Magyar Telekom results for the fourth quarter of 2017

Highlights:

- Total revenues for Q4 2017 increased by 6.3% year-on-year to HUF 161.4 billion, attributable to the significant growth in SI/IT, equipment and mobile data revenues that more than offset the decline in fixed and mobile retail voice and energy revenues. Factors driving these movements were similar to those behind the 6.4% increase in total revenues to HUF 610.9 billion for the full year 2017. A breakdown by geography shows revenue for the full year 2017 grew by 7.3% in Hungary, while the Macedonian operation witnessed a 3.0% decline.Mobile revenues in Q4 2017 increased by 5.9% year-on-year to HUF 83.3 billionas higher mobile data and equipment revenues more than offset the decline in voice revenues both in Hungary and Macedonia. With regards to the full year 2017 results, mobile revenues increased by 5.4% to HUF 322.7 billion for similar reasons.Fixed line revenues increased by 5.3% year-on-year to HUF 51.5 billion in Q4 2017at the Group level. The improvement was driven by the Hungarian operations’ results where higher equipment and TV revenues more than offset the continuing structural decline in voice revenues. In Macedonia, the sustained positive momentum in TV was offset by declines elsewhere (voice, broadband, equipment and wholesale revenues). With regards to the full year 2017, fixed line revenues increased to HUF 196.1 billion, up from HUF 193.8 billion in 2016 for similar reasons.SI/IT revenues increased by 15.7% year-on-year to HUF 26.4 billion in Q4 2017,and by 30.0% to HUF 87.5 billion in full year 2017. The increase was primarily driven by the acceleration of EU fund inflows into Hungary after the temporary drop witnessed in 2016, leading to strong growth at the Hungarian operation. At the same time, System Integration and IT revenues fell in Macedonia as a number of major public sector projects witnessed some delays following a period of political uncertainty.Energy Service revenuesdecreased by 78.4% year-on-year to HUF 0.3 billion in Q4 2017and by 32.1% to HUF 4.6 billion in full year 2017. The sharp decline reflects the expiry of the last remaining gas universal contracts and the exit from the residential segment of the electricity market which came into effect on November 1, 2017.

- Direct costs increased by 14.8% for Q4 2017 year-on-year to HUF 72.1 billion, primarily due to higher SI/IT and equipment sales costs which were in line with rises in the related revenue. The same drivers led to the 15.7% increase in direct costs for the full year 2017 to HUF 245.8 billion, from HUF 212.4 billion in 2016.Interconnection costsremained broadly unchanged at HUF 4.9 billion in Q4 2017 as higher mobile traffic which led to increased payments to domestic mobile operators in Hungary was offset by lower interconnection expenses in Macedonia reflecting the MTR cuts in December 2016. For the full year 2017, interconnection costs declined by 3.8% to HUF 18.9 billion, as the above impacts were coupled with a decline in outpayments related to the termination of some wholesale activities at our Romanian subsidiary.SI/IT service related costsincreased by 33.2% to HUF 18.7 billion in Q4 2017, in line with the related revenue increases.Energy service related costsdecreased by 57.9% to HUF 0.7 billion in Q4 2017, as a result of the exit from the residential segment of the electricity market with effect of November 1, 2017.Bad debt expenseswere lower by 49.5% at HUF 0.9 billion in Q4 2017, reflecting the lower rates of impairment applied to the Hungarian mobile operations due to the improved rates of collection.Other direct costsincreased by 17.3% to HUF 40.3 billion in Q4 2017 primarily due to the higher costs of mobile equipment, accessories and other equipment sales, in line with the higher sales volumes recorded in both Hungary and Macedonia, together with an increase in Hungarian roaming outpayments.

- Gross profit improved marginally to HUF 89.3 billion in Q4 2017 year-on-yearas the improvement in the level of bad debt expenses was mostly offset by the lower SI/IT gross margin and higher equipment and roaming related outpayments. For the full year 2017, gross profit improved 1.0% to HUF 365.1 billion, from HUF 361.6 billion in 2016, as the strong increase in revenues more than offset the decline in overall gross margin.

