Magyar Telekom result for the fourth quarter of 2018

Total revenues (excluding the impact of IFRS 15 adoption) increased by 7.8% year-on-year to HUF 174.0 billion in Q4 2018and by 7.2% year-on-year to HUF 655.1 billion in FY 2018.Revenue growth continued to be primarily driven by a strong increase in SI/IT revenues, along with higher equipment sales and mobile data usage.

- Mobile revenues (excluding IFRS 15 impacts) increased by 8.7% year-on-year to HUF 90.5 billion in Q4 2018and by 6.0% year-on-year to HUF 342.1 billion in FY 2018, primarily driven by the growth in equipment sales and a continued increase in mobile data revenues.

- Fixed line revenues (excluding IFRS 15 impacts) rose by 4.6% year-on-year to HUF 53.9 billion in Q4 2018and by 5.0% to HUF 205.9 billion in FY 2018. This growth was attributable to rising equipment sales as well as higher TV and broadband retail service revenues.

- System Integration (SI) and IT revenues grew by 12.2% year-on-year to HUF 29.6 billionin Q4 2018, resulting in year-on-year annual revenue growth of 22.4% in FY 2018. Growth continued to be primarily driven by public sector projects, while deliveries of instant payment solutions to the banking sector also contributed to the increase in Hungary in Q4 2018. In Macedonia, the growth in SI/IT revenues was fuelled by a higher volume of customized solutions projects.

- Energy Serviceswere discontinued as of November 1, 2017, following the exit from the residential segment of the electricity market.

Direct costs (excluding IFRS 9 and 15 impacts) increased by 13.2% year-on-year, to HUF 81.6 billion in Q4 2018and by 15.9% year-on-year to HUF 284.9 billion in FY 2018. This wasdriven by higher SI/IT and equipment costs, in line with the growth delivered in related revenue lines, coupled with higher bad debt expenses.

- Interconnect costsincreased by 5.7% year-on-year to HUF 5.2 billion in Q4 2018, reflecting increased mobile traffic in both countries that led to higher payments to domestic mobile operators.

- SI/IT service related costsincreased by 8.2% year-on-year to HUF 20.2 billion in Q4 2018, driven by a higher volume of related projects.

- Bad debt expensesdeteriorated by HUF 2.2 billion year-on-year to HUF 3.2 billion in Q4 2018. This was driven primarily by higher bad debt expense in Hungary. This resulted from the strong growth in revenues, as well as the absence of the positive one-off impact recorded in 2017 that stemmed from the application of lower impairment rates. In Macedonia, bad debt expense (excluding the impact of IFRS adoption) declined thanks to lower impairment levels related to mobile sales.

- Telecom taxdeclined slightly by 3.1% year-on-year to HUF 6.3 billion in Q4 2018, as lower residential fixed voice usage outweighed the increase in mobile traffic in Hungary. Telecom tax for the full year rose by a moderate 1.6% year-on-year to HUF 25.5 billion, reflecting higher mobile traffic in Hungary, both in the retail and business segments.

- Other direct costsincreased by 15.8% year-on-year, to HUF 46.7 billion in Q4 2018, primarily due to an increase in the cost of equipment sales, in line with higher sales and an increase in TV outpayments.

Gross profit (excluding IFRS 9 and 15 impacts) increased by 3.4% year-on-year to HUF 92.4 billion in Q4 2018and by 1.4% to HUF 370.2 billion in FY 2018, as the strong increase in revenues outweighed the impact of the increasing weight of lower margin services in the sales mix.

Indirect costs (excluding IFRS 9 and 15 impacts) improved by 2.0% year-on-yearto HUF 46.2 billionin Q4 2018, as higher other operating income fully offset higher employee related and other operating expenses. Indirect costs for the full year declined by1.1% year-on-year to HUF 177.4 billion, as higher other operating income, coupled with savings in other operating expenses outweighed the rise in employee related expenses.

