Magyar Telekom fourth quarter 2023 results

Magyar Telekom

(Reuters: MTEL.BU and Bloomberg: MTELEKOM HB, hereinafter: Company), the

leading Hungarian telecommunications service provider, today reported its

consolidated financial results for the fourth quarter and full year of 2023, in accordance with

International Financial Reporting Standards (IFRS) as adopted by the EU

(hereinafter: quarterly financial report). The quarterly financial report

contains unaudited figures for each reporting period.

Financial highlights:

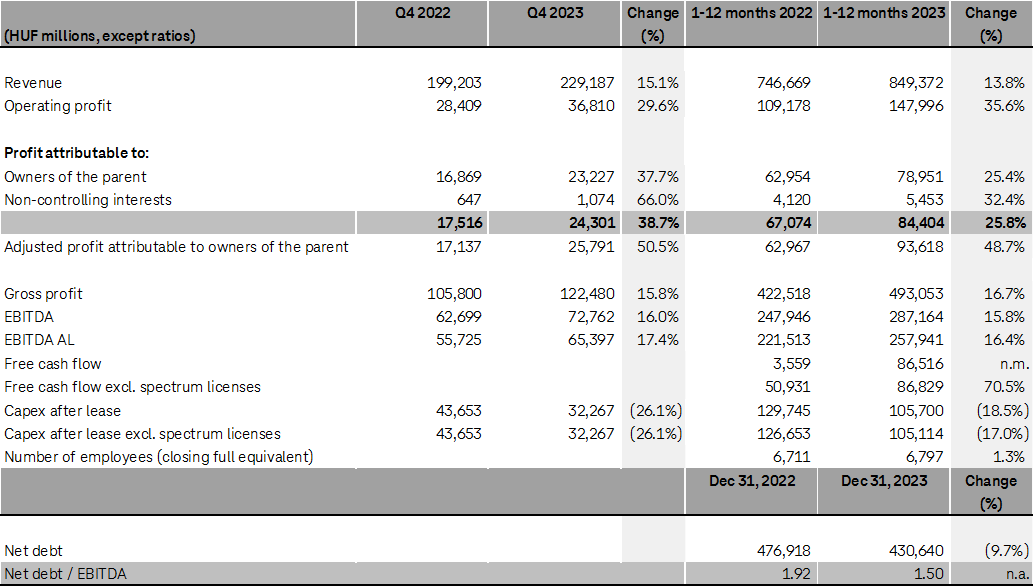

- Group revenue increased by 15.1% year-on-year in Q4 2023 and by 13.8% for the full year 2023. This expansion was primarily driven by the continued strong demand for mobile data and fixed broadband services, coupled with the positive effects of inflation-based fee adjustments in Hungary.

- Gross profit improved by 15.8% year-on-year in Q4 2023 and registered a 16.7% increase for the full year 2023, attributable to the growth in service revenues.

- EBITDA AL increased by 17.4% year-on-year in Q4 2023 and by 16.4% for the full year 2023, as the growth in gross profit offset the rise in indirect costs.

- Adjusted net income for Q4 2023 amounted to HUF 25.8 billion and reached HUF 93.6 billion for the full year 2023, reflecting the improvement in operational performance.

- Capex after leases, excluding spectrum licenses, decreased by 17.0% year-on-year in 2023, amounting to HUF 105.1 billion. This reduction was a result of lower network-related investments in both countries.

- Free cash flow, excluding spectrum license fees, amounted to HUF 86.8 billion in 2023, representing a year-on-year increase of HUF 35.9 billion. This growth was driven by a combination of operational result improvements and reduced Capex levels.

- The Board of Directors proposes a dividend payment of HUF 41.56 billion for the 2023 financial year, for approval to the Company’s Annual General Meeting. Additionally, the Board envisages a share buyback of up to HUF 24.0 billion resulting in a total annual shareholder remuneration of up to HUF 65.56 billion after the 2023 results.

- The rollout of the gigabit network in Hungary continued throughout 2023, reaching 200 thousand new access points and achieving 80% coverage of gigabit-capable access points within our fixed network by year-end.

- The expanded gigabit coverage contributed to the growth in the Hungarian fixed broadband customer base and ARPU, which increased by 5.1% and 19.0% year-on-year in 2023, respectively.

- The mobile network modernization in Hungary reached an advanced stage of 80%, with outdoor population-based 5G coverage reaching 65%.

- Mobile network enhancement facilitated an over 20% increase in our customers’ average mobile data usage in 2023, reflected in the 17.7% year-on-year growth in Hungarian mobile postpaid ARPU.

Tibor Rékasi, Magyar Telekom CEO commented:

“I am delighted to report that despite the significant macroeconomic challenges we faced in 2023, we maintained strong commercial momentum, experiencing increased demand for both mobile data and gigabit broadband services. In line with our strategic priorities, we further advanced the digital transformation of Hungary through the continued roll-out of the gigabit network. By the end of the year, we surpassed 3.6 million access points, with approximately 50% of our customers opting for gigabit broadband speeds nationwide. Our unwavering commitment remained centered on delivering seamless connectivity and outstanding user experiences to our customers.

Reflecting our dedication and the implementation of an inflation-based fee adjustment effective 1st March, our revenue saw a notable increase of 13.8% in 2023. Despite facing higher electricity costs which were four-fold higher year-on-year, and inflationary pressures on our cost base, particularly vendor expenses, we achieved robust year-on-year growth of 16.4% in EBITDA AL.

I am pleased to announce that due to our strong underlying performance, the Group’s adjusted net income increased by 48.7% to HUF 93.6 billion. Consequently, the Board is proposing a total annual shareholder remuneration of up to HUF 65.56 billion, comprising a total dividend payment of HUF 41.56 billion for the 2023 financial year and a share buyback of up to HUF 24.0 billion. This represents approximately 70% of the adjusted net income generated during 2023.

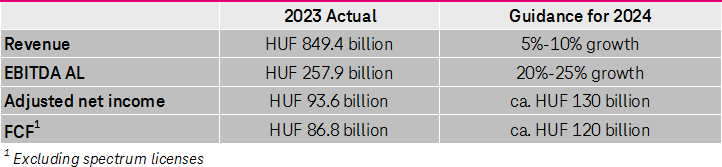

Looking ahead to 2024, we expect some further pressure on profitability stemming from the challenging economic landscape. However, thanks to our strong commercial performance and the positive impacts of the previously communicated fee adjustments across our contracts, we are targeting revenue growth of 5%-10%. Furthermore, with the termination of the utility tax in 2024 and more favorable energy costs, we anticipate EBITDA AL to grow 20%-25% in 2024. Our guidance for adjusted net income is approximately HUF 130 billion, with a projected free cashflow generation of circa HUF 120 billion.”

This investor news contains forward-looking statements. Statements that are not historical facts, including statements about our beliefs and expectations, are forward-looking statements. These statements are based on current plans, estimates and projections, and therefore should not have undue reliance placed upon them. Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update publicly any of them in light of new information or future events.

Forward-looking statements involve inherent risks and uncertainties. We caution you that a number of important factors could cause actual results to differ materially from those contained in any forward-looking statement. Such factors are described in, among other things, our annual financial statements for the year ended December 31, 2022, available on our website athttp://www.telekom.hu

.