Magyar Telekom results for the fourth quarter of 2020

Highlights:

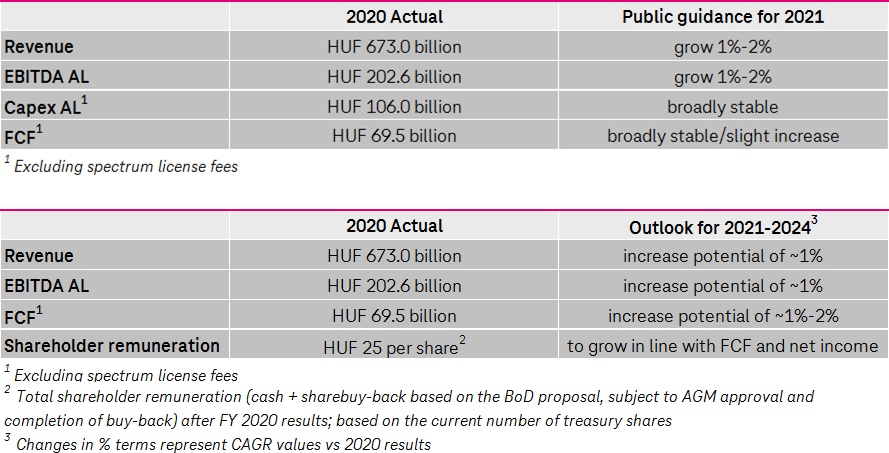

Total revenues increased by 3.6% year-on-year to HUF 188.9 billion in Q4 2020thanks to increases in telecommunication service revenues in both countries coupled with higher equipment sales, and a positive foreign exchange impact stemming from the strengthening of the denar compared to the forint. For the full year 2020, revenues were up 1.0% at HUF 673.0 billionas the mentioned positive impacts were mitigated by lower Hungarian SI/IT revenues.

- Mobile revenues were up 3.6% year-on-year to HUF 97.9 billion in Q4 2020, and 2.9% higher at HUF 364.6 billion in 2020, thanks to higher mobile data and equipment sales revenues which could fully offset lower retail voice revenues.

- Fixed line revenues increased by 5.4% year-on-year, to HUF 58.0 billion in Q4 2020and by 3.0% to HUF 219.0 billion in 2020 as the continued decline in voice revenues was fully offset by improvements in broadband and TV revenues at both operations.

- System Integration (SI) and IT (‘SI/IT’) revenues were moderately up at HUF 33.0 billion in Q4 2020. In Hungary, revenue contraction slowed to 2.9% year-on-year in Q4 2020 reflecting higher deliveries to the public and financial sectors, whereas in North Macedonia, strong increase was recorded in relation to a hardware delivery project. In full year 2020, SI/ IT revenues recorded a decline of 10.2% to HUF 89.5 billion, driven by lower volumes of implementation projects delivered primarily to the public sector in Hungary that could not be offset by higher customized solution projects related revenues in North Macedonia.

Direct costs increased by 3.0% year-on-year to HUF 90.9 billion in Q4 2020mostly driven by higher equipment costs.For 2020, direct costs were up by 1.7% year-on-year at HUF 297.5 billionreflecting increases in telecom tax and other direct costs partly mitigated by lower SI/IT expenses.

- Interconnect costsincreased by 10.7% year-on-year to HUF 5.9 billion in Q4 2020, reflecting the sharp increase in off-network mobile voice traffic primarily visible at the North Macedonian operation, that led to higher payments to domestic mobile operators.

- SI/IT service-related costsincreased moderately year-on-year to HUF 23.7 billion in Q4 2020, reflecting slightly higher volume of related projects. In full year 2020, SI/IT service-related costs declined by 12.2% to HUF 63.3 billion driven by lower volume of implementation projects in Hungary during the year.

- Bad debt expensesdecreased by 20.7% year-on-year to HUF 2.5 billion in Q4 2020, thanks to favorable aging of receivables in Hungary, particularly in mobile coupled with absence of negative one-off items impacting Q4 2019 results in North Macedonia that combined more than offset a moderate increase related to COVID-19 effects. However, in full year 2020 bad debt expenses were up by 7.3% at HUF 9.7 billion, reflecting the absence of a one-off favorable impact resulting from a reduction of the impairment rates applied to the Hungarian fixed and mobile operations during 2019, partially offset by the favorable aging of mobile receivables at the Hungarian operation and the absence of one-off impairments in North Macedonia.

- Telecom taxrose by 11.4% year-on-year to HUF 6.7 billion in Q4 2020, driven by increases in mobile voice traffic in the business and residential segments and higher residential landline usage in Hungary.

- Other direct costswere up 3.8% year-on-year at HUF 52.2 billion in Q4 2020, driven primarily by higher equipment costs in both countries coupled with an increase in the Hungarian TV content outpayments, latter also reflecting the weakening of the forint against the euro. These could only be partially offset by lower roaming outpayments.

