Magyar Telekom first quarter 2020 results

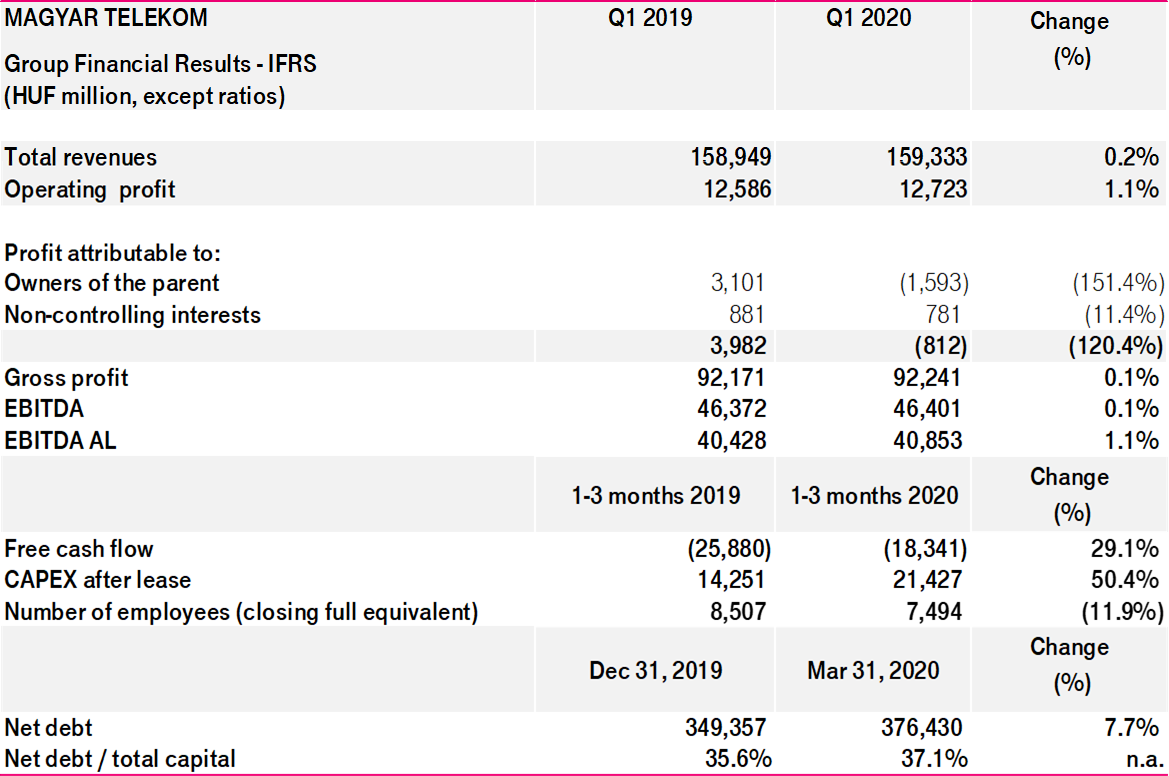

- Stable revenues as sustained growth in telecommunication service revenues in both countries of operation was offset by a decline in SI/IT project demand in Hungary

- Gross profit remained unchanged as the higher weight of telecommunication services in the sales mix was balanced by elevated bad debt and telecom tax expenses

- Severance expenses of HUF 4.0 billion largely offset by savings related to headcount reduction and lower advisory costs, leading to flat indirect costs

- EBITDA AL improved moderately as stable EBITDA was coupled with lower IFRS 16 related depreciation and interest expenses

- Negative free cash flow in the amount of HUF 18.3 billion was driven by seasonal factors such as high payments to suppliers, coupled with utility tax and income tax payments and a negative foreign exchange (FX) impact stemming from the weakening of the forint

- 5G spectrum license payments amounting HUF 54.2 billion and the capitalization of the present value of frequency fees in the amount of HUF 37.3 billion will be recognized in the second quarter

- Dividend, following the authorization granted by Government Decree, the Board of Directors approved the payment of HUF 20 dividend per share after 2019 results

Tibor Rékasi, CEO commented:

“I am pleased to

report that despite the negative impact of the COVID-19 pandemic towards the

end of the quarter, thanks to continued focus on executing our commercial and strategic

priorities, we delivered broadly stable total revenues and EBITDA year-on-year.

Our main focus

since the outbreak of the coronavirus has been on the swift implementation of

measures to safeguard the health and safety of both our employees and

customers. We have introduced strict social distancing across the Group and, at

this time, around 80% of our employees are working remotely. While the majority

of our points of sale remain open, we have significantly limited traffic within

stores. Our call centers and online support services are successfully handling

the resulting increased volumes of customer requests. In an effort to support

our customers during this challenging period, we are also providing free mobile

data and TV content, a range of attractively priced laptops and tablets, free

voice usage for the most vulnerable in our society as well as payment

restructuring for customers in financial difficulties.

Digitalization

has been of vital importance in these times of unprecedented crisis and our

networks are playing a critical role in keeping businesses and families

connected. To ensure the reliability and security of our networks, we continue

to invest in our infrastructure. The rollout of our fiber network remains a key

priority and capex dedicated to such investments has doubled versus the first

quarter of 2019. Since acquiring spectrum licenses related to 5G and mobile

broadband services, we commenced commercial 5G services in early April and

intend to steadily expand our coverage over the coming months.

Looking ahead,

while the precise impact of the current crisis on our financial performance

remains uncertain, as a telecommunications provider, demand for our services

remains strong. Since the start of the pandemic, we have seen higher voice and

data traffic across our fixed and mobile networks and a lower level of

international roaming. At the same time, demand for IT services has been shaped

by social distancing measures with projects facilitating digitalization of

businesses among the most sought-after. These projects, while of great

significance longer term, have a lower contribution to our profitability today.

We also expect our profitability to be affected by higher expenses driven by

increased usage levels and the weakening of the forint. To mitigate the impact

of such trends on our performance we intend to pursue further cost optimization

measures that will support us in our efforts to reach our targets for the full

year.

Given the high

level of uncertainty regarding the duration of the restrictions and its impact

on the economy, we will continue to closely monitor the impact of the pandemic

on our operations and provide further updates to all our stakeholders as the

situation evolves.”

Public guidance

1) excluding spectrum license fees and CAPEX of right-of-use assets (i.e. the impact of IFRS 16 implementation)

This investor news contains

forward-looking statements. Statements that are not historical facts, including

statements about our beliefs and expectations, are forward-looking statements.

These statements are based on current plans, estimates and projections, and

therefore should not have undue reliance placed upon them. Forward-looking

statements speak only as of the date they are made, and we undertake no

obligation to update publicly any of them in light of new information or future

events.

Forward-looking statements involve inherent risks and uncertainties. We caution you that a number of important factors could cause actual results to differ materially from those contained in any forward-looking statement. Such factors are described in, among other things, our annual financial statements for the year ended December 31, 2019, available on our website athttps://www.telekom.hu

In addition to figures prepared in accordance with IFRS, Magyar Telekom also presents non-GAAP financial performance measures, including, among others, EBITDA, EBITDA margin and net debt. These non-GAAP measures should be considered in addition to, but not as a substitute for, the information prepared in accordance with IFRS. Non-GAAP financial performance measures are not subject to IFRS or any other generally accepted accounting principles. Other companies may define these terms in different ways. For further information relevant to the interpretation of these terms, please refer to the chapter “Reconciliation of pro forma figures”, which is posted on Magyar Telekom’s Investor Relations webpage at www.telekom.hu/investor_relations.

.