Magyar Telekom results for the first quarter of 2022

Total revenue increased by 8.4% year-on-year to HUF 175.9 billion in Q1 2022as strong growth in mobile data and fixed broadband revenue, coupled with higher equipment sales compensated for moderately lower voice and System Integration and IT (‘SI/IT’) revenue.

- Mobile revenue rose by 11.9% year-on-year to HUF 101.1 billion in Q1 2022, driven by growth in mobile data revenue and higher equipment sales which offset lower retail voice revenue at both countries of operation.

- Fixed line revenue increased by 7.0% year-on-year, to HUF 57.6 billion in Q1 2022thanks to increases in fixed broadband and TV revenues driven by the customer base expansion at the Hungarian operation.

- System Integration (SI) and IT (‘SI/IT’) revenues decreased by 5.3% to HUF 17.1 billion in Q1 2022due to the absence of revenues that were formerly generated by Pan-Inform LLC and the lower revenue from public sector. The decrease of revenue in Hungarian operation was slightly offset by the double-digit increase in North Macedonia.

Direct costs increased in line with revenues by 8.4% year-on-year to HUF 75.0 billion in Q1 2022,attributable to higher equipment costs and roaming expenses.

- Interconnect costsincreased moderately by 1.9% year-on-year to HUF 6.0 billion in Q1 2022, reflecting higher payments at the Hungarian operation to domestic mobile operators in relation to the elevated SMS traffic.

- SI/IT service-related costsincreased by 2.4% year-on-year to HUF 12.7 billion in Q1 2022, driven by the changed composition of SI/IT projects in North Macedonia resulting in higher related costs and some one-off items at the Hungarian operation.

- Bad debt expensesdecreased moderately to HUF 1.9 billion, reflecting similar tendencies during the first quarter of 2022 as we experienced during last year.

- Telecom taxdeclined by 2.1% year-on-year to HUF 6.6 billion in Q1 2022, driven by lower fixed and mobile voice traffic which offset the higher SMS traffic at the Hungarian operation.

- Other direct costswere up 13.4% year-on-year to HUF 47.7 billion in Q1 2022, driven by higher equipment costs and an increase in roaming outpayments driven by the easing of travel limitations compared to a year earlier.

Gross profit improved by 8.3% year-on-year to HUF 100.9 billion in Q1 2022,thanks to a higher contribution from telecommunication services, particularly data, at both countries of operation.

Indirect costs improved by HUF 4.2 billion year-on-year, to HUF 38.8 billion in Q1 2022,primarily reflecting the one-off gain on a subsidiary sale as well as lower employee-related expenses.

- Employee-related expenseswere down by 4.4% year-on-year, amounting to HUF 18.4 billion in Q1 2022, reflecting different timing of bonus provisions, while the impact of the general wage increase was offset by the reduction in headcount.

- Utility taxwas broadly unchanged year-on-year, amounting to HUF 7.3 billion in Q1 2022, reflecting the combined impact of an increase in the length of the taxable network (mostly due to expiring tax credits from network investments in 2016), offset by the positive effect of the tax credit relating to Magyar Telekom’s new network investments and upgrades that enable internet access of at least 100 Mbps.

- Other operating expenses(excluding the utility tax) improved moderately year-on-year to HUF 17.1 billion in Q1 2022, as temporary increases in marketing expenses in Hungary and higher energy costs in North Macedonia were offset by savings in IT, network and real estate maintenance and repair costs at the Hungarian operation.

- Other operating incomewas up at HUF 4.1 billion in Q1 2022, driven by one-off profit realized on the sale of a Hungarian IT subsidiary, Pan-Inform LLC.

EBITDA rose by 23.8% year-on-year to HUF 62.1 billion,withEBITDA AL improving by 26.4% year-on-year to HUF 55.8 billion in Q1 2022, driven by the improvement in gross profit coupled with the one-off subsidiary sale gain.

Depreciation and amortization (‘D&A’) expenses were broadly unchanged year-on-year at HUF 35.4 billion in Q1 2022, as some increase driven by shortened useful life and accelerated depreciation in relation to RAN modernization in North Macedonia was offset by lower depreciation expenses at the Hungarian operation attributable to full copper network retirement in some areas of Hungary.

Profit for the period rose by HUF 9.3 billion year-on-year to HUF 19.3 billion in Q1 2022, reflecting higher EBITDA, partly offset by higher financial expenses and income taxes.

