Magyar Telekom results for the first quarter of 2018

Highlights:

- Total revenues, excluding the impact of IFRS 15 adoption, increased 6.5% year-on-year to HUF 149.6 billion in Q1 2018, largely driven by mobile data and equipment sales, as well as System Integration and IT revenue growth. The adoption of IFRS 15 resulted in additional HUF 1.0 billion revenue in Q1 2018. Mobile revenues (excluding IFRS 15 impacts) increased 4.6% year-on-year to HUF 77.7 billion in Q1 2018, thanks to higher revenues across all service lines. Fixed line revenues (excluding IFRS 15 impacts) were 7.6% higher year-on-year at HUF 51.2 billion in Q1 2018. In Hungary, improvements in broadband and TV revenues, coupled with strong growth in equipment sales, fully offset the erosion of voice revenue, whereas in Macedonia, fixed revenues declined moderately. System Integration (SI) and IT revenues grew by 21.2% year-on-year to HUF 20.8 billionin Q1 2018, thanks to significant public sector asset sales coupled with license deliveries for the health care sector in Hungary. In Macedonia, SI/IT revenues returned to modest growth, after falling temporarily during 2017. Energy Services were ceased following the exit from the residential segment of the electricity market, which came into effect on November 1, 2017.

- Direct costs, excluding IFRS 9 and 15 impacts, increased by 11.6% year-on-year, to HUF 59.1 billion in Q1 2018. This was driven by higher SI/IT and equipment costs, in line with the growth delivered in the related revenue lines. The adoption of IFRS 9 and 15 resulted in additional HUF 0.4 billion direct costs in Q1 2018. Interconnect costs increased to HUF 4.7 billion in Q1 2018, reflecting increased mobile traffic in Hungary which led to higher payments to domestic mobile operators, whereas interconnect costs in Macedonia remained broadly unchanged. SI/IT service related costs increased by 31.1% year-on-year to HUF 14.0 billion in Q1 2018, driven by an increase in related revenue and a higher ratio of infrastructure delivery projects in the sales mix. Bad debt expenses improved by HUF 0.5 billion year-on-year falling to HUF 1.1 billion in Q1 2018. This was primarily thanks to a positive effect from improvements in the aging structure of our receivables, in addition to temporarily favourable results related to factored trade receivables in Hungary. Telecom tax rose by 5.3% year-on-year to HUF 6.2billion in Q1 2018, as a result of increased mobile traffic in Hungary, both in the retail and business segments. Other direct costs increased by 14.9% year-on-year, to HUF 33.1 billion in Q1 2018, due to an increase in the cost of equipment sales resulting from higher smartphone sales and an increase in Hungarian roaming outpayments.

- Gross profit (excluding IFRS 9 and 15 impacts) grew by 3.4% year-on-year to HUF 90.5 billion in Q1 2018. Higher revenues, coupled with reduced bad debt expenses, more than offset the increase in equipment subsidies and margin deterioration in SI/IT services. The adoption of IFRS 9 and 15 resulted in an additional HUF 0.6 billion of gross profit in Q1 2018 (fora more detailed breakdown please see section 3.9.)

- Indirect costs, excluding IFRS 9 and 15 impacts, improved by 1.3% year-on-year to HUF 48.6 billion in Q1 2018, thanks to lower utility tax expenses coupled with some savings in other operating expenses and higher other operating income. Employee-related expenses increased moderately by 0.8% year-on-year to HUF 19.5 billion. This was driven by the insourcing of trainees in the Hungarian operations, which resulted in the related wage costs being booked as employee expenses, rather than being reported among other operating expenses in the base period. At the same time, the negative impact of the 5% average wage increase at the Company was counterbalanced by a lower average regular employee headcount. Hungarian utility tax in Q1 2018 was HUF 7.2 billion, HUF 0.3 billion lower than in Q1 2017. This reflects the positive effects of Magyar Telekom’s tax credit relating to new network investments and upgrades which enable internet access of at least 100 Mbps. Other operating expenses improved moderately, falling 0.9% year-on-year to HUF 22.9 billion in Q1 2018. Savings in energy costs and advisory fees compensated for higher fees related to the rental of local state-of-the-art cable networks and a temporary increase in marketing expenses. Other operating income increased to HUF 1.0 billion in Q1 2018, reflecting one-off accrual reversals related to lapsed unbilled liabilities.