- Employee-related expensesrose by 4.3% year-on-year to HUF 23.0 billion in Q4 2018 as a combined result of changed trainee employment form in Hungary, a 5% average wage increase at the Company and higher severance-related expenses in Macedonia.

- Other operating expenseswere 6.6% higher year-on-year at HUF 29.3 billion in Q4 2018, driven by higher marketing expenses and an increase in rental fees in relation to the new headquarters. Other operating expenses for the full year improved by 1.8% year-on-year to HUF 96.7 billion as lower HR-related, IT maintenance and energy costs more than offset increased rental fees and maintenance costs in Hungary. Other operating expenses in Macedonia improved moderately thanks to lower marketing and maintenance expenses.

- Other operating incomerose by HUF 3.7 billion year-on-year to HUF 6.2 billion in Q4 2018, reflecting the one-off profits realized from the sale of the old headquarters in Hungary.

EBITDA (excluding IFRS 9 and 15 impacts) increased by 9.4% year-on-year to HUF 46.2 billion in Q4 2018reflecting the combined impact of higher gross profit and higher other operating income in Hungary, which fully offset the temporary EBITDA decline in Macedonia. EBITDA for the full year improved by 3.8% year-on-year to HUF 192.8 billion thanks to the combined impact of improvements in gross profit and indirect costs.

Depreciation and amortization (D&A) expenses increased by 6.8% year-on-year to HUF 29.7 billionin Q4 2018 and by 6.8% to HUF 115.5 billion in FY 2018, driven by the shortening of the useful lives of certain network equipment related to customer connections.

Profit for the period from continuing operations (excluding IFRS 9 and 15 impacts) increased by 40.2% year-on-year to HUF 7.2 billion in Q4 2018, as higher EBITDA and a slight decline in income tax expense, more than offset the increase in D&A and net financial expenses. In FY 2018, profit for the period from continuing operationsincreased by 16.1% to HUF 46.7 billion, thanks to higher EBITDA and savings in financial and income tax expenses.

- Net financial expenseswere 10.1% higher year-on-year at HUF 5.2 billion in Q4 2018, as higher losses on the fair valuation of derivates stemming from the weakening of the forint against the euro, offset the positive impact of lower interest expense associated with the declining debt level. In FY 2018, net financial expenses improved by 17.8% year-on-year to HUF 17.8 billion, thanks to the lower average debt level, as well as a reduction in losses on the fair valuation of derivatives versus 2017. This occurred due to different EUR-HUF exchange rate and yield developments between the two periods.

- Income taxexpense decreased from HUF 4.7 billion in Q4 2017 to HUF 4.3 billion in Q4 2018 reflecting the decrease in deferred tax expense deriving from the booking of one-offs in Q4 2017 relating to previous periods.

Profit attributable to non-controlling interests (excluding IFRS 9 and 15 impacts), decreased from HUF 0.5 billion in Q4 2017 to HUF 0.1 billion in Q4 2018, as lower EBITDA was combined with higher D&A expenses at the Macedonian operations. In FY 2018, profit attributable to non-controlling interests increased moderately to HUF 3.1 billion, thanks to the improved performance of our Macedonian operation.

Profit from discontinued operation:In January 2017, the Company signed a share purchase agreement with Hrvatski Telekom d.d. for the sale of the Company’s entire 76.53% shareholding in Crnogorski Telekom A.D., for a total consideration of EUR 123.5 million (HUF 38.5 billion). The transaction closed in January 2017. Consequently, in accordance with IFRS 5, the results and cash flows of the Montenegrin operations are presented as discontinued operations for both the comparative and the current period. (For further details please see section 2.2.3)

Net debt at the end of 2018 declined to HUF 272.8 billion, from HUF 309.6 billion at the end of 2017, with the net debt ratio (net debt to total capital) decreasing to 30.7%.

Increase in Free cash flowas higher EBITDA, declining acquisition costs and one-off income from real-estate sales offset higher working capital and capex payments.

