Magyar Telekom results for the fourth quarter of 2021

Highlights:

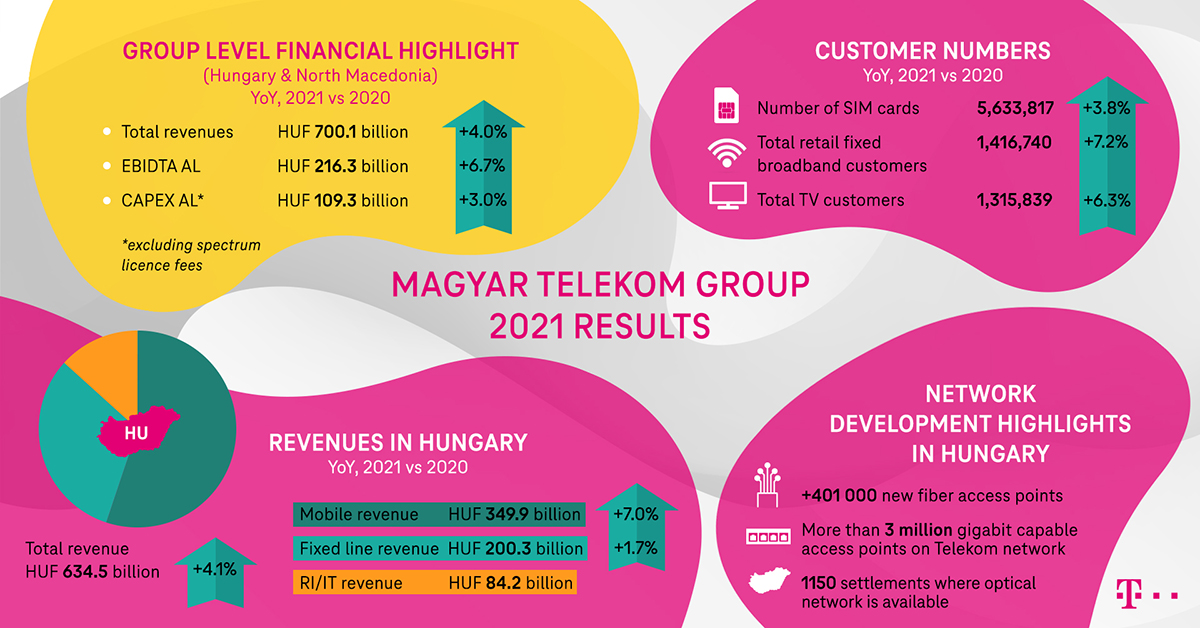

Total revenue increased by 2.5% year-on-year to HUF 193.6 billion in Q4 2021,or 4.0% year-on-year to HUF 700.1 billion for the full year, primarily driven by increases in telecommunication service revenue, particularly mobile data which offset the lower System Integration and IT (SI/IT) sales in both countries of operation.

- Mobile revenue increased by 9.3% year-on-year to HUF 107.1 billion in Q4 2021, driven by further growth in mobile data and SMS revenue, coupled with an increase in equipment sales in Hungary.

- Fixed line revenue increased by 1.1% year-on-year, to HUF 58.6 billion in Q4 2021as improvements in broadband and TV revenue offset the decline in voice revenue and lower equipment sales.

- System Integration and IT revenue was lower by 15.4% year-on-year to HUF 27.9 billion in Q4 2021and declined moderately by 2.9% to HUF 86.9 billion for the full year 2021. Quarterly performance reflects different seasonal patterns in Hungarian project revenue with year-on-year lower revenues in the fourth quarter, coupled with the absence of major customized solution projects in North Macedonia.

Direct costs increased by 6.1% year-on-year to HUF 96.4 billion in Q4 2021,and by 4.8% year-on-year to HUF 311.7 billion for the full year, largely driven by higher bad debt and equipment expenses.

- Interconnect costsincreased by 8.0% year-on-year to HUF 6.3 billion in Q4 2021, primarily reflecting a combination of higher off-network mobile voice and SMS traffic in Hungary, which resulted in higher payments to domestic mobile operators.

- SI/IT service-related costsdeclined year-on-year in line with revenue and amounted to HUF 20.3 billion in Q4 2021.

- Bad debt expenseswere up by HUF 2.7 billion at HUF 5.2 billion in Q4 2021 due to a forward-looking impairment recognized in the amount of HUF 3.2 billion at the Hungarian operation, reflecting a possible deterioration of the solvency of customers, driven by unfavorable macroeconomic tendencies and the impacts of the termination of a loan moratorium in Hungary expected for mid-2022, coupled with higher write-off in North Macedonia. This offset the positive impact of favorable aging of receivables at the Hungarian operation.

- Telecom taxremained stable year-on-year, amounting to HUF 6.7 billion for the period, reflecting the combined impact of declining fixed but increasing mobile traffic.

- Other direct costswere up 11.1% year-on-year to HUF 57.9 billion in Q4 2021, primarily driven by higher equipment costs coupled with increased roaming and TV outpayments, with the latter reflecting the expanding TV customer base.