- EBITDA, excluding IFRS 9 and 15 impacts, grew by 9.4%year-on-year to HUF 41.9 billion in Q1 2018, following an increase in gross profit, in addition to some indirect cost savings. The adoption of IFRS 9 and 15 resulted in an additional HUF 0.6 billion of EBITDA in Q1 2018.

- Depreciation and amortization expenses increased by 4.3% year-on-year to HUF 26.8 billion, reflecting higher capitalization of software and physical equipment during 2017.

- Profit for the period from continuing operations, excluding IFRS 9 and 15 impacts, grew by HUF 4.1 billion to HUF 8.9 billion in Q1 2018 compared to Q1 2017, as the increase in EBITDA was coupled with lower financial expenses that more than offset the increase in D&A expenses. Net financial expenses improved by 28.7% year-on-year to HUF 4.3 billion in Q1 2018. This was thanks to lower losses on the fair valuation of derivatives compared to Q1 2017, due to different EUR-HUF exchange rates and yield developments during the two quarters. Income tax expenses increased by 11.0% year-on-year, to HUF 2.3 billion in Q1 2018, reflecting the increase in profit before income tax.

- Profit attributable to non-controlling interestsfrom continuing operations excluding IFRS 9 and 15 impacts, increased by 14.2% year-on-year to HUF 0.8 billion in Q1 2018, as the increase in the Macedonian EBITDA outweighed higher D&A expenses.

- Profit from discontinued operation: In January 2017, the Company signed a share purchase agreement with Hrvatski Telekom d.d. for the sale of the Company’s entire 76.53% shareholding in Crnogorski Telekom A.D., for a total consideration of EUR 123.5 million (HUF 38.5 billion). The transaction closed in January 2017. Consequently, in accordance with IFRS5, the results and cash flows of the Montenegrin operations are presented as discontinued operations for both the comparative and the current period. (For further details please see section 2.2.3)

- Net debt increased from HUF 309.6 billion at the end of 2017 to HUF 318.1 billion by the end of March 2018. At the same time, the net debt ratio (net debt to total capital) fall from 34.8% to 34.4%, reflecting the increase in retained earnings caused by IFRS 9 and 15 implementation.

- Free Cash Flow reduction due to unfavourable seasonality in working capital, including higher payments to handset suppliers.

Christopher Mattheisen, CEO commented:

“I am pleased to confirm that Magyar Telekom has maintained its momentum from the previous fiscal year to deliver strong growth in both revenue and EBITDA in Q1 2018. Our continued commitment to meeting customer needs and refreshing our product offering ensured the Hungarian operation continued along the positive trajectory set last year, with revenue increasing across all three major services lines.

In the mobile segment, data services continued to play a significant role in revenue creation with both domestic and visitor data usage increasing. In addition, regulatory changes introduced in 2017 requiring the sale of audiovisual equipment with 2-year loyalty contracts boosted revenue in the equipment line. Pre- to postpaid migration continued in the quarter, leading to a more favorable customer mix and higher altogether mobile ARPU.

In the fixed segment, revenues from equipment sales rose by 70% year-on-year for the period due to successful efforts to develop the network and restructure the broadband offering. As a result, we managed to grow our broadband and TV customer base by over 5% in the quarter and are confident that we are well positioned to capitalize on the positive trends in the segment going forward.

FMC remained a key focus for the quarter as we introduced our ‘FMC first’ strategy to further expand our FMC customer base while giving customers a complete solution for their communications needs.

Turnaround in Macedonia continued into Q1 2018 with revenue up 2.6% year-on-year, primarily as a result of positive dynamics in the mobile segment. Despite growing competitive pressures, EBITDA increased by 11% as a result of ongoing cost saving measures.

We have had a strong start to the year. Having strengthened our position in several key areas, such as post-paid mobile and fixed broadband, and with our strategic focus on expanding our FMC customer base, we are well placed to deliver another year of growth in 2018. As you probably know I’ll be leaving Magyar Telekom at the beginning of July and as such you’ll hear the rest of this success story from my successor Tibor Rékasi.”

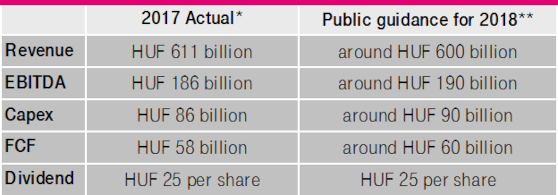

Public guidance:

*excluding Crnogorski Telekom financials and the transaction price of the disposal of the majority ownership

** including IFRS 9 & 15 impacts