Tibor Rékasi, CEO commented:

“The Group has maintained strong earnings momentum throughout 2018, delivering revenue growth of 7.6% for the year. We outperformed our guidance, for both revenues, which reached HUF 657.1 billion, and EBITDA, which amounted to HUF 192.5 billion. The factors behind the EBITDA growth were the higher gross profit and one-off profit realized by the sale of real estates. We also exceeded our free cash flow target, which reached HUF 68 billion in 2018 thanks to a higher EBITDA, declining acquisition costs and the one-off income from the real-estate sales, while CAPEX stood at HUF 91.8 billion. Furthermore, through our continuous focus on our core business and meeting customer needs, and by constantly refreshing our product offering, we regained or maintained our leading position in all key market segments, including post-paid mobile, TV and fixed broadband.

In Hungary, positive business trends continued throughout the year, with revenue growth across all three major business lines. In the mobile segment, demand for mobile data continued to grow as more customers used our state-of-the-art 4G network, significantly supporting revenue generation. This was reinforced by our ongoing strategy for equipment sales and the migration of pre-paid customers into post-paid packages. We delivered moderate growth in our customer base, while also increasing mobile ARPU in Q4, with growth of 6.8% achieved in the full year.

In the fixed market, we maintained our strong focus on growing our fixed network, providing nearly 300,000 new households with 100+ MBs internet connectivity, and bringing us closer to our goal of providing gigabit internet connectivity across the whole country. We continued to see the positive results of this strategy in the growth of fixed line revenue, where – despite the industry-wide trend of declining voice revenues – we grew revenues by 5.5% year-on-year and by 4.9% in the final quarter. Furthermore, broadband and TV revenues and fixed line equipment revenues maintained strong growth, reaching 95.9% year-on-year, thanks to a strong fourth quarter performance helped by Black Friday and Christmas promotions.

With the strong performance of both our fixed and mobile business lines, we were able to focus on the third pillar of our core business strategy, the FMC customer base. In 2018 we remained the only truly integrated player in Hungary and we took action to reinforce our leading position in this market. While in the second quarter we doubled the mobile data allowance, in the third quarter we unified our offering, giving our Magenta1 customers the ability to secure a 30% discount on all related services. Building on this we were able to continuously grow our Magenta1 customer base, by offering a simpler and more attractive package. We also looked for new ways to reach our customers and strengthened our online channels. Over 40% of our customers now use our Telekom app and over 20% of all sales occur via our online channels.

In the System Integration and IT segment we had a strong year, achieving 22.4% growth versus 2017. Once again, the growth was attributable to a high volume of software and hardware projects with lower profit margins. Our strategy is to continue focusing on these deals, to build long-term relationships with our business partners, and over time convert these relationships to higher margin service contracts.

Group performance during the year was further supported by the continued turnaround in Macedonia. Both revenues and EBITDA improved, thanks to a solid performance across all business lines, positive trends in service revenues, and outstanding growth in System Integration and IT revenues.

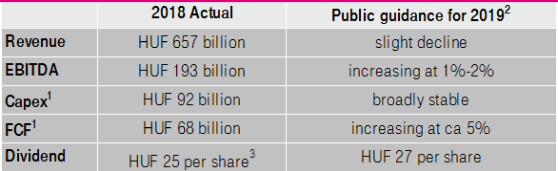

Looking forward we expect revenues to moderately decline in 2019, whilst EBITDA is expected to increase by 1%-2% on a comparable basis thanks to a reduction in indirect costs. Capital expenditures are expected to remain stable (excluding the increase driven by IFRS 16 implementation and any possible spectrum costs) as spending on the fixed network will continue to reflect the acceleration of the fiber-rollout program. Continuing the successful turnaround in profitability, we expect free cash flow (excluding spectrum license fees) to continue increase by around 5%. Based on the current operating and regulatory environment and outlook, we expect the Company to pay HUF 27 dividend per share in relation to 2019 earnings. This is subject to the Board of Directors’ future proposal to the General Meeting which will be submitted in due course, once all necessary information is available and all prerequisites to making such a proposal are met.”

Public guidance

1) excluding spectrum license fees