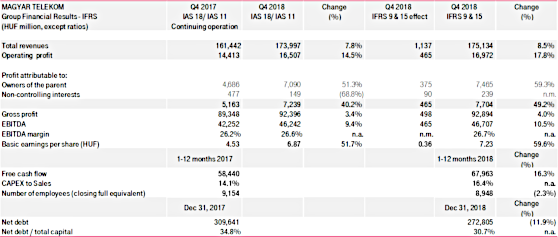

Magyar Telekom fourth quarter 2018 results

Strategic highlights:

- Improvement in Gross profit reflecting an increase in service revenues

- EBITDA growth thanks to higher gross profit and a one-off profit realized on real-estate sales

- One-off capex of HUF 15.3 billion booked in relation to the prolongation of the 2100 MHz frequency usage rights

- Increase in Free cash flow as higher EBITDA, declining acquisition costs and one-off income from real-estate sales offset higher working capital and capex payments

- After 2018 results, HUF 25 dividend per share proposed for approval at the Annual General Meeting

Tibor Rékasi, CEO commented:

“The Group has maintained strong earnings momentum throughout 2018, delivering revenue growth of 7.6% for the year. We outperformed our guidance, for both revenues, which reached HUF 657.1 billion, and EBITDA, which amounted to HUF 192.5 billion. The factors behind the EBITDA growth were the higher gross profit and one-off profit realized by the sale of real estates. We also exceeded our free cash flow target, which reached HUF 68 billion in 2018 thanks to a higher EBITDA, declining acquisition costs and the one-off income from the real-estate sales, while CAPEX stood at HUF 91.8 billion. Furthermore, through our continuous focus on our core business and meeting customer needs, and by constantly refreshing our product offering, we regained or maintained our leading position in all key market segments, including post-paid mobile, TV and fixed broadband.

In Hungary, positive business trends

continued throughout the year, with revenue growth across all three major

business lines. In the mobile segment, demand for mobile

data continued to grow as more customers used our state-of-the-art 4G network,

significantly supporting revenue generation. This was reinforced by our ongoing

strategy for equipment sales and the migration of pre-paid customers into

post-paid packages. We delivered moderate growth in our customer base, while

also increasing mobile ARPU in Q4, with growth of 6.8% achieved in the full

year.

AIn the fixed market, we maintained our

strong focus on growing our fixed network, providing nearly 300,000 new

households with 100+ MBs internet connectivity, and bringing us closer to our

goal of providing gigabit internet connectivity across the whole country. We

continued to see the positive results of this strategy in the growth of fixed

line revenue, where – despite the industry-wide trend of declining voice

revenues – we grew revenues by 5.5% year-on-year and by 4.9% in the final

quarter. Furthermore, broadband and TV revenues and fixed line equipment

revenues maintained strong growth, reaching 95.9% year-on-year, thanks to a

strong fourth quarter performance helped by Black Friday and Christmas

promotions.

With the strong performance of both our

fixed and mobile business lines, we were able to focus on the third pillar of

our core business strategy, the FMC customer base. In 2018 we remained the only

truly integrated player in Hungary and we took action to reinforce our leading position

in this market. While in the second quarter we doubled the mobile data

allowance, in the third quarter we unified our offering, giving our Magenta1

customers the ability to secure a 30% discount on all related services. Building

on this we were able to continuously grow our Magenta1 customer base, by offering

a simpler and more attractive package. We also looked for new ways to reach our

customers and strengthened our online channels. Over 40% of our customers now

use our Telekom app and over 20% of all sales occur via our online channels.

In the System

Integration and IT segment we had a strong quarter, reaching 19.8% revenue

growth year-on-year. The growth was again attributable to a high volume of

software and hardware projects with a lower profit margin. These projects, with

a lower than average margin, serve to establish relationships with several

different institutions – ones we can later convert to higher margin service

contracts.

Group performance during the year was further supported by the continued turnaround in Macedonia. Both revenues and EBITDA improved, thanks to a solid performance across all business lines, positive trends in service revenues, and outstanding growth in System Integration and IT revenues.

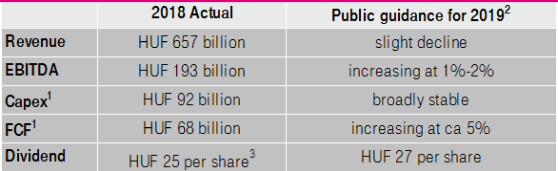

Looking forward we expect revenues to moderately decline in 2019, whilst EBITDA is expected to increase by 1%-2% on a comparable basis thanks to a reduction in indirect costs. Capital expenditures are expected to remain stable (excluding the increase driven by IFRS 16 implementation and any possible spectrum costs) as spending on the fixed network will continue to reflect the acceleration of the fiber-rollout program. Continuing the successful turnaround in profitability, we expect free cash flow (excluding spectrum license fees) to continue increase by around 5%. Based on the current operating and regulatory environment and outlook, we expect the Company to pay HUF 27 dividend per share in relation to 2019 earnings. This is subject to the Board of Directors’ future proposal to the General Meeting which will be submitted in due course, once all necessary information is available and all prerequisites to making such a proposal are met”

Public guidance

1) excluding spectrum license fees

This investor news contains

forward-looking statements. Statements that are not historical facts, including

statements about our beliefs and expectations, are forward-looking statements.

These statements are based on current plans, estimates and projections, and

therefore should not have undue reliance placed upon them. Forward-looking

statements speak only as of the date they are made, and we undertake no

obligation to update publicly any of them in light of new information or future

events.

Forward-looking statements involve inherent risks and uncertainties. We caution you that a number of important factors could cause actual results to differ materially from those contained in any forward-looking statement. Such factors are described in, among other things, our annual financial statements for the year ended December 31, 2017, available on our website athttps://www.telekom.hu

In addition to figures prepared in accordance with IFRS, Magyar Telekom also presents non-GAAP financial performance measures, including, among others, EBITDA, EBITDA margin and net debt. These non-GAAP measures should be considered in addition to, but not as a substitute for, the information prepared in accordance with IFRS. Non-GAAP financial performance measures are not subject to IFRS or any other generally accepted accounting principles. Other companies may define these terms in different ways. For further information relevant to the interpretation of these terms, please refer to the chapter “Reconciliation of pro forma figures”, which is posted on Magyar Telekom’s Investor Relations webpage at www.telekom.hu/investor_relations.

.