Magyar Telekom results for the third quarter of 2021

Highlights:

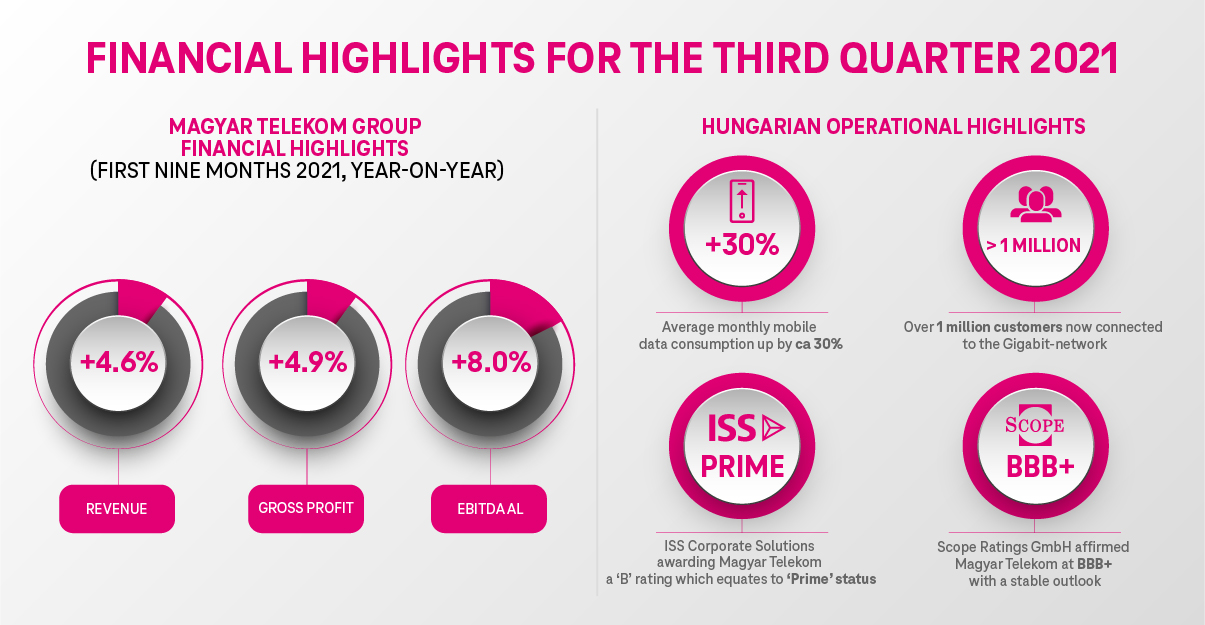

In Q3 2021, total revenue increased by 6.2% year-on-year to HUF 178.1 billion,and 4.6% year-on-year to HUF 506.5 billion for the first nine months of the year, primarily driven by increases in telecommunication service revenue, particularly mobile data, and some increases in System Integration and IT (SI/IT) sales in both countries of operation.

- Mobile revenue increased by 6.5% year-on-year to HUF 98.6 billion in Q3 2021, driven by further growth in mobile data, SMS and visitor revenue, which fully offset lower retail voice revenue.

- Fixed line revenue increased by 2.2% year-on-year, to HUF 56.3 billion in Q3 2021as improvements in broadband and TV revenue offset the decline in voice revenue in both markets.

- System Integration and IT revenue rose by 16.1% year-on-year to HUF 23.2 billion in Q3 2021, reflecting more favorable seasonal patterns in Hungarian project revenue coupled with higher revenue from customized solution projects in North Macedonia.

Direct costs increased by 5.5% year-on-year to HUF 76.4 billion in Q3 2021,and by 4.2% year-on-year to HUF 215.3 billion in the first nine months of 2021, largely driven by higher SI/IT service related, roaming and interconnect costs.

- Interconnect costsincreased by 17.4% year-on-year to HUF 6.5 billion during the third quarter, primarily reflecting a combination of higher off-network mobile voice and SMS traffic in the Hungarian operation, which resulted in higher payments to domestic mobile operators and increased expenses related to international transit traffic in North Macedonia.

- SI/IT service-related costsincreased largely in line with revenue year-on-year and amounted to HUF 16.7 billion in Q3 2021.