- Indirect costs declined slightly by 0.4% to HUF 47.1 billion in Q4 2017year-on-year, as the decline in other operating expenses compensated for the higher severance costs. For the full year 2017, indirect costs were 3.0% higher year-on-year, at HUF 179.4 billion, due to the absence of positive one-off items (the sale of Origo and Infopark Building G) that occurred in 2016.Employee related expensesincreased by 7.6% to HUF 22.1 billion in Q4 2017 due to higher severance expense relating to the Hungarian headcount reduction coupled with an increase in the average number of Group employees resulting in higher wage costs.Other operating expensesimproved by 6.2%, amounting to HUF 27.5 billion in Q4 2017, thanks to cost saving measures implemented during the year resulting in lower HR-related, material and marketing costs. For the full year 2017 however, other operating expenses remained broadly stable at HUF 98.5 billion as the positive impacts from these cost saving measures were matched by an increase in rental fees and maintenance costs.Other operating incomeremained stable at HUF 2.5 billion in Q4 2017 as lower income from real estate sales was compensated by higher brand fee income emanating from the E2 energy joint venture. However, for the full year 2017, other operating income declined to HUF 6.7 billion from HUF 10.9 billion in 2016 owing to HUF 5.1 billion of one-off profits realized on the Infopark Building G and the Origo sales in Q1 2016.

- EBITDA for the Group improved by 1.2% year-on-year to HUF 42.3 billion in Q4 2017, as the marginally higher gross profit was coupled with a degree of improvement in indirect costs. A breakdown by geography for the quarter shows that in Hungary, the higher gross profit more than compensated for the increased severance expense leading to moderately higher EBITDA year-on-year; whilst in Macedonia, despite the improvement in indirect costs, overall EBITDA declined reflecting the pressures on gross profit. For the full year 2017, Group EBITDA declined by 1.0% overall to HUF 185.7 billion as the improvements recorded in the Hungarian gross profit along with EBITDA improvement in Macedonia were counterbalanced by higher severance expenses and a decline in other operating income in Hungary.

- Depreciation and amortization expenses declined by 9.6% year-on-year in Q4 2017and by 2.8% year-on-year to HUF 108.2 billion for the full year 2017. In Hungary, the lower D&A expense was driven by extensions to the useful lives of a number of assets; whereas in Macedonia, the lower D&A reflected the smaller asset base.

- Profit for the period from continuing operations was HUF 5.2 billion in Q4 2017 compared to HUF 20.2 billion in Q4 2016, reflecting the significant one-off income tax gain booked in the last quarter of 2016. For the full year 2017, net profit was 25.6% lower year-on-year at HUF 40.2 billion as the improvement in operating profit and net financial expenses was offset by the impact of the one-off tax gain booked in Q4 2016.Net financial expense declinedto HUF 4.7 billion in Q4 2017 from HUF 7.6 billion in Q4 2016, driven by a lower average level of loans outstanding and more favorable financing rates.Income tax reversedfrom an income of HUF 16.9 billion that was recorded in Q4 2016 to an expense of HUF 4.7 billion in Q4 2017. The primary reason for this movement was the reduction in the corporate income tax rate from 19% to a flat rate of 9% as of 1 January 2017 that resulted in a change of the deferred tax position being recognised as a one-off tax gain in Q4 2016. Furthermore, the changes in the tax calculation methodology relating to the transition to standalone IFRS were finalized at year end 2017 resulting in a one-off increase in the effective tax rate in Q4 2017.

- Profit attributableto non-controlling interests from continuing operationsdecreased by 32.1% year-on-year to HUF 0.5 billion in Q4 2017 due to the lower level of net profit recorded in Macedonia for the quarter. This contrasts with the full year 2017, where profit attributable to non-controlling interests from continuing operations increased by 34.0%, a reflection of the improved profitability of the Macedonian subsidiary over the year.

- Profit from discontinued operations:In January 2017, the Company signed a share purchase agreement with Hrvatski Telekom d.d. for the sale of the Company’s entire 76.53% shareholding in Crnogorski Telekom A.D., for a total consideration of EUR 123.5 million (HUF 38.5 billion). The transaction closed in January 2017. Consequently, in accordance with IFRS 5, the results and cash flows of the Montenegrin operations are presented as discontinued operations for both the comparative and the current period. (For further details please see section 2.2.3)

- Net debt stood at HUF 309.6 billion at 31 December 2017, a decrease of 17.8% year-on-year (end 2016: HUF 376.6 billion) with a net debt ratio (net debt to total capital) of 34.8%.

- Increase in Free Cash Flow from continuing operations to HUF 58.4 billionreflects lower interest payments and Capex spending.

