MAGYAR TELEKOM RESULTS FOR THE FOURTH QUARTER OF 2023

Highlights:

Total revenue increased by 15.1% year-on-year to HUF 229.2 billion in Q4 2023, primarily driven by continued growth in mobile data and fixed broadband revenue, reflecting the underlying business growth as well as the positive impact of the inflation-based fee adjustment implemented to the Hungarian subscription fees from March 1, 2023. These increases were coupled with year-on-year higher equipment sales and SI/IT revenues at the Hungarian operation that more than offset the lower contribution from North Macedonia due to the weakening of the Macedonian denar vs the Hungarian forint.

- Mobile revenue rose by 14.8% year-on-year to HUF 131.7 billion in Q4 2023, thanks to the increase in service revenues coupled with higher equipment sales.

- Fixed line revenue increased by 16.0% year-on-year, to HUF 72.2 billion in Q4 2023.This improvement was primarily driven by increases in fixed broadband and TV revenues that were also coupled with higher equipment sales revenues.

- System Integration and IT (‘SI/IT’) revenue increased by 13.9% to HUF 25.3 billion in Q4 2023,as a result of higher revenue at the Hungarian operation thanks to increased revenue from high value projects.

Direct costs were up by 14.2% year-on-year at HUF 106.7 billion in Q4 2023,driven by higher bad debt expenses and other direct costs.

- Interconnect costswere lower by 6.5% year-on-year, at HUF 5.8 billion in Q4 2023, reflecting lower outgoing traffic volumes, especially at the Hungarian operation.

- SI/IT service-related costswere up by 16.4% year-on-year at HUF 18.5 billion in Q4 2023, in line with the higher revenue.

- Impairment losses and gains on financial assets and contract assets (bad debt expenses)was up by HUF 3.0 billion year-on-year, amounting to HUF 6.9 billion in Q4 2023 reflecting partly the higher revenue base as well as the HUF 3.5 billion additional forward-looking impairment recognized at the Hungarian operation in relation to the outstanding installment sales receivables due to the increased probability of deteriorating recovery rates. This was partly offset by lower bad debt expenses at the North Macedonian operation driven by favorable change in the local impairment rates.

- Telecom taxwas lower moderately year-on-year, amounting to HUF 6.4 billion in Q4 2023, reflecting the declining mobile voice usage.

- Other direct costswere up by 13.5% year-on-year to HUF 69.2 billion in Q4 2023, driven by higher equipment costs and TV content fees.

Gross profit improved by 15.8% year-on-year to HUF 122.5 billion in Q4 2023,thanks primarily to a higher contribution from telecommunication services.

Indirect costs rose by 15.4% year-on-year, to HUF 49.7 billion in Q4 2023,reflecting higher employee-related expenses, energy costs and supplementary telecommunication tax expense at the Hungarian operations.

- Employee-related expensesamounted to HUF 22.7 billion in Q4 2023, representing a 17.9% increase year-on-year. This was the combined result of the wage increases implemented at the Hungarian operation and the higher expenses at the North Macedonian operation following the insource of certain maintenance functions.

- Supplementary telecommunication taxwas recognized in the amount of HUF 7.7 billion in Q4 2023, reflecting the annual revenue development.

- Other operating expenses(excluding the utility tax and the supplementary telecommunication tax) rose by 6.5% year-on-year to HUF 21.9 billion in Q4 2023, reflecting higher energy costs and further inflation-driven cost pressures at the Hungarian operation partly mitigated by cost efficiency measures and favorable year-on-year development in the North Macedonian energy costs.

- Other operating incomeincreased by 8.4% year-on-year to HUF 2.6 billion in Q4 2023, reflecting accrual reversals as well as earned income of the energy saving certificates from the energy efficiency obligation system in relation to the Company’s energy efficiency projects.

EBITDA increased by 16.0% year-on-year to HUF 72.8 billionand EBITDA AL was up by 17.4% year-on-year to HUF 65.4 billion in Q4 2023driven by the improvement in gross profit that offset higher indirect costs.