- Bad debt expensesimproved by 21.3% year-on-year to HUF 1.9 billion in Q3 2021, due to better receivable factoring results and more favorable aging at the Hungarian operation. This was partly offset by unfavorable one-off impairment expenses in North Macedonia.

- Telecom taxdeclined by 14.5% year-on-year, amounting to HUF 6.5 billion for the period, reflecting the absence of a one-off non-recurring adjustment booked in Q3 2020 and lower overall usage levels, especially among business customers.

- Other direct costswere up 4.6% year-on-year to HUF 44.9 billion in Q3 2021, driven by higher roaming outpayments and some increases in equipment costs.

Gross profit improved by 6.8% year-on-year to HUF 101.7 billion in Q3 2021and by 4.9% year-on-year to HUF 291.3 billion in the first nine months of 2021, as a result of the increasing contribution from both telecommunication and SI/IT services.

Indirect costs increased by 2.3% year-on-year to HUF 35.3 billion in Q3 2021,and 0.9% year-on-year to HUF 115.4 billion in the first nine months of 2021, driven by higher employee related expenses which offset the decline in other operating expenses.

- Employee-related expensesrose by HUF 1.8 billion year-on-year, amounting to HUF 20.1 billion in Q3 2021, mostly driven by higher severance expenses related to the Hungarian voluntary redundancy program and higher performance bonus expenses. This more than offset the positive impact of the lower average headcount.

- Other operating expenseswere 6.0% lower year-on-year at HUF 16.2 billion for the quarter, thanks to the positive contribution of cost optimization measures, particularly relating to maintenance and repair expenses and raw material costs.

- Other operating incomeremained stable at HUF 1.0 billion in Q3 2021, and was up by HUF 0.4 billion year on year in the first nine months of 2021, latter reflecting higher income from real estate sales in Hungary.

EBITDA rose by 9.3% year-on-year to HUF 66.4 billion for the quarter,withEBITDA AL improving by 9.7% year-on-year to HUF 60.3 billion. In the first nine months of 2021, EBITDA rose by 7.7%, and EBITDA AL by 8.0% year-on-year. These improvements were primarily driven by the increase in service revenue and consequently, gross profit.

Depreciation and amortization (D&A) expensesrose by 4.4% year-on-year to HUF 36.9 billion in Q3 2021,attributable to frequency licenses activated in September 2020 in Hungary, and higher depreciation in relation to the copper retirement project.

Profit for the period was moderately lower by 1.3% year-on-year at HUF 19.4 billion in Q3 2021, as the improvement in operational performance was offset by weaker financial results, primarily driven by the absence of favorable one-off impacts in the base period. In the first nine months of 2021, profit for the period rose by 45.0% year-on-year to HUF 44.0 billion as a result of EBITDA increases and stronger financial results.

- Net financial resultdeclined by 4.3 billion year-on-year, amounting to a loss of HUF 5.5 billion in Q3 2021. The increase in financial expenses is partly driven by higher interest expenses, booked in relation to spectrum payment liabilities, and less favorable results relating to recognition of derivatives at fair value. This reflects different yield-curve movements compared to the base period. In the first nine months of 2021, net financial result improved by 6.4 billion year-on-year, amounting to a loss of HUF 11.2 billion, largely driven by more favorable FX impacts compared to the first nine months of 2020.

- Income tax expensesremained broadly unchanged year-on-year at HUF 4.5 billion in Q3 2021, reflecting the similar level of profit before tax.

Profit attributable to non-controlling interests rose by 44.4% year-on-year to HUF 1.6 billion in Q3 2021, thanks to a strong improvement in both revenue and profitability trends in North Macedonia.

Free cash flow excl. spectrum licenses (i.e. without one-time spectrum license fees) amounted to HUF 34.4 billionin the first nine months of 2021, reflecting strong EBITDA generation, partly offset by investment-related payments and working capital developments.

Tibor Rékasi,Magyar Telekom CEO commented:

“Our operating environment continued to develop favorably in the third quarter of 2021 as the effects of COVID-19 diminished further, for both Magyar Telekom and the wider market. In line with our strategy, we continued to build and modernize our Gigabit-capable network and by the end of the third quarter we reached 2.89 million access points.

Magyar Telekom grew significantly year-on-year in terms of revenue, gross profit and EBITDA. This is testament to our excellent network quality and outstanding customer satisfaction, which have enabled us to successfully monetize strong market demand for our telecommunications and data services.”