Christopher Mattheisen, CEO commented:

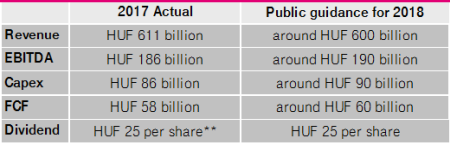

“Magyar Telekom continued to deliver strong performance in 2017. The revenue growth recorded by the Group in the first nine months of 2017 continued into Q4 2017, resulting in a 6% revenue rise for the full year. At the same time, despite the absence of the considerable one-off profits recorded in 2016, we managed to maintain EBITDA at 2016 levels, leaving us well positioned for the year ahead. This also means that we have outperformed our previously announced guidance both on revenues and EBITDA, which reached HUF 611 billion and HUF 186 billion respectively, against our guidance of HUF 580 billion and HUF 182 billion. We managed to surpass our FCF goals by HUF 3 billion, finishing the year with HUF 58 billion, while CAPEX stood at HUF 87 billion. Furthermore, thanks to our continued commitment to meeting customer needs and constantly refreshing our product offering, we have strengthened our position in the Hungarian market in several key areas including post-paid mobile, TV and fixed broadband.

The Hungarian operation continued on the positive trajectory set earlier this year as revenue increased across all three major services lines.

In the mobile segment, data services continued to play a significant role in revenue creation with both domestic and visitor data usage increasing. The growth in mobile revenues was supported by the introduction of unlimited packages and a new mobile service portfolio structure. These proved successful both financially and in terms of increasing customer satisfaction, as over 700,000 customers signed up to these packages throughout the year. These innovations, coupled with our ongoing efforts aimed at migrating prepaid customers to post-paid packages, led to a higher ARPU for the year. In the prepaid segment, we took decisive action to address the challenges brought about by the new obligatory customer registration and we used this as an opportunity to accelerate subscriber migration to post-paid.

In the fixed line segment, our focus was on network development and the restructuring of our broadband offering to enhance our competitiveness. Significantly, 2017 marked the introduction of the first 2Gbps package in the Hungarian market. Through such initiatives, we managed to grow our customer base by over 5%, both in broadband and the TV segment, and are confident that we are well positioned to capitalize on this growth going forward. Our efforts were also supported by Flip, our new brand, which offers one very attractively priced 3Play package that was well received by the market.

In October, we faced a significant regulatory change which meant we are only able to offer 2-year loyalty contracts with equipment sales attached. In line with our objective of pursuing differentiation through our device offering, and to mitigate any negative effects of the new regulation, we strengthened our equipment offering across both mobile and fixed segments.

FMC (fixed-mobile convergence) remains one of our core focuses as we strongly believe that the key to long term success lies in the ability to offer truly integrated solutions to our customers. In line with this, we have extended our Magenta1 offer according to our customers’ requirements, including the possibility to swap fixed voice for mobile data in the package. This helped us to further expand our FMC subscriber base.

In the SI/IT segment we significantly increased our income. This was primarily attributable to the acceleration of the inflow of EU funds into Hungary, and though many projects were low margin deals, the focus remains on pursuing higher margin projects.

In Macedonia, total revenues registered an annual decline in 2017 as competition in the fixed segment remained strong, and these same competitive pressures emerged in the fourth quarter in the mobile segment. SI/IT revenues fell as a number of major projects were postponed in 2017. Despite these competitive pressures, we achieved year-on-year EBITDA growth through the successful implementation of ongoing cost saving measures.

Looking ahead to 2018, we will place even greater focus on the FMC segment where we are currently in a unique position to meet the full range of communication requirements of Hungarian households. In Macedonia, we are confident that, in spite of challenging market conditions, the EBITDA turnaround is sustainable. Consequently, we expect a slight year-on-year decline in our revenues to approximately HUF 600 billion for 2018, on account of the exit of our energy business and lower equipment sales revenues. However, these are not expected to affect 2018 EBITDA, which we anticipate will increase to approximately HUF 190 billion for the year thanks to planned group-wide efficiency improvements. We expect a slight increase in our CAPEX to around HUF 90 billion as we continue to invest in our fixed networks in Hungary. Our Free Cash Flow will receive a slight boost in 2018 from upcoming real-estate sales ahead of our move into new headquarters, and should total around HUF 60 billion. Based on the current operating and regulatory environment and outlook, we expect the Company to pay HUF 25 dividend per share in relation to 2018 earnings. This is subject to the Board of Directors’ future proposal to the General Meeting which will be submitted in due course, once all necessary information is available and all prerequisites to making such a proposal are met.”

Public guidance*:

*excluding Crnogorski Telekom financials and the transaction price of the disposal of th majority ownership