- Net financial resultdeteriorated from a loss of HUF 1.6 billion in Q1 2021 to a loss of HUF 3.0 billion in Q1 2022 driven by lower value of gains on the recognition of derivatives at fair value which outweighed the decline in interest expenses.

- Income tax expensesincreased by HUF 1.1 billion to HUF 4.5 billion in Q1 2022, reflecting the year-on-year higher profit before tax.

Profit attributable to non-controlling interests declined by HUF 0.3 billion year-on-year to HUF 0.9 billion in Q1 2022, as higher operating expenses and deprecation offset the gross profit improvement and led to lower net income in North Macedonia.

Free cash outflow amounted to HUF 0.5 billion in Q1 2022,improving by HUF 16.5 billion year-on-year, driven by the positive underlying results, lower interest payments and the one-off cash inflow from the IT subsidiary sale. Payment for the recently acquired 900 MHz and 1800 MHz frequency bands in the amount of HUF 44.3 billion was made at the beginning of April 2022, rather than in Q1 2022 as originally planned, and so had no impact on free cashflow in the quarter.

Operational highlights

- Customer base expansion in Hungary continued into Q1 2022: fixed broadband subscriptions rose by 7.3%, TV customers increased by 6.0% while the mobile SIM base rose by 5.0% year-on-year.

- Hungarian fiber network penetration continued to rise, reaching almost 30% by end-March 2022.

- Accelerated growth in mobile data usage was sustained with an 30% year-on-year increase; average monthly usage reached 8.7 GB in Q1 2022.

- Strong focus on investment in fixed and mobile networks, vital to maintaining superior customer experience, continued in both countries of operation with accelerated fiber roll-out and RAN modernization.

Tibor Rékasi,Magyar Telekom CEO commented:

“Despite

the fast-changing macroeconomic environment since the start of the year, Magyar

Telekom maintained strong momentum across its business lines, delivering 8.4%

revenue growth for the quarter. This positive trend was driven by successful

expansion of our fixed and mobile customer bases, as well as the accelerated

mobile data usage and strong demand for the gigabit capable network experience.

We excelled at the latter thanks to our accelerated fiber rollout and RAN

modernization in Hungary and North Macedonia, which form a key part of our

customer-centric strategy.

During the quarter we deployed smart control and conservative approach on our operating expenses grew our gross profit and successfully closed the sale of Pan-Inform LLC, all of which allowed us to significantly increase our EBITDA AL year-on-year in Q1 2022. Looking ahead, we remain strongly committed to continued delivery against our strategic objectives. Taking into account the increased level of uncertainty in our external environment, we maintain our targets for 2022 at present.”

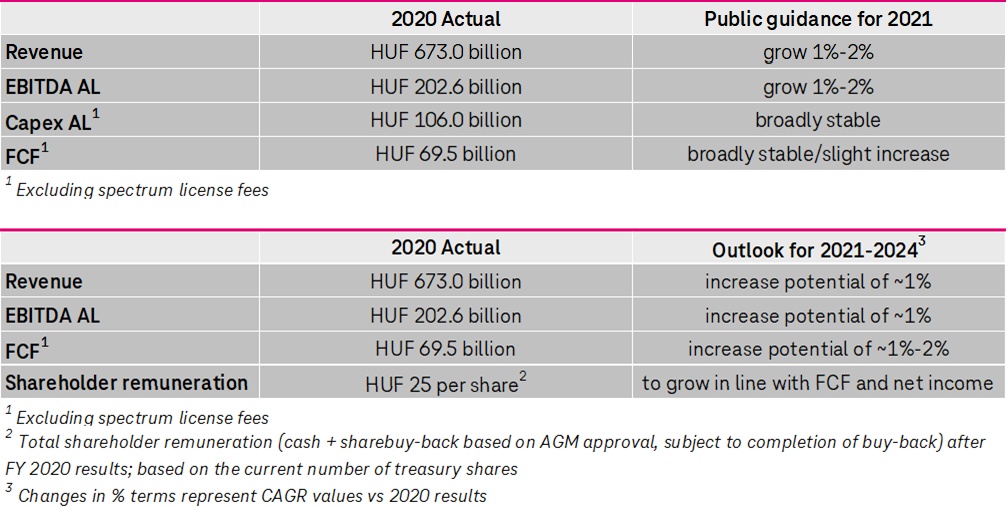

Public targets