Magyar Telekom results for the third quarter of 2023

Highlights:

Total revenue increased by 13.3% year-on-year to HUF 216.2 billion in Q3 2023, primarily driven by strong growth in mobile data and fixed broadband revenue, reflecting the underlying business growth as well as the positive impact of the inflation-based fee adjustment implemented to the Hungarian subscription fees from March 1, 2023.

- Mobile revenue rose by 13.0% year-on-year to HUF 126.0 billion in Q3 2023, driven by the continued growth in mobile data revenue coupled with increasing voice-retail revenue.

- Fixed line revenue increased by 17.0% year-on-year, to HUF 69.5 billion in Q3 2023.This improvement was primarily driven by increases in fixed broadband and TV revenues that were also now coupled with higher equipment sales revenues.

- System Integration and IT (‘SI/IT’) revenue increased by 3.8% to HUF 20.7 billion in Q3 2023,as a result of higher revenue at the Hungarian operation thanks to increased revenue from high value projects.

Direct costs were up by 5.4% year-on-year at HUF 85.0 billion in Q3 2023,driven by higher bad debt expenses and other direct costs.

- Interconnect costswere broadly unchanged year-on-year, at HUF 6.0 billion in Q3 2023, as lower payments at the Hungarian operation to domestic mobile operators in line with the lower outgoing traffic volumes were offset by higher outpayments at the North Macedonian operation due to increase international transit traffic volumes.

- SI/IT service-related costswere up by 6.9% year-on-year at HUF 14.8 billion in Q3 2023, in line with the higher revenue.

- Impairment losses and gains on financial assets and contract assets (bad debt expenses)was higher by HUF 1.3 billion year-on-year, amounting to HUF 2.7 billion in Q3 2023. This was equally attributable to higher revenue base and the less favorable aging structure of the customer receivables in the current period versus the favorable aging impact supporting the results in Q3 2022, at the Hungarian operation.

- Telecom taxwas lower by 4.0% year-on-year, amounting to HUF 6.3 billion in Q3 2023, primarily reflecting declining mobile voice usage of the business customer base.

- Other direct costswere up by 4.5% year-on-year to HUF 55.2 billion in Q3 2023, driven by higher equipment costs and TV content fees.

Gross profit improved by 19.0% year-on-year to HUF 131.3 billion in Q3 2023,thanks to a higher contribution from telecommunication services.

Indirect costs rose by 12.6% year-on-year, to HUF 50.8 billion in Q3 2023,primarily driven by higher energy expenses at the Hungarian operation.

- Employee-related expensesamounted to HUF 21.1 billion in Q3 2023, representing a 1.0% increase year-on-year. This was the result of higher expenses at the North Macedonian operation following the insourcing of certain maintenance functions as well as the wage increases implemented at the Hungarian operation, mostly offset by the absence of one-off compensation to employees in Hungary, that unfavorably impacted Q3 2022 expenses.

- Supplementary telecommunication taxwas booked in the amount of HUF 7.5 billion in Q3 2023, up by 16% year-on-year, reflecting the expected revenue increase.

- Other operating expenses(excluding the utility tax and the supplementary telecommunication tax) rose by 22.6% year-on-year to HUF 23.1 billion in Q3 2023, reflecting higher energy costs at the Hungarian operation, particularly electricity, coupled with further inflation-driven cost pressures partly mitigated by cost efficiency measures and favorable year-on-year development in the North Macedonian energy costs.

- Other operating incomewas HUF 0.9 billion in Q3 2023, in line with earlier trends.

EBITDA increased by 23.4% year-on-year to HUF 80.5 billionand EBITDA AL was up by 24.8% year-on-year to HUF 73.1 billion in Q3 2023driven by the improvement in gross profit that offset the higher indirect costs.

Depreciation and amortization (‘D&A’) expenseswere 2.5% higher year-on-year, amounting to HUF 34.7 billion in Q3 2023,reflecting increases in IFRS 16 lease liability related depreciation expenses.

Profit for the period rose by 33.3% year-on-year to HUF 24.7 billion in Q3 2023driven by the higher EBITDA that offset increases in financial expenses.

- Net financial resultdeteriorated from a loss of HUF 8.1 billion in Q3 2022 to a loss of HUF 15.3 billion in Q3 2023. Interest expense increased driven by higher interest related to lease liabilities, installment sales and higher average interest costs. The unfavorable change in other finance expense primarily reflects less favorable results related to derivatives attributable to the different shifts in the relevant yield curves whilst the euro-forint currency movement showed weakening in both periods, resulting in FX losses.

- Income tax expenseswere up by 22.1% year-on-year at HUF 5.7 billion in Q3 2023, reflecting the year-on-year higher profit levels.

Profit attributable to non-controlling interests increased by 19.6% year-on-year to HUF 1.7 billion in Q3 2023, reflecting primarily the improvement in EBITDA at the North Macedonian subsidiary.

Free cash flow (FCF) amounted to HUF 48.3 billion cash inflow in the first nine months of 2023 (the first nine months of 2022: HUF 5.6 billion cash inflow).

Tibor Rékasi, Magyar Telekom CEO commented:

“Thanks to the successful execution of our sustainable growth strategy, our operations remained resilient during the third quarter, even in the face of a challenging macro environment. I am pleased to report that, in the period, Magyar Telekom Group’s revenue grew by 13.3% year-on-year, while EBITDA AL increased by 24.8% year-on-year.

Our strong commitment to enhancing our networks enabled us to continue to deliver outstanding customer experience and meet the ever-increasing demands for fixed and mobile data. Furthermore, we recently reinforced our commitment to support Hungary’s digitalization efforts by signing a Memorandum of Understanding, confirming long-term cooperation with the Hungarian Government for the Digital Transformation of Hungary.

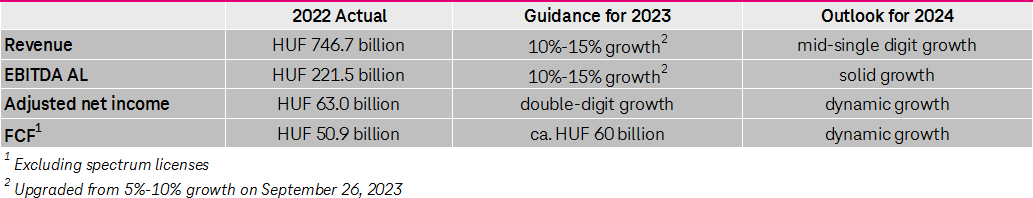

As communicated in September 2023, we recently upgraded our guidance for the full year. Looking ahead, we expect revenue and EBITDA AL to grow by 10%-15% for the full year, as a result of recent developments in the Hungarian telecommunications market being more favorable than previously expected.”

Public targets