Gross profit improved by 4.1% year-on-year to HUF 97.9 billion in Q4 2020thanks to higher contribution from telecommunication services partly counterbalanced by lower roaming results in both countries of operation.Gross profit was up moderately to HUF 375.6 billion in 2020, as the positive telecommunication service trends were mitigated by lower Hungarian SI/IT contribution.

Indirect costs improved by 3.0% year-on-year, to HUF 35.3 billion in Q4 2020, and by 2.6% year-on-year to HUF 149.7 billion in 2020, thanks to broad-based cost saving measures implemented at the Hungarian operation.

- Employee-related expensesrose up by 4.0% year-on-year to HUF 20.6 billion in Q4 2020. The increase was reflecting a one-time bonus payment to employees in the frame of a Deutsche Telekom Group wide initiative coupled with moderately higher severance related expenses. In full year 2020,employee-related expenses improved by 1.5% year-on-year to HUF 79.0 billion, reflecting a reduction in headcount partly offset by the combined impacts of the general wage increase, a rise in bonus payments and higher severance expenses.

- Other operating expensesimproved by 8.6% year-on-year to HUF 18.4 billion in Q4 2020, primarily due to savings in marketing, advisory and maintenance expenses.

- Other operating incomewas moderately up at HUF 3.7 billion in Q4 2020, driven by income related to real estate sales in Hungary. In full year 2020, other operating income decreased to HUF 5.8 billion in 2020 from HUF 7.6 billion in 2019, as on an annual basis profits realized from real estate sales in Hungary declined.

EBITDA rose by 8.6% year-on-year to HUF 62.6 billion in Q4 2020,and by 2.4% to HUF 225.9 billion in full year 2020, as the result of higher gross profit coupled with lower indirect costs.EBITDA AL improved by 9.9% year-on-year to HUF 56.6 billion in Q4 2020, and by 2.5% annually to HUF 202.6 billion in full year 2020.

Depreciation and amortization (‘D&A’) expenses decreased by 2.6% year-on-year, to HUF 36.7 billionin Q4 2020, reflecting the extension of the useful life of some assets as well as the absence of useful life shortening of some IT software, impacting the base period. D&A expenses rose by 2.7% year-on-year to HUF 141.1 billion in 2020, attributable to the frequency licenses acquired in March 2020 in Hungary, while in North Macedonia the increase reflected higher amortization expenses in relation to content rights, software and licenses.

Profit for the period rose by 22.9% year-on-year to HUF 16.0 billion in Q4 2020, reflecting higher EBITDA coupled with lower D&A expenses. In full year 2020, profit rose by 4.1% year-on-year to HUF 46.3 billion, as the annual EBITDA improvement could offset the higher D&A expenses.

- Net financial resultsdeteriorated by HUF 3.1 billion year-on-year to HUF 6.2 billion in Q4 2020. The significant year-on-year decrease was primarily attributable to the partial reversal of the yield-curve movements experienced in Q3 2020, that now led to unrealized losses. That was coupled with the absence of gains in relation to FX based lease liabilities and other items reflecting a broadly stable FX rate during the period as opposed to some forint strengthening in Q4 2019. These impacts were partially mitigated by reversal of a one-off interest provision related to a legal case at the North Macedonian operation and some decline in interest expenses of the debt portfolio thanks to lower average interest rates.

- Income tax expensesremained broadly stable year-on-year at HUF 3.7 billion in Q4 2020. Although profit before tax increased, lower local business tax expense, driven by the decline of the relevant tax base, led to an overall decrease in income tax expenses.

Profit attributable to non-controlling interests rose by HUF 1.0 billion year-on-year to HUF 1.2 billion in Q4 2020, as higher EBITDA was coupled with better financial results, resulting in an increased profit at the North Macedonian operation.

Free cash flow excluding spectrum licenses reached HUF 69.5 billion in 2020, representing a HUF 4.5 billion improvement versus the previous year.Despite increased investment into the business, favorable working capital developments, rising profitability and lower financial charges payable led to enhanced annual free cash flow.Free cash flow after spectrum licenses reached HUF 15.3 billion for the full year, including the payment of 5G spectrum license fees in Q2 2020.

Tibor Rékasi,Magyar Telekom CEO commented:

“I am particularly proud that in the face of the COVID-19 pandemic, all our employees rose to the challenge to deliver a performance ahead of our 2020 expectations. In the fourth quarter, the business achieved robust results with a significant HUF 5 billion improvement in total EBITDA AL to HUF 56.6 billion. This strong final-quarter performance contributed to the successful delivery of our most important annual financial KPIs, including revenue, EBITDA AL and free cash flow.

2020 will also go down in history as a year of significant investments into our fixed and mobile networks. The fiber network roll-out gathered pace last year with overall development exceeding previous years’ levels. Looking ahead to 2021, I am confident that we will continue on our growth path despite ongoing volatility in our operating environment.”