, and we undertake no

obligation to update publicly any of them in light of new information or future

events.

Forward-looking statements involve inherent risks and uncertainties. We caution you that a number of important factors could cause actual results to differ materially from those contained in any forward-looking statement. Such factors are described in, among other things, our annual financial statements for the year ended December 31, 2018, available on our website athttps://www.telekom.hu

In addition to figures prepared in accordance with IFRS, Magyar Telekom also presents non-GAAP financial performance measures, including, among others, EBITDA, EBITDA margin and net debt. These non-GAAP measures should be considered in addition to, but not as a substitute for, the information prepared in accordance with IFRS. Non-GAAP financial performance measures are not subject to IFRS or any other generally accepted accounting principles. Other companies may define these terms in different ways. For further information relevant to the interpretation of these terms, please refer to the chapter “Reconciliation of pro forma figures”, which is posted on Magyar Telekom’s Investor Relations webpage at www.telekom.hu/investor_relations.

.