Depreciation and amortization(‘D&A’) expenseswere 4.8% higher year-on-year, amounting to HUF 36.0 billion in Q4 2023,reflecting higher software fee and IFRS 16 lease liability related depreciation expenses.

Profit for the period rose by 38.7% year-on-year to HUF 24.3 billion in Q4 2023driven by the higher EBITDA.

- Net financial resultdeteriorated from a loss of HUF 7.2 billion in Q4 2022 to a loss of HUF 8.1 billion in Q4 2023. Net interest expense decreased driven by a legal case related provision reversal and lower interest related to installment sales transactions. At the same time, other finance expense was higher year-on-year primarily reflecting less favorable results related to derivatives mostly attributable to the different shifts in the relevant yield curves.

- Income tax expenseswere up by 20.4% year-on-year at HUF 4.5 billion in Q4 2023, reflecting the year-on-year increase in the profit before tax partly mitigated by higher amount of tax credits booked.

Profit attributable to non-controlling interests increased by 66.0% year-on-year to HUF 1.1 billion in Q4 2023, driven by year-on-year decline of D&A expenses at the North Macedonian subsidiary.

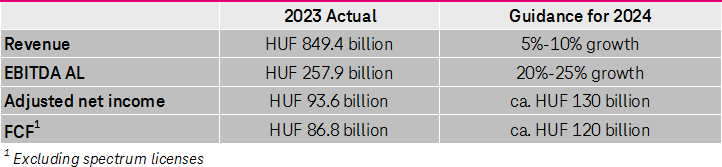

Adjusted net income (profit attributable to owners of the parent)was HUF 25.8 billion in Q4 2023 and amounted to HUF 93.6 billion for the full year 2023.Adjustmentsto reported net incomeof HUF 14.7 billionin 2023 are primarily attributable to unrealized losses related to measurement of derivatives at fair value.

Free cash flow (FCF) amounted to HUF 86.5 billion cash inflow in 2023 (2022: HUF 3.6 billion cash inflow) mainly due to the reasons described below.

Tibor Rékasi, Magyar Telekom CEO commented:

“I am delighted to report that despite the significant macroeconomic challenges we faced in 2023, we maintained strong commercial momentum, experiencing increased demand for both mobile data and gigabit broadband services. In line with our strategic priorities, we further advanced the digital transformation of Hungary through the continued roll-out of the gigabit network. By the end of the year, we surpassed 3.6 million access points, with approximately 50% of our customers opting for gigabit broadband speeds nationwide. Our unwavering commitment remained centered on delivering seamless connectivity and outstanding user experiences to our customers.

Reflecting our dedication and the implementation of an inflation-based fee adjustment effective 1st March, our revenue saw a notable increase of 13.8% in 2023. Despite facing higher electricity costs which were four-fold higher year-on-year, and inflationary pressures on our cost base, particularly vendor expenses, we achieved robust year-on-year growth of 16.4% in EBITDA AL.

I am pleased to announce that due to our strong underlying performance, the Group’s adjusted net income increased by 48.7% to HUF 93.6 billion. Consequently, the Board is proposing a total annual shareholder remuneration of up to HUF 65.56 billion, comprising a total dividend payment of HUF 41.56 billion for the 2023 financial year and a share buyback of up to HUF 24.0 billion. This represents approximately 70% of the adjusted net income generated during 2023.

Looking ahead to 2024, we expect some further pressure on profitability stemming from the challenging economic landscape. However, thanks to our strong commercial performance and the positive impacts of the previously communicated fee adjustments across our contracts, we are targeting revenue growth of 5%-10%. Furthermore, with the termination of the utility tax in 2024 and more favorable energy costs, we anticipate EBITDA AL to grow 20%-25% in 2024. Our guidance for adjusted net income is approximately HUF 130 billion, with a projected free cashflow generation of circa HUF 120 billion.”

Public targets