Gross profit was down 0.8% year-on-year to HUF 97.2 billion in Q4 2021as one-off bad debt provision counterbalanced positive organic performance. Nevertheless, gross profit for the full year improved by 3.4% year-on-year to HUF 388.4 billion thanks to the increasing contribution of telecommunication services in both countries.

Indirect costs were lower by 8.8% year-on-year at HUF 32.2 billion in Q4 2021,and by 1.3% year-on-year at HUF 147.7 billion for the full year, thanks to lower employee related expenses which offset the lower level of other operating income.

- Employee-related expensesdeclined by HUF 4.6 billion year-on-year, amounting to HUF 16.0 billion in Q4 2021, thanks to the positive impact of the lower average headcount, lower severance expenses year-on-year at the Hungarian operation, coupled with lower bonus expenses, reflecting different timing of related bookings within the year.

- Other operating expenseswere 4.8% lower year-on-year at HUF 17.5 billion for the quarter, thanks to the positive contribution of cost optimization measures, particularly relating to maintenance and repair expenses and advisory costs.

- Other operating incomewas lower by HUF 2.3 billion at HUF 1.3 billion in Q4 2021, due to the absence of income from real estate sales in Hungary.

EBITDA rose by 3.7% year-on-year to HUF 64.9 billion for the quarter,withEBITDA AL improving by 3.4% year-on-year to HUF 58.6 billion.

For the full year, EBITDA rose by 6.6%, and EBITDA AL by 6.7% year-on-year. These improvements were primarily driven by the increase in service revenue coupled with savings in employee related expenses.

Depreciation and amortization (D&A) expensesrose by 7.0% year-on-year to HUF 39.3 billion in Q4 2021.In Hungary higher D&A expenses were related to capitalization and shortened useful life of software whilst in North Macedonia the increase reflects shortened useful life and accelerated depreciation in relation to RAN modernization.

Profit for the period increased by 18.0% year-on-year to HUF 18.8 billion in Q4 2021and was up by 35.7% at HUF 62.8 billion for the full year. The increase was attributable to strong operational performance, improved cost efficiency and more favorable financial results.

- Net financial resultimproved by HUF 3.7 billion year-on-year, amounting to a loss of HUF 2.5 billion in Q4 2021. Although interest expenses increased due to higher spectrum payment liabilities and the absence of a one-off interest provision reversal at the North Macedonian operation booked in Q4 2020, more favorable results on the measurement of derivatives at fair value reflecting the different shifts in the relevant yield curves led to a significant year-on-year improvement.

- Income tax expensesrose by 15.1% year-on-year to HUF 4.3 billion in Q4 2021 in line with higher profit before tax.

Profit attributable to non-controlling interests declined by HUF 1.0 billion year-on-year to HUF 0.1 billion in Q4 2021, driven by one-off cost items in D&A and interest expenses that offset the positive impact of the favorable underlying developments at the North Macedonian subsidiary.

Free cash flowexcl. spectrum licenses (i.e. without one-time spectrum license fees)amounted to HUF 56.2 billion for 2021,with year-on-year decline driven by higher investment spending and less favorable working capital developments.

Tibor Rékasi,Magyar Telekom CEO commented:

“Our performance in 2021 demonstrates the success with which we addressed the external challenges arising from the Covid-19 pandemic. Thanks to our efforts to respond promptly to rapidly changing consumer needs, we continued to provide enhanced quality of service and additional support to our customers throughout the year. Considerable ongoing investment in our networks has enabled Magyar Telekom to provide sought-after seamless connectivity. As a result, an increasing number of clients chose Magyar Telekom as their preferred telecommunication provider, allowing us to deliver year-on-year revenue and EBITDA AL growth of 4.0% and 6.7%, respectively, ahead of our targets for the year. Our strong investment in the business is reflected in moderately higher Capex versus our initial targets. This, coupled with temporary unfavorable working capital developments, resulted in a lower than expected free cash flow of HUF 56.2 billion.

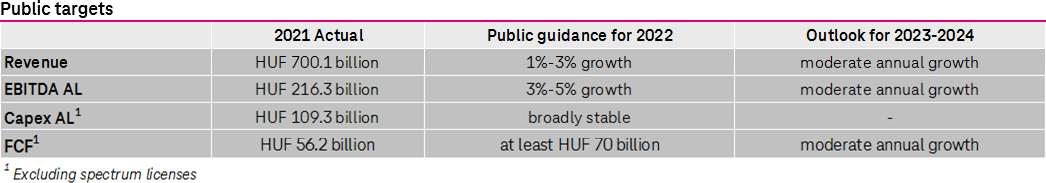

Looking ahead, we expect to sustain this positive commercial momentum in 2022, which is likely to lead to revenue growth of 1% to 3%, with EBITDA AL growing by 3% to 5%, supported by cost control measures. Network quality remains a significant differentiator for the Company and to preserve this, we intend to maintain the steady pace of our fiber roll-out and mobile network modernization program. As a result, investment levels are expected to remain broadly stable year-on-year. Free cash flow, excluding spectrum license payments, is forecast to increase to at least HUF 70 billion in 2022, thanks to positive trends in EBITDA AL